Important Dates for Financial Aid Refunds You Need to Know

When it comes to managing your education expenses, keeping track of when support funds make their way to you is crucial. Many students find themselves wondering when they can expect to receive the financial resources that can help lighten their load. Navigating the world of school funding can feel overwhelming, but knowing the key moments in this process can ease some of the uncertainty.

It’s important to stay informed about the specific timelines related to these resources, as they can vary from institution to institution. Missing a deadline or misunderstanding the schedule can lead to unnecessary stress. By familiarizing yourself with when these payments arrive, you can better manage your budget and plan for necessary purchases.

In this section, we’ll delve into what you need to know about the timing of these resources, ensuring you’re prepared when the moment arrives. By gaining insight into these schedules, you can take control of your financial planning and make the most out of the support available to you.

Understanding Financial Support Returns

When pursuing education, navigating the ins and outs of monetary assistance can feel overwhelming. One key aspect that students often encounter is the timing of the cash back process. It’s essential to grasp how this system works to ensure you’re well-prepared for when those funds make their way to you.

So, what does this process entail? Essentially, after tuition and fees are covered, any leftover funds are distributed back to the students. This surplus can be utilized for various expenses such as books, supplies, or living costs. Knowing when to expect these resources can alleviate some financial stress during your studies.

It’s also important to stay updated on the specific timeline set by your institution. Each school has its own schedule regarding when these payments are processed, so keeping in touch with the financial office can provide clarity. Planning ahead means being proactive about your budgeting, and that’s always a smart move.

In summary, understanding how the return of resources works is crucial in planning your financial strategy. By knowing what to expect and when, you can better manage your expenses and avoid any unnecessary surprises during your academic journey.

Key Dates for Student Support

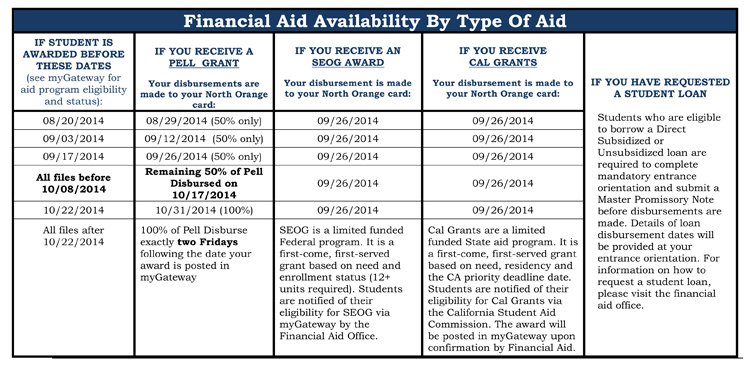

Understanding the timeline of support disbursements is crucial for students managing their educational expenses. Keeping track of when funds are available can help you budget effectively and ensure that you cover your essential costs. Here’s a rundown of the important milestones to watch for during the academic year.

First off, check for the initial notification periods. This is when institutions communicate the details on eligibility and the amounts you can expect to receive. These announcements typically happen at the start of the semester, so mark your calendar early!

Next, there are specific times when you can anticipate receiving the funds. These transfers often occur at the beginning of each term, but be aware that internal processing can sometimes delay the actual availability in your account. Always stay informed by consulting with your college’s financial office.

Another key moment to note is the balance adjustment period. After funds are credited to your account, be prepared for any changes that might occur based on enrollment status or other criteria. Staying aware of these adjustments will help you navigate your finances responsibly.

Lastly, don’t forget about any additional opportunities that may arise throughout the year. There may be periodic reviews and reassessments, especially for those taking summer classes or engaging in unique funding programs. Keeping a proactive mindset will ensure you make the most out of the support available to you.

How to Manage Your Funds Effectively

When you receive a sum of money that you weren’t counting on, it can feel like a windfall. However, approaching this unexpected income wisely is crucial to ensure it benefits you in the long run. Instead of splurging immediately, consider how you can allocate these resources to enhance your financial stability and future opportunities.

First and foremost, take a moment to evaluate your current financial situation. Are there pressing bills or debts that need to be addressed? Prioritizing these obligations can reduce stress and set a solid foundation for your financial well-being. By paying off high-interest loans or outstanding dues, you can save money on interest in the future.

Next, think about setting aside a portion for savings. Establishing or boosting an emergency fund can provide a safety net for unforeseen expenses down the road. Aim for at least three to six months’ worth of living expenses to give yourself peace of mind.

Additionally, consider investing in your education or personal growth. Whether it’s a course or a workshop, enhancing your skills can lead to better job prospects and higher earning potential. Investing in yourself is always a wise choice.

Lastly, don’t forget to treat yourself–responsibly, of course! Allocating a small percentage for enjoyment can keep you motivated without derailing your financial goals. Balance is key. With careful planning, you can turn this unexpected income into a stepping stone for a brighter financial future.