Navigating the Complex World of Financial Aid Terminology

Understanding the intricacies of funding support can often feel like deciphering a foreign language. Many individuals find themselves overwhelmed by the complex terminology and abbreviations associated with financial support programs. It’s crucial to demystify this lexicon to empower people to make informed decisions when pursuing monetary resources.

From grants to scholarships, countless terms are used to describe various types of support. This unique language can create barriers for those seeking help, leading to confusion or frustration. By breaking down these terms into more digestible pieces, we can pave the way for a clearer path toward securing the necessary resources.

In this guide, we’ll explore the key concepts and terminology that everyone should know. Whether you’re a student, a parent, or someone looking for guidance on funding options, gaining a solid understanding of this vocabulary is essential. Let’s dive in and unravel the complexities together, ensuring that you feel confident in your journey toward financial assistance.

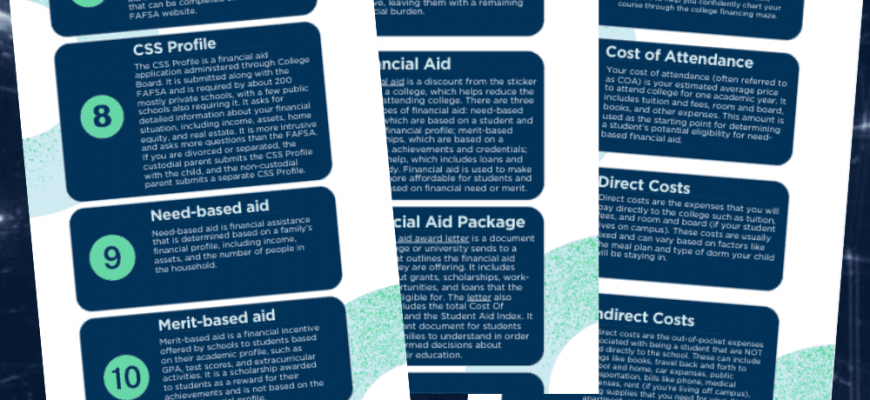

Understanding Key Terms in Financial Support

When navigating the world of monetary assistance for education, it’s essential to grasp the vocabulary that comes with it. Many terms may seem confusing at first glance, but having a solid understanding of them can make your journey much smoother. Knowing what each concept means will empower you to make informed choices regarding your funding options.

One crucial term to familiarize yourself with is “scholarship.” This is essentially a sum of money awarded to students based on various criteria, which does not need to be repaid. Conversely, “grant” refers to funds provided by the government or institutions that don’t require repayment as well, usually awarded based on financial need.

Next up is “loan.” This is borrowed money that must be paid back, often with interest. Students are encouraged to distinguish between “subsidized” and “unsubsidized” loans, as the former does not accumulate interest while the student is in school, whereas the latter does. Understanding the nuances of these options can greatly influence future financial planning.

Another important phrase is “cost of attendance.” This encompasses all expenses related to schooling, including tuition, housing, food, and other necessities. Knowing this figure helps in evaluating how much support you may require.

Lastly, don’t overlook the term “work-study.” This provides students with part-time job opportunities to help cover costs while they study. It’s an excellent way to gain experience and minimize debt simultaneously.

By mastering these essential terms, you’ll be well-equipped to tackle any funding situation that comes your way. Understanding the language of monetary assistance not only facilitates the application process but also helps in making sound financial decisions for your education.

Navigating Scholarships and Grants

Finding the right resources to help pay for education can sometimes feel overwhelming. With so many options available, it’s essential to learn how to identify and pursue the opportunities that align with your goals. Whether you’re a high school graduate or returning to school as an adult, understanding how to navigate these funding sources can open doors to new possibilities.

First things first: research is key. Take the time to explore various scholarships and grants tailored to your field of study, demographic background, or special talents. Not all funding opportunities are created equal, so a bit of digging can yield great rewards. Websites, local organizations, and institutional resources can be invaluable in your search.

Next up, get organized. Create a list of deadlines, requirements, and necessary documents for each option you’re considering. This step will help you manage your time efficiently and ensure you don’t miss out on potential support. Remember, attention to detail can make or break your applications, so be thorough in your preparations.

Finally, don’t hesitate to ask for help. Many institutions offer guidance offices specifically for students seeking funding. Reaching out for advice or mentorship from educators can provide insights that save you time and boost your chances of success. With the right approach, unlocking the potential of these resources can lead to a much brighter educational journey.

Loans: Types and Repayment Options

When it comes to funding your education or other significant expenses, borrowing money can be a helpful strategy. There are various kinds of loans available, each designed for specific needs and circumstances. Understanding these options is crucial, as it directly impacts how you’ll handle repayment later on.

Types of Loans

Loans generally fall into two main categories: federal and private. Federal loans are backed by the government and typically offer lower interest rates and flexible repayment plans. On the other hand, private loans are issued by banks or financial institutions, which may come with higher rates and less forgiving terms. Within these categories, you’ll find options like subsidized loans, where the government covers interest while you’re in school, and unsubsidized loans, where interest accrues immediately.

Repayment Options

Once you’ve borrowed funds, understanding how to pay them back is essential. Many loans offer various repayment plans. For example, standard repayment typically involves consistent monthly payments over a set period. Alternatively, income-driven repayment plans adjust your monthly payments based on your earnings, making them more manageable if your income fluctuates. Additionally, some loans may offer deferment or forbearance options, allowing you to temporarily pause payments under certain circumstances.

Ultimately, choosing the right loan type and repayment plan depends on your financial situation and future goals. Taking the time to explore these options can pave the way for a smoother financial journey ahead.