A Comprehensive Comparison Between Financial Aid and Federal Loans for Education Financing

When pursuing higher learning, many students find themselves navigating the complex world of financial resources. There are various pathways to receive the assistance needed to manage tuition fees and related expenses. Making sense of these options can seem daunting, but gaining clarity is essential for making informed decisions about your educational journey.

In this section, we will explore two primary types of support available to students. On one hand, we have programs designed to provide students with gifts that don’t require repayment, tailored for those who meet specific eligibility criteria. On the other, there are types of funding that must be repaid after graduation or once the student is no longer enrolled. Each option has its advantages and requirements, and understanding the differences can help you optimize your financial strategy.

The choice between these resources is not merely about numbers. It’s about considering your long-term goals, financial circumstances, and potential career paths. By weighing these options carefully, you can set yourself up for success while minimizing future financial burdens. Let’s dive deeper to uncover what each of these avenues has to offer!

Understanding Support Options

When it comes to financing education, many individuals often find themselves navigating a maze of choices. There’s a wide array of resources available to help manage the costs associated with attending school. Knowing where to look and how to make the most of these resources can significantly ease the financial burden.

Scholarships are one popular choice, offering funds that do not need to be repaid. These can come from various sources, including institutions, nonprofits, and private organizations. The key is to research thoroughly and find those that align with your achievements and aspirations.

Grants are another valuable option. Typically awarded based on need, they provide monetary assistance to help cover tuition and other expenses. Unlike loans, these funds are often given without the expectation of repayment, making them a great solution for those looking to minimize debt.

If you’re considering more structured options, work-study programs can be an ideal way to earn money while studying. This initiative allows students to work part-time jobs, often on campus, as part of their financial support package. It’s a great way to gain experience while also boosting your budget.

Lastly, there are always private resources available. These might include contributions from family, savings plans specifically designed for education, or even community initiatives. While these might not cover all expenses, they can significantly supplement your educational investments.

Understanding the full spectrum of available options empowers students to make informed decisions and effectively allocate resources, paving the way for a more manageable educational journey.

Understanding Government-Backed Funding: Key Features Explained

When it comes to securing necessary resources for education, it’s essential to grasp the unique aspects of government-supported options that help individuals manage their financial needs. These funding opportunities are designed to aid students in overcoming the costs associated with pursuing their academic goals, making education more accessible and achievable.

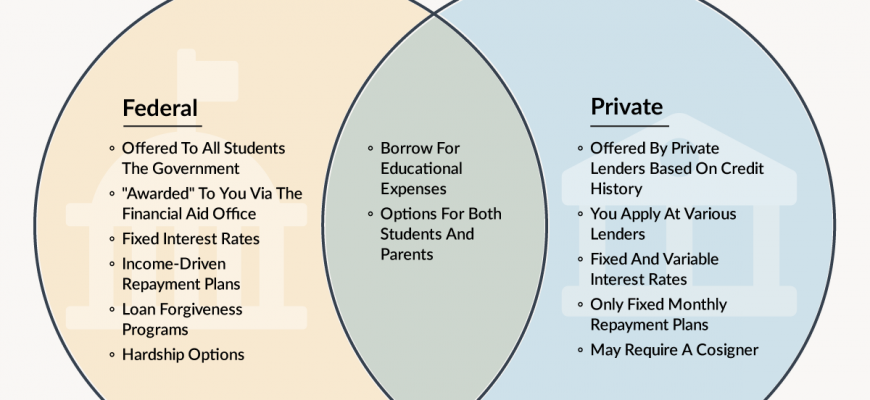

One of the standout features of these financial products is their relatively low-interest rates compared to private alternatives. This characteristic makes them a more attractive option for those seeking to minimize their repayment burden in the long run. Furthermore, many of these offers come with flexible repayment plans, catering to various financial situations over time.

Another important aspect is the deferment possibilities available for individuals who may face temporary financial difficulties. This means that borrowers can pause their payments without facing immediate penalties, allowing them to focus on their studies or other commitments without added stress.

It’s also worth noting that eligibility for these funding solutions is often not based on credit scores, making them accessible to a broader range of applicants. This opens doors for students who may not have established a strong credit history yet.

In summary, government-backed funding options are characterized by favorable interest rates, flexible repayment plans, and accessible eligibility criteria. Understanding these key features can empower students to make informed decisions as they navigate their educational journeys.

Comparing Grants and Scholarships Effectively

When it comes to funding education, many students often find themselves weighing their options between different types of support. Both grants and scholarships play a significant role in lightening the financial burden, but they come with distinct features worth exploring. Understanding the nuances of each can greatly influence your decision-making process and potentially lead to more favorable outcomes in your academic journey.

Grants typically come from government bodies or institutions and are often need-based, meaning they’re awarded based on your financial situation. On the other hand, scholarships usually focus on merit or specific achievements, which may include academic excellence, athletic talent, or involvement in community service. This fundamental difference can determine which option might be more suitable for you depending on your circumstances.

Another crucial aspect is that grants usually do not require repayment, which is a major advantage. Scholarships follow a similar rule–most also do not need to be repaid, making them an attractive option. However, certain scholarships may come with conditions, such as maintaining a specific GPA or participating in extracurricular activities, which can affect your eligibility in the long run.

In terms of availability, both forms of support can be competitive. Grants may have limited funding, making them harder to secure, especially for those who are not in dire financial need. Scholarships can also be tough to come by, but they often have a wider array of categories. This means that a dedicated student could potentially find a scholarship that suits their unique skills or interests.

Ultimately, the decision on which path to pursue should be based on a careful assessment of your personal situation, achievements, and future goals. By taking the time to compare these options, you can make informed choices that align with your educational aspirations and help pave the way for a successful college experience.