Exploring the Various Types of Financial Aid Available

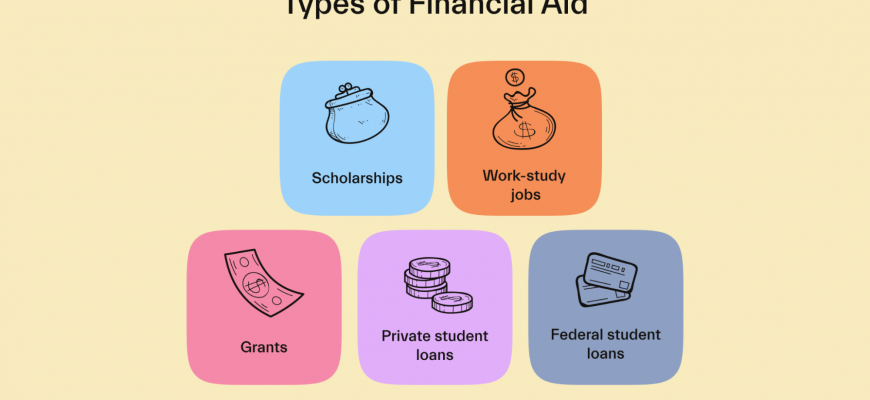

When it comes to pursuing higher learning, navigating the sea of funding opportunities can feel overwhelming. It’s more than just seeking out the cash; it’s about understanding the various avenues available to help support your educational journey. Each option comes with its own set of characteristics, requirements, and benefits that can either make or break your financial planning.

In this section, we’ll dive into the different avenues of support that can make a significant difference when it comes to covering tuition and other related expenses. From government programs to private offerings, there’s a wide array of possibilities that can help lighten your financial load. Identifying the right mix of resources tailored to your needs is essential in transforming your academic dreams into reality.

Knowing what’s out there is half the battle. By familiarizing yourself with the variety of assistance options, you’ll be better equipped to make informed decisions that will pave the way for your success. So, let’s take a closer look at the fruitful opportunities that await you!

Understanding Scholarships and Grants

Diving into educational funding can be quite the adventure, right? There are so many options out there that it can feel overwhelming. Among the most popular choices are scholarships and grants, which can make a significant difference in achieving your academic dreams without the burden of repaying anything later on.

Scholarships are typically awarded based on merit, which can include academic achievements, talents, or even unique skills. Think of it as a recognition of your hard work and excellence, often coming from universities, private organizations, or community groups. They can vary widely in amount and criteria, so it’s worth exploring what’s available to you.

On the other hand, grants are generally needs-based and are intended to provide support for students who may struggle to cover educational expenses. These funds often come from governmental sources or educational institutions. Unlike loans, you don’t need to pay this money back, making them incredibly helpful for those looking to ease their financial burden.

Both scholarships and grants open doors to educational opportunities, enabling many to pursue their goals without the looming worry of cost. By understanding how these funding options work, you can strategically navigate your choices and maximize your chances of receiving assistance.

Loans: Navigating Your Borrowing Options

When it comes to funding your education or any significant expense, understanding the landscape of borrowing can be crucial. There are numerous choices available, each with its own set of benefits and challenges. Figuring out the best fit for your situation requires a bit of research and reflection, but it’s definitely doable. Let’s break down some of the choices you might encounter and what to consider when picking the right one.

First up, you’ll likely come across the option of private borrowing. These loans can come from banks or other financial institutions and may offer attractive interest rates, but they often require a solid credit history. If you’re new to borrowing, this can be a hurdle. However, many lenders provide alternatives for those just starting out, so it’s worth shopping around to find one that suits your needs.

On the other hand, you might be interested in federal borrowing options. These tend to have more favorable terms, including lower interest rates and repayment flexibility, especially if you’re facing financial hardship down the line. It’s essential to examine these carefully, as they could provide you with the security you need as you embark on your journey.

As you delve deeper into your choices, consider the impact of interest rates and repayment plans. Some options allow you to defer payments while you study, while others might require you to start paying back right away. Understanding the implications of each can make a significant difference in your long-term financial health.

Finally, don’t hesitate to reach out for guidance. Many institutions offer resources to help you navigate these waters. Whether you’re speaking to a financial advisor or tapping into online resources, you’ll find a wealth of information to guide your decision-making. Take your time, weigh your options, and you’ll find a path that feels right for you.

Work-Study Programs: Balancing Work and Study

Many students are looking for ways to manage their educational pursuits while also earning an income. This is where work-study initiatives come into play, allowing individuals to gain practical experience and financial support without overwhelming their schedules. These programs create a unique opportunity to weave work into the academic journey, helping students develop crucial skills along the way.

Participating in these programs can be a game-changer for those juggling classes, assignments, and personal commitments. Students often find themselves in positions that align with their study fields, combining theoretical knowledge with hands-on experience. Not only does this help in covering everyday expenses, but it also enhances resumes, making graduates more appealing to future employers.

Time management becomes a vital skill as participants navigate their dual roles. Balancing shifts and study sessions requires careful planning, yet the rewards can be significant. With the right approach, students can thrive both in the workplace and in the classroom, creating a foundation for success in their careers.

Moreover, these programs foster a sense of community on campus. Students often build connections with peers and mentors in their fields, enriching their learning experience. Networking opportunities abound as they engage with professionals and fellow students, paving the way for future collaborations.

In summary, work-study programs present an excellent chance to integrate learning and earning. They empower students to take charge of their educational journeys while acquiring invaluable skills that will serve them long into their professional lives. The experience gained through these programs can truly set individuals apart in today’s competitive job market.