Exploring the Benefits and Drawbacks of Financial Aid Compared to Job Offers

When it comes to pursuing one’s dreams, the choices that lie ahead can be both exciting and daunting. Navigating the landscape of options available to individuals can often feel overwhelming. On one hand, there’s a system that helps alleviate financial burdens, while on the other, there are pathways leading directly to employment. Each avenue brings its own set of pros and cons, challenging us to weigh our priorities carefully.

As you embark on this journey, it’s essential to consider what aligns best with your long-term goals. The support mechanisms can provide a safety net, allowing for exploration and growth, while pursuing direct opportunities can lead to immediate rewards and experience. Ultimately, the decision may hinge on personal circumstances, aspirations, and the potential for future success.

In this discussion, we’ll delve into the nuances of each approach, comparing the lasting impacts they may have on your trajectory. From immediate resources to hands-on experience, understanding the distinctions and advantages of these two options is key to making an informed choice.

Understanding Support Options

Navigating the landscape of educational support can often feel overwhelming, but it’s crucial to know the resources available to help you on your journey. There are various forms of assistance designed to alleviate the financial burden of pursuing your studies. Grasping these options can pave the way for more attainable educational goals.

First, you might encounter grants, which are often need-based and don’t require repayment. These funds can significantly lighten your financial load, enabling you to focus on your academics without the stress of accumulating debt. Scholarships, another popular option, are typically awarded based on merit, achievements, or specific criteria set by the awarding institution. Obtaining a scholarship can lead to a substantial decrease in overall expenses.

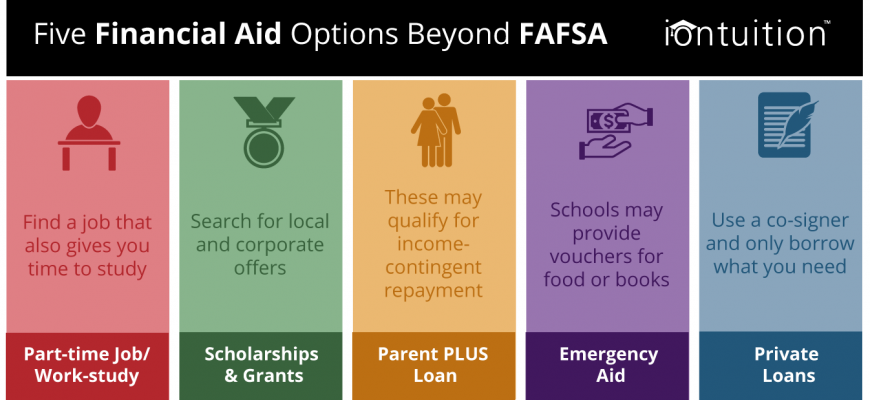

Additionally, you may want to consider low-interest loans. While these funds must be repaid, they often come with favorable terms that make managing your payments more feasible after graduation. It’s important to research and compare different loan options to find what suits your situation best. Some institutions also have work-study programs that allow you to earn money while attending classes, providing an excellent balance between studying and gaining experience.

Lastly, it’s beneficial to stay informed about other local and national programs aimed at supporting students. Many organizations provide resources that can enhance your educational experience while reducing financial strain. Understanding these various forms of assistance is key to making informed decisions and setting yourself up for success in your academic endeavors.

Evaluating Opportunities for Students

Finding the right position can feel overwhelming for many learners. It’s essential to weigh various aspects that can significantly impact your experience and future. It’s not just about the paycheck; other factors play a crucial role in shaping your overall satisfaction and growth.

First, consider the responsibilities involved. Are they aligned with your interests and career aspirations? Engaging in work that excites you can make a world of difference. Additionally, think about the work environment. A supportive atmosphere with good colleagues can enhance your motivation and productivity.

Next, don’t forget to look at the long-term potential of the position. Opportunities for advancement or skill-building can be invaluable as you progress in your career. Look for roles that not only fill your wallet today but also pave the way for tomorrow.

Lastly, always review the balance between your academic commitments and professional responsibilities. Striking the right balance is key to ensuring you thrive in both realms, allowing for a successful educational journey while gaining practical experience.

Maximizing Benefits from Both Paths

In today’s world, individuals often face the choice between pursuing assistance that can ease their financial burdens and diving into the workforce. Each approach has its own unique advantages, and understanding how to extract the most value from both can set you on a path to success. The trick lies in harmonizing these two avenues to complement rather than compete with each other.

Capitalizing on educational support while simultaneously gaining work experience is a smart strategy. Support systems can alleviate immediate expenses, allowing you to focus on skill development. Meanwhile, gaining practical experience not only enhances your resume but also fosters networking opportunities. By balancing your efforts, you can create a solid foundation for future endeavors.

Another important aspect is time management. Allocating your hours effectively between studying or training and working will yield the best outcomes. Prioritize tasks and remain adaptable to shift between focus areas as needed. Engaging with mentors and peers can provide valuable insights into what strategies have worked for others in similar situations.

Moreover, investing in personal growth is essential. Take advantage of workshops, seminars, or online courses that both enhance your expertise and make you more appealing to potential employers. This ongoing learning will keep you at the forefront of your field while ensuring that you derive maximum benefit from all available resources.

Ultimately, the goal is to align your aspirations with both forms of support, thereby creating a synergy that propels you forward. By embracing the opportunities that each path presents, you can build a brighter and more secure future.