Exploring Financial Assistance Opportunities at Harvard Business School Online

Embarking on an academic journey can often feel overwhelming, especially when it comes to managing the costs associated with it. Many potential students worry about how they will fund their studies, and that’s completely understandable. Fortunately, there are various opportunities available that can help alleviate some of the financial burdens, making education more accessible to a wider audience.

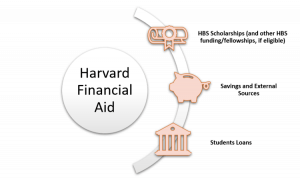

When delving into the resources available, it’s essential to understand the different forms of assistance designed to support students in their aspirations. These offerings can range from scholarships and grants to tailored payment plans, all aimed at ensuring that a commitment to learning doesn’t have to be hindered by monetary constraints. With the right information, navigating these options becomes much more manageable.

For those considering their educational possibilities, staying informed about the various support systems can open doors that might have seemed closed. Whether you’re seeking information about competitive scholarships or understanding the process for applying for assistance, there’s a wealth of resources to explore. Your dream of advancing your education is within reach, and knowing how to access these resources is the first step towards achieving it.

Understanding Financial Assistance Options

Navigating the world of funding can feel overwhelming, especially when pursuing advanced learning opportunities. There are various resources available to help ease the financial burden, ensuring that anyone motivated can access quality education without breaking the bank. It’s crucial to explore all potential avenues for support and determine which options align best with your individual needs and circumstances.

Scholarships often serve as a great starting point. These merit-based or need-based grants do not require repayment and can significantly reduce overall costs. Additionally, there are programs that may offer stipends or other forms of monetary support, often contingent on maintaining specific academic achievements or contributions to the community.

Another avenue to consider is tuition reimbursement from employers. Many organizations recognize the value of continuous education and may offer assistance to employees looking to upgrade their skills or expand their knowledge. Always check with your HR department to see if such benefits are available.

Loans are also an option for those who need immediate funding. While these require repayment, they provide the necessary resources upfront to pursue your goals. However, it’s essential to carefully assess your financial situation and future earning potential to ensure a responsible approach to borrowing.

Finally, many programs may offer payment plans to help manage costs over time. This can make the overall expense more manageable, allowing you to budget effectively while investing in your future. Understanding these various options can empower you to make well-informed decisions about your educational journey without overwhelming financial stress.

Navigating Application Processes Effectively

When tackling the journey of seeking assistance for your educational pursuits, understanding the application framework can make a world of difference. It’s all about maximizing your chances by being well-prepared and informed. Let’s dive into some key strategies that will help you sail through the process smoothly.

First and foremost, take the time to thoroughly research the different options available to you. Each opportunity may come with its own set of eligibility criteria and submission guidelines. Knowing what you’re getting into can save you a lot of headaches later on. Create a checklist to keep track of important deadlines and required documentation.

Additionally, consider reaching out to current participants or alumni. Their insights can offer invaluable perspectives on what to expect during the submission phase. Networking within these circles can also lead to potential recommendations, which can significantly enhance your application.

Don’t underestimate the power of personal narratives. Your written statements should reflect your unique journey and aspirations. Be authentic and let your passion shine through. Highlighting what motivates you will help the evaluators connect with your story on a deeper level.

Lastly, remember that persistence is key. If your initial attempt doesn’t yield the desired results, take it as a learning experience. Reflect on your submission, seek constructive feedback, and don’t hesitate to reapply. The journey toward securing support can be challenging, but with determination and the right approach, success is within your reach.

Maximizing Your Financial Aid Benefits

When it comes to managing educational expenses, optimizing the resources available can make a significant difference. It’s important to explore every avenue that can assist you in pursuing your goals while keeping costs manageable. By understanding how to effectively leverage the support systems in place, you can enhance your overall experience without a financial burden.

First and foremost, familiarize yourself with the various options that may be available to you. Different programs often offer distinct types of support, so it’s crucial to assess your eligibility for each. This means looking into grants, scholarships, and other opportunities that may not require repayment. Additionally, don’t hesitate to reach out to advisors or coordinators who can provide insights tailored to your situation.

Another effective strategy involves budgeting wisely. Create a comprehensive financial plan that outlines your expected expenses and potential income sources. This will not only help you stay organized but also allow you to identify areas where you can save or allocate resources more effectively. Remember, staying on top of your finances will enable you to make informed decisions that align with your educational aspirations.

Additionally, consider participating in workshops or seminars that focus on financial literacy. These sessions can equip you with valuable skills and knowledge, empowering you to navigate your monetary responsibilities with confidence. Many institutions offer these resources, which can be an excellent way to learn more about managing educational costs.

Lastly, maintain open communication with your institution’s support team. If circumstances change or you encounter unexpected challenges, they might offer solutions or adjustments that you hadn’t considered. Being proactive and engaged can ensure that you take full advantage of the support available to you.

In conclusion, by being informed, organized, and proactive, you can truly maximize the resources available to you. This approach not only eases the financial strain but also allows you to focus more on your educational journey and achieve your aspirations.