Understanding the Criteria for Eligibility in College Financial Aid Programs

Embarking on the journey of higher learning can often feel daunting, especially when the topic of safeguarding your financial resources comes into play. Many students find themselves navigating a maze of options, seeking out support to alleviate some of the burden that comes with tuition fees and other associated costs. It’s essential to grasp the basic requirements that open the door to various forms of assistance available to learners aiming for academic success.

As you dive deeper into this subject, you’ll discover that there are several pathways to unlocking financial support. Whether you’re exploring possibilities through government programs, private organizations, or institutional offerings, understanding the various conditions and necessities will empower you to make informed decisions. Grasping these aspects can significantly impact your ability to pursue your academic goals without excessive stress over finances.

In this section, we’ll break down the essential elements that determine your standing when applying for resources. By examining what factors come into play, you’ll be better equipped to navigate this crucial aspect of your education and make the most of the opportunities available to you. So let’s get started on this journey towards understanding how to maximize your chances of receiving the support you need to thrive academically.

Understanding Different Types of Support

When it comes to pursuing higher education, navigating the landscape of available assistance can be a bit overwhelming. There are various options out there, each designed to help students lighten the financial load that comes with tuition and other expenses. Knowing what’s available and how to access it can make all the difference in your academic journey.

The most common forms of support come in the shape of grants, scholarships, and loans. Grants are typically need-based and don’t require repayment, while scholarships are often awarded based on merit, interests, or specific criteria. Loans, on the other hand, do need to be paid back, often with added interest, so it’s essential to understand the implications of borrowing money in this context.

Another vital aspect to consider is work-study programs, which allow students to work part-time during their study period to help cover costs. This option can provide not only financial relief but also valuable work experience. Additionally, state and federal programs may offer unique opportunities tailored to specific groups or fields of study, adding even more variety to your options.

Understanding these different types of support can empower you to make informed decisions about your education funding. Take the time to research each option thoroughly, as this knowledge will play a pivotal role in shaping your financial strategy for the future.

Eligibility Criteria for Grants and Scholarships

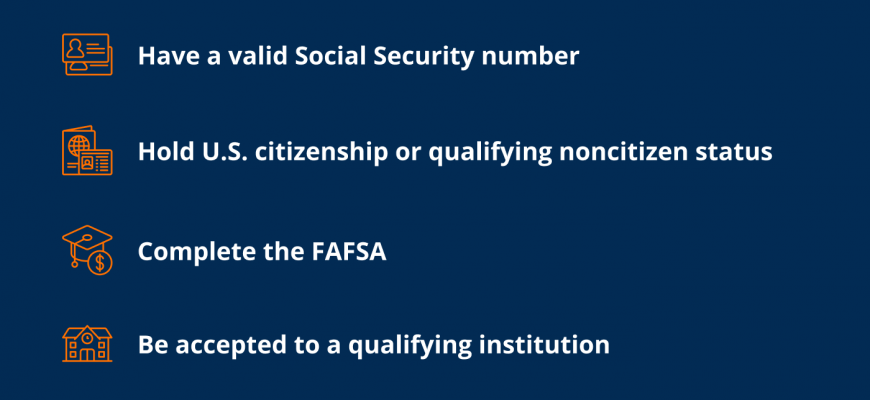

When it comes to obtaining funding for your studies, understanding the requirements is essential. Different programs have unique stipulations that determine who can receive support. Knowing these factors can help streamline your search and increase your chances of securing financial support that aligns with your needs.

Academic performance often plays a significant role in eligibility. Many organizations seek students with strong grades or test scores, as they reflect dedication and ability. Other avenues might consider extracurricular activities or community service, showcasing a well-rounded individual who contributes positively to society.

Income level can also impact your chances of qualifying. Some options prioritize individuals from lower-income households, thus making education more accessible to those who need it most. Additionally, certain programs target specific demographics, such as minorities or first-generation learners, to promote diversity and inclusion.

Don’t forget about residency status. Numerous opportunities are available for residents of specific states or regions, which can affect your eligibility based on your location. Lastly, be sure to check the deadlines and requirements for each opportunity. Staying organized and informed will greatly enhance your chances of success in securing funding solutions.

How to Apply for Federal Student Assistance

Navigating the process of obtaining support for your educational journey can feel overwhelming, but it doesn’t have to be. Understanding the steps involved in requesting government resources will help you access the funding you need. Let’s break down the process so you can tackle it with confidence.

First and foremost, you’ll want to fill out the Free Application for Federal Student Aid, commonly known as the FAFSA. This form is essential as it determines your eligibility for different programs designed to help students cover their expenses. Make sure to gather the necessary documents such as your tax returns, bank statements, and other financial information before starting the application.

After submitting your FAFSA, be on the lookout for your Student Aid Report. This document will summarize your financial situation and may indicate which types of assistance you qualify for. Review it carefully, as it contains important details you may need to provide to your chosen institutions.

Next, reach out to the financial services office of the schools you are interested in. They can offer guidance on additional requirements and help you understand the specific programs available. Don’t hesitate to ask questions–this is what they are there for!

Lastly, keep track of deadlines. Ensure that you submit your FAFSA and any other required forms on time to maximize your opportunities for assistance. Staying organized will make the whole process smoother and help you focus on what’s truly important–your education!