A Comprehensive Comparison of Financial Aid and Xero Solutions for Managing Finances

When it comes to managing funds and resources, the choices available can often feel overwhelming. Individuals and organizations alike are in search of the best ways to maximize their capabilities while ensuring they are on the right path toward financial stability. In today’s ever-evolving landscape, two prominent options have emerged: various forms of support systems and a groundbreaking accounting software that has taken the market by storm.

Understanding the nuances between these alternatives is crucial for anyone looking to streamline their operations. On one hand, there are easy-to-navigate schemes designed to provide assistance with budgeting and resource allocation, while on the other, a sophisticated platform automates and simplifies bookkeeping tasks. Each option carries its own set of advantages and challenges, and choosing the right one requires careful consideration of specific needs and goals.

Join us as we dive deeper into the world of financial support mechanisms and innovative accounting solutions. We’ll evaluate their features, examine their impact on efficiency, and help you determine which path aligns better with your aspirations. Embrace the journey to smarter resource management!

Understanding Assistance Options

When it comes to funding your education or project, there are various pathways to explore that can help lighten your financial burden. Whether you are a student, an entrepreneur, or anyone seeking support, knowing what resources are available is crucial. These options can provide you with the necessary backing you need to achieve your goals without overwhelming your budget.

There are numerous alternatives to consider, each designed to cater to different needs and situations. Grants, scholarships, and loans are some of the most common tools that individuals can tap into. Understanding the differences between these choices is essential for making informed decisions that suit your circumstances. By gathering the right information, you can navigate this landscape more effectively and select the best options for your journey.

Additionally, support from relatives, crowdfunding platforms, and community organizations can also offer significant help. Each option comes with its advantages and considerations, so it’s important to weigh the pros and cons of each. Being proactive and thorough in your research can lead to securing the best possible resources to aid your aspirations.

Ultimately, exploring these avenues can open doors to opportunities that might have seemed out of reach. By educating yourself about the landscape of resources available, you will be better equipped to pursue your ambitions with confidence.

The Role of Xero in Business Accounting

Managing accounts can often feel overwhelming for many entrepreneurs. A modern solution can simplify this process significantly. By utilizing cutting-edge software, businesses can keep track of their financial activities effortlessly, making informed decisions based on real-time data. This innovative tool provides a streamlined approach to bookkeeping, enabling users to focus more on growth rather than getting lost in numbers.

One of the most attractive features of this platform is its user-friendly interface. Even those without a background in accounting can navigate through it with ease. The intuitive design allows for quick access to essential features, meaning that you won’t need to spend hours figuring out how to manage your books. Instead, you can jump right into tracking expenses and revenue.

Moreover, this system promotes collaboration. By allowing multiple users to access the same data, business owners can work closely with their accountants and advisors. This shared visibility helps ensure that everyone is on the same page, reducing the chances of miscommunication. When financial records are transparent, it fosters trust and efficiency within the team.

Automation is another key advantage of utilizing such software. Routine tasks, like invoicing and reminders for payments, can be automated to save time and minimize errors. This means business owners can spend less time on administrative duties and focus on what truly matters: delivering value to customers and growing their enterprise.

Lastly, having real-time insights into financial health is invaluable. This enables proactive decision-making instead of reactive. Business owners can identify trends, manage cash flow, and prepare for the future with confidence. In a competitive landscape, having this level of insight can make a substantial difference.

Comparative Analysis: Funding Solutions and Software

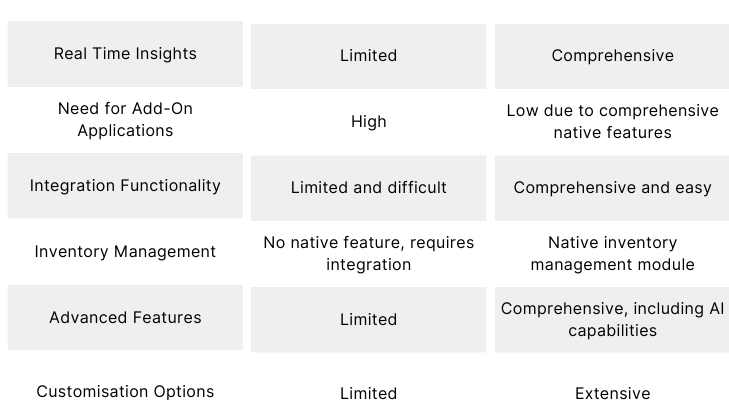

When it comes to supporting business growth, choosing between various funding options and management tools can be quite the challenge. On one hand, you have different avenues to secure the necessary resources, and on the other, there’s an array of digital solutions to streamline your operations. Both aspects play a vital role in ensuring a smooth journey, but understanding their unique features can make all the difference.

Funding Options often include loans, grants, or investments, each with its own set of benefits and drawbacks. For instance, securing a loan could provide immediate capital, but it often entails strict repayment terms. On the flip side, grants do not require repayment, yet they are typically competitive and come with specific eligibility criteria. Recognizing the nuances of these avenues is essential for making informed decisions that align with your goals.

On the other hand, Management Tools serve as essential resources for managing your finances and operations. Software solutions can help simplify accounting, track expenses, and generate reports effectively. They offer automation that reduces manual tasks, saving you time and minimizing errors. Picking the right tool requires understanding your business needs and evaluating the functionalities that will serve you best.

Ultimately, the choice between funding avenues and digital tools isn’t an either-or situation. Both play a crucial role in promoting success. By conducting a thorough analysis of the available options, you can effectively navigate the landscape and position your venture for sustainable growth.