Exploring the Differences Between Financial Aid and Tuition Assistance Options for Students

When it comes to pursuing higher learning, navigating the different forms of support available can feel overwhelming. Many students and their families find themselves faced with a maze of opportunities designed to ease the burden of education-related expenses. Whether you’re a fresh high school graduate or a returning adult learner, understanding these options is essential for making informed decisions about your future.

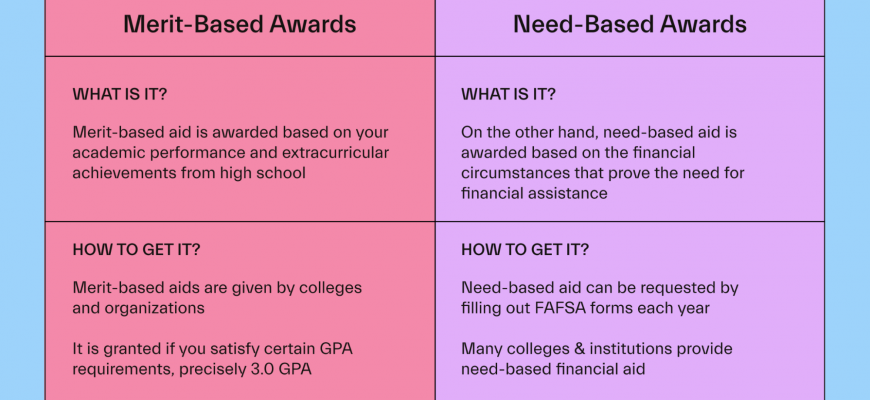

On one hand, there are programs that provide targeted financial support based on various criteria, such as income, academic merit, or field of study. These initiatives aim to reduce the overall cost burden, helping students focus on their studies rather than worrying about their finances. Meanwhile, you may encounter avenues that offer support based on specific institutions or programs. Each has its unique features and requirements, which can lead to confusion if not properly understood.

The challenge lies in distinguishing the types of support available and understanding how they can work together. Recognizing the nuances between these options is crucial for aspiring students aiming to maximize their educational experiences while minimizing costs. In this article, we will break down these two major categories of support, clarifying their roles and how they can benefit you on your educational journey.

Understanding Financial Aid Options

When it comes to funding your education, there are various pathways designed to ease the financial burden. These solutions, often referred to with different terms, can help students manage their expenses while pursuing academic goals. Knowing what options are available is key to making informed decisions about how to navigate the cost of higher learning.

Grants are one option that many individuals find beneficial. These are typically need-based funds that don’t require repayment, making them an attractive choice for those looking to lessen their financial load. On the other hand, scholarships are awarded based on various criteria, including merit or specific talents. Similar to grants, scholarships do not need to be paid back, allowing students to focus more on their studies than their finances.

If students don’t meet the requirements for grants or scholarships, there are also loans available. These funds require repayment after graduation, but they can cover a significant portion of educational costs upfront, offering a lifeline for those who need immediate support. Additionally, some institutions offer programs that help students work part-time, easing cash flow and providing valuable experience.

Lastly, it’s important to consider work-study opportunities, which allow you to earn money while studying. This arrangement not only helps financially but also provides practical experience in a real-world setting. Exploring these avenues can empower students to make the most of their educational journey without overwhelming financial stress.

Grants and Scholarships: Free Money for School

When it comes to pursuing education, one of the best ways to ease the burden on your wallet is by tapping into the world of grants and scholarships. These opportunities are essentially gifts that help cover the costs of your learning journey, and the best part? They don’t need to be paid back. Whether you’re a high school graduate or an adult looking to upskill, there’s likely something out there just waiting for you.

Grants are typically awarded based on financial necessity or specific criteria. They come from various sources, such as governments, institutions, or private organizations. On the other hand, scholarships often recognize academic achievements, talents, or unique backgrounds. Both can significantly trim down your expenses, allowing you to focus more on your studies and less on how to fund them.

Finding these opportunities may feel overwhelming at first, but with a little research, you’ll discover a plethora of options tailored to different situations. Always remember to check eligibility requirements and deadlines! By taking full advantage of the free funding available, you can set yourself up for a successful and fulfilling educational experience without the looming stress of debt.

Tuition Assistance Programs Explained

Understanding the different paths available to improve the affordability of your education can be quite enlightening. Programs designed to support learners in managing their educational costs come in various forms and can significantly influence your journey towards achieving your academic goals. These initiatives often help ease the burden of expenses associated with schooling, allowing students to focus on their studies rather than worrying about finances.

One popular type of support involves employer-sponsored schemes that encourage employees to pursue higher learning. This often includes reimbursements or direct payments that lessen the overall financial load. Many organizations recognize the value of a well-educated workforce and, in turn, invest in their employees’ growth.

Another common avenue is governmental programs that offer reductions or coverage of certain educational expenses for eligible individuals. These initiatives are often designed to promote accessibility for various demographics, ensuring that education is within reach for those who might otherwise face obstacles due to cost.

Additionally, private entities and non-profits may provide scholarships that do not require repayment. These can be based on merit, need, or specific criteria, which can considerably reduce the cost of attending college for deserving candidates.

Ultimately, exploring these various support options can provide pathways to achieving higher learning without overwhelming debt. It’s important to research thoroughly and take advantage of what is available to lessen the financial strains associated with education.