Exploring Financial Aid Opportunities at UC San Diego for Students in Need

Navigating the world of higher education can often feel overwhelming, especially when it comes to managing the costs associated with it. Many students find themselves searching for resources that can help lighten the financial load and make their academic journey more manageable. Here, we’ll explore various opportunities available to assist students in securing the necessary funds to thrive during their studies.

The process of obtaining support can seem daunting, but understanding the different avenues available is a crucial step. Whether you’re considering scholarships, grants, or other forms of monetary assistance, knowing your options can empower you to make informed decisions. It’s not just about the money; it’s about accessing the tools and resources that can help you focus on your education without the constant worry of expenses.

In this discussion, we’ll break down the types of resources that students can tap into, highlighting tips to maximize these benefits. From navigating applications to meeting eligibility requirements, we aim to equip you with the knowledge needed to make your educational experience both rewarding and affordable.

Understanding Financial Aid Options at UCSD

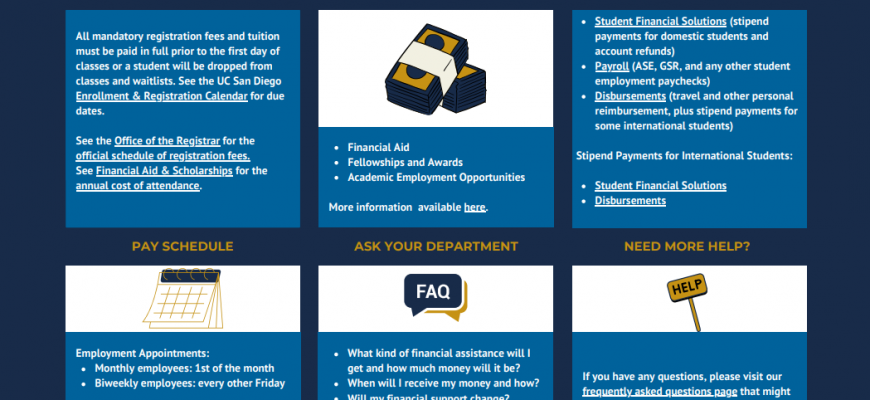

Navigating the various options for support in higher education can be quite a journey, but it’s essential for easing the cost of college. At this institution, students have access to a range of opportunities designed to alleviate the financial burden associated with their studies. Whether you’re an incoming freshman or a returning student, it’s important to familiarize yourself with the resources available to help fund your education.

One of the primary sources of assistance comes in the form of grants, which do not require repayment. These are often awarded based on need and can significantly lessen tuition costs. Additionally, scholarships are a fantastic way to secure funding; they may be based on merit, talent, or specific criteria set by donors. Researching different scholarships can lead to great opportunities that fit your unique situation.

Loans are another option to consider, allowing students to cover expenses upfront with the understanding they will need to be repaid post-graduation. However, it’s crucial to be mindful of the terms and conditions attached to these loans. Furthermore, work-study programs provide an added benefit, enabling students to earn while they learn, gaining valuable experience along the way.

Lastly, financial literacy plays a key role in making informed decisions about funding options. Taking the time to understand budgeting, repayment plans, and the implications of different types of support will empower students to make the best choices for their future. Embracing available resources can lead to a more manageable and successful academic experience.

Applying for Scholarships and Grants

Diving into the world of funding opportunities can be exciting yet overwhelming. With a plethora of options available, understanding how to navigate the process is crucial. Seeking monetary support in the form of awards or subsidies can significantly ease the financial burden of education.

First things first, research is key. Spend some time exploring various programs that fit your background, interests, and aspirations. Many organizations offer targeted support based on academic achievements, extracurricular involvement, or specific fields of study. Don’t hesitate to dig deep to find those hidden gems!

Once you’ve identified potential opportunities, start preparing your application. Each program may have different requirements, so it’s essential to tailor your responses accordingly. Gather necessary documents, like transcripts and letters of recommendation, well in advance. If an essay is part of the process, take your time to craft a compelling narrative that showcases your unique qualities and experiences.

As deadlines approach, stay organized. Keep a checklist to manage your submissions and ensure that nothing slips through the cracks. Following up on your applications can also be beneficial. If a program allows for it, reaching out to inquire about your status can demonstrate your genuine interest.

Finally, don’t get discouraged by setbacks. Rejections are part of the journey. Use them as motivation to refine your approach and keep applying. With determination and the right strategies, you’ll increase your chances of securing that vital support you need to achieve your educational goals.

Student Loans: What You Need to Know

When it comes to pursuing higher education, many individuals find themselves considering various options for funding their studies. One common route is borrowing money to help cover tuition and living expenses. Understanding how these loans work can make a significant difference in your overall experience and future financial health.

Before diving in, it’s crucial to familiarize yourself with the types of loans available. There are federal programs that often offer lower interest rates and more flexible repayment options compared to private lenders. Knowing the distinction can help you make more informed decisions about your financial commitments.

Another key aspect is the importance of budgeting. It’s easy to overlook how much money you’ll need to repay after graduation, so creating a detailed budget can help you gauge the impact of these loans on your post-college life. Remember, it’s not just about taking the funds; it’s about planning how to manage them responsibly once the time comes to pay them back.

Don’t forget to explore potential repayment plans tailored to your situation. Some lenders provide options that accommodate changes in income, ensuring that you’re not stretched too thin. Understanding these arrangements can be a lifesaver, especially during those first few years after graduation when expenses are typically higher.

Lastly, always read the fine print before signing any agreement. Each loan comes with specific terms and conditions that may affect you down the road. Staying informed will empower you to navigate the financial landscape and ultimately make choices that align with your goals.