Exploring the Differences Between Financial Aid Loans and Grants for Students

When it comes to pursuing higher education, the financial aspect can often feel daunting. Many individuals find themselves navigating a maze of options designed to help ease the burden of tuition and other expenses. Understanding the various types of support available can unlock new pathways to achieving your academic goals.

Two prominent avenues that students often consider are monetary assistance that requires repayment and resources that do not create a financial obligation. Each choice has its own set of advantages and considerations, making it essential to weigh your options carefully. Learning how these forms of support differ can empower you to make informed decisions about your education funding.

As you embark on this journey, it’s crucial to gather information on eligibility criteria, application processes, and potential impacts on your future finances. The right choice for you will depend on your circumstances, aspirations, and how you envision your educational experience unfolding. Embracing this knowledge will set you on a path toward a brighter, more affordable future.

Understanding Financial Aid Options

Navigating the world of educational support can feel overwhelming, but it’s essential to know what’s available to help fund your studies. There are various options out there, each designed to ease the financial burden of pursuing higher learning. From resources that you don’t have to repay, to those that come with obligations, understanding the differences is crucial for making wise choices.

One common type of support involves funds that students do not need to return, offering a sense of relief as you embark on your academic journey. These opportunities often depend on merit or financial need and can significantly lower overall costs. In contrast, some forms of assistance require repayment after graduation, which can influence your long-term financial planning. These options often come with interest rates and specific terms that you’ll need to consider.

Whether you’re looking for non-repayable resources or those with an obligation, it’s important to research thoroughly. Identifying what fits your situation best can make a significant difference in how you approach your education. Don’t hesitate to explore various avenues, ask questions, and seek guidance to ensure you’re making well-informed decisions that align with your goals.

Differences Between Loans and Grants

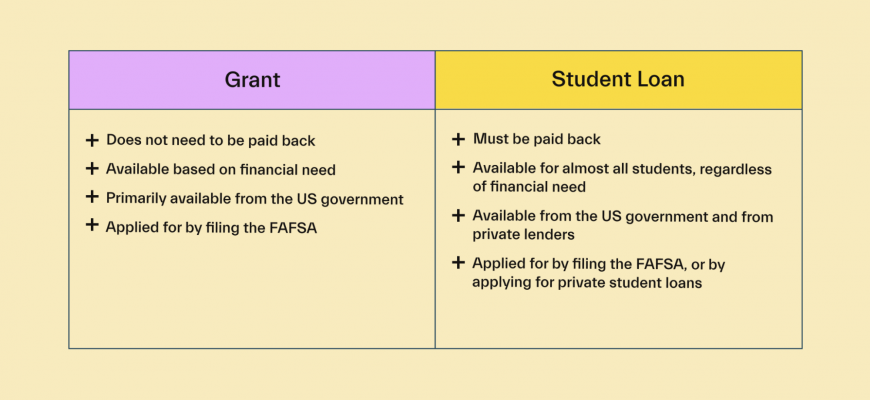

When it comes to funding your education or other expenses, it’s important to understand the distinctions between different types of financial support. Each option has its own characteristics, which can significantly impact how you manage your funds in the future.

Here are some key differences to keep in mind:

- Repayment: Typically, one type requires you to pay back the amount you receive, often with added interest, while the other does not require any repayment at all.

- Eligibility: Another option usually involves stricter criteria based on income, academic performance, or specific demographic factors, whereas the other may be more accessible to a broader audience.

- Purpose: Some types are specifically designated for educational costs, while others can be spent on a variety of personal expenses.

- Application Process: The method of application might differ as well, with one often requiring a detailed proposal or financial documentation, and the other being more straightforward.

Understanding these differences can help you make more informed choices regarding how you secure the funds you need. Each type has its pros and cons, so it’s essential to weigh them carefully based on your unique situation.

Applying for Financial Assistance

Seeking help for your education or training expenses can feel overwhelming, but it doesn’t have to be. Understanding the process and knowing where to start will make it much easier to access the resources available to you. Whether you’re looking to cover tuition, books, or living costs, there are options designed to assist you in your journey.

The first step is to gather all necessary documents. This usually includes your income information, school details, and any other relevant paperwork. Having everything organized will save you time and make you more confident when submitting your requests.

Next, research the various resources offered by institutions, organizations, and government programs. Each source has its own requirements and application procedures, so be sure to read them carefully. Some may prioritize specific groups, like those from low-income backgrounds or those pursuing certain fields of study.

Once you’ve identified the options that fit your situation, it’s time to complete your applications. Pay attention to deadlines and submission guidelines. Providing accurate and thorough information increases your chances of receiving support.

Finally, don’t hesitate to follow up on your applications. Keeping in touch with the relevant offices can help clarify any questions and show your interest in obtaining assistance. Remember, you’re not alone in this process–many have successfully navigated it and are eager to share their experiences and advice.

Repayment Plans for Student Loans

When it comes to managing education-related debt, having a clear strategy is essential. Understanding various repayment options can help you navigate the road ahead with confidence and ease. There are multiple pathways to consider, each designed to fit different circumstances and financial situations.

Standard Repayment Plan is often the default choice, spreading payments evenly over a set period. This method usually leads to the highest monthly payments but ultimately minimizes interest accrued over time. It’s a straightforward approach for those who prefer predictability in their budget.

For those looking for a bit more flexibility, Graduated Repayment Plans offer an attractive alternative. Monthly payments start lower and gradually increase, making it a good option for recent grads who anticipate higher earnings in the future. This can ease the burden right after school while allowing room for growth.

If your circumstances fluctuate or if you expect an unstable income, you may want to explore Income-Driven Repayment Plans. These options link your monthly payments to your earnings, which can significantly lighten the load during tough financial times. Plus, they often come with the possibility of forgiveness after a certain number of years.

Finally, Extended Repayment Plans provide another layer of adaptability by allowing repayment over an extended duration. This can lower monthly payments, yet it may result in paying more overall due to accumulating interest. It’s a trade-off that can be beneficial for those prioritizing cash flow in the present.

In the end, evaluating your specific needs and future earning potential is crucial. Finding the right strategy can pave the way for a more manageable financial future, so take your time exploring the various options available!