Understanding the Differences Between Subsidized and Unsubsidized Financial Aid Options

When pursuing higher education, many students find themselves navigating the complex world of funding options. It’s crucial to understand the various forms of support available, as they each come with their own set of rules and benefits. This knowledge can significantly impact your financial strategy while studying.

In this article, we’ll explore two main categories of educational support that students often encounter. By breaking these options down, we aim to shed light on their characteristics, helping future scholars make informed decisions about their funding strategies.

Whether you seek to minimize your overall expenses or maximize resources, being well-versed in these financial options will empower you to take charge of your education without overwhelming debt or stress. Let’s dive in!

Understanding Subsidized Options

When it comes to funding your education, there are resources that can ease the financial burden by covering part of your expenses while you are still studying. These resources can often be a great help, especially for those who may find it challenging to pay for school upfront. It’s essential to know how these opportunities work, so you can make informed decisions about your educational journey.

One significant aspect of these resources is that they typically do not accrue interest while you are in school. This means you can focus on your studies without worrying about accumulating debt during your academic years. Understanding how these options differ from other types can save you money in the long run and help you plan your finances more effectively.

Additionally, eligibility often depends on certain criteria, such as your financial situation or academic progress. Exploring these opportunities can provide relief and make your path to graduation smoother. It’s a smart move to research and see how you can make the most of these supportive programs that fit your needs.

Key Differences Between Loan Types

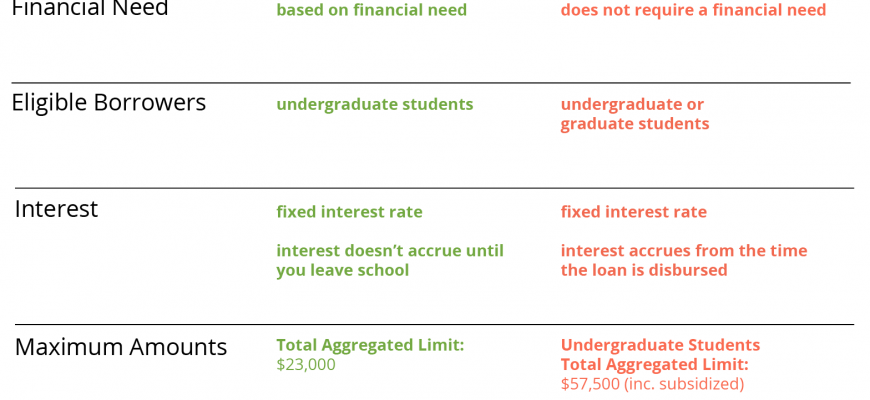

When it comes to borrowing money for education, not all options are created equal. Understanding the distinctions between the various categories of loans is essential for making informed decisions about funding your studies. Each loan type comes with its own set of features, advantages, and requirements, which can greatly impact your financial situation down the road.

One significant difference is the interest rate. Some loans offer fixed rates, which remain unchanged over time, while others provide variable rates that can fluctuate based on market conditions. This variance can lead to different overall costs over the life of the loan.

Another key aspect is the repayment structure. Certain loans might require payments while you’re still in school, causing an immediate financial burden, whereas others may allow you to defer payments until after graduation. This flexibility can be a crucial factor in choosing the right loan for your circumstances.

Eligibility criteria can also vary widely. Some options are based on financial need, while others are available to all students regardless of income levels. This aspect is important to consider as you evaluate your options and determine what you qualify for.

Lastly, there could be benefits tied to certain loans, such as potential loan forgiveness programs or incentives for public service. These perks can play a significant role in your decision-making process, as they may reduce the total amount you need to repay in the long run.

Strategies for Maximizing Support Opportunities

When it comes to securing assistance for your educational journey, having a well-thought-out plan can make all the difference. It’s essential to explore various options and strategize to ensure you receive the resources you need. Here are some effective approaches to enhance your chances of obtaining the help that can ease your financial burden.

First, thoroughly research all available options. Many institutions offer a variety of programs that cater to different needs. Take the time to understand what’s out there, whether it’s scholarships, grants, or other forms of support. This knowledge will empower you to make informed decisions and choose the best opportunities for your situation.

Next, make your application stand out. This means crafting a compelling story that highlights your achievements, aspirations, and financial circumstances. Personalize each application, demonstrating why you are a worthy candidate for consideration. A well-written essay or personal statement can significantly increase your chances of receiving funding.

Don’t hesitate to seek help with your applications. Speaking with counselors, mentors, or peers can provide valuable insights and feedback. They may point out strengths you hadn’t considered or suggest ways to improve your submissions, making your applications even more compelling.

Additionally, keep an eye on deadlines. Staying organized and aware of submission dates is crucial; missing a deadline can cost you a potential opportunity. Create a calendar that tracks important dates and set reminders to ensure you remain on top of everything.

Finally, network with other students and professionals in your field. Engaging with others can open doors to hidden opportunities that may not be widely advertised. Sharing experiences and gathering recommendations can enhance your prospects for securing vital support for your studies.