Exploring Financial Assistance Options Available in Oregon

Thinking about pursuing your education can be thrilling, but it often comes with a hefty price tag. Fortunately, there are numerous resources available to help lessen that financial burden. These programs are designed to assist individuals in navigating the costs associated with tuition, textbooks, and other essential expenses.

Whether you’re a recent high school graduate, a returning student, or someone looking to enhance your career, exploring funding possibilities can be a game-changer. Numerous organizations and initiatives in the region aim to ensure that socio-economic barriers don’t hinder anyone’s academic journey.

Understanding the variety of scholarships, grants, and loan options is crucial. Gathering information about what’s out there can empower you to make informed decisions. In this section, we’ll dive deeper into the different forms of support that are accessible, promoting a pathway to success for every eager learner.

Types of Support Options in Oregon

When it comes to pursuing education in this beautiful state, there are various ways to alleviate the costs associated with it. Understanding the different types of support can make a significant difference in managing expenses and making education more accessible for everyone. Each option possesses unique features that suit the needs of individuals at various stages in their educational journey.

Grants are a popular choice, offering funds that typically do not require repayment. These resources come from federal programs, state initiatives, or private organizations. They often focus on assisting those with demonstrated financial necessity, encouraging students to reach their academic goals without the burden of debt.

Scholarships are another great avenue, usually awarded based on merit, academic achievements, or specific talents. They can significantly reduce tuition costs and are available through schools, private foundations, and community organizations. Best of all, like grants, they generally do not require repayment.

Loans represent a more serious commitment, as they must be repaid with interest after graduation. They can come from federal sources or private lenders and are often necessary for many students to cover the full range of educational expenses. Understanding the terms and conditions is crucial before accepting any loan agreement.

Work-study programs enable students to earn money while studying. These positions often relate directly to their field of study, providing valuable experience alongside financial support. This option not only helps to manage costs but also enhances a student’s resume with relevant job experience.

In addition to these, there are also local scholarships and community resources designed to help students reduce their financial burdens. By exploring these various support avenues, individuals can create a comprehensive strategy for managing their education costs while focusing on achieving their academic aspirations.

Navigating State Grants and Scholarships

When it comes to funding your education, there are plenty of options that can lighten the load. Exploring various programs offered by the state can open doors to additional resources that help you cover the costs of tuition and other expenses. Understanding how these opportunities work can significantly ease your educational journey.

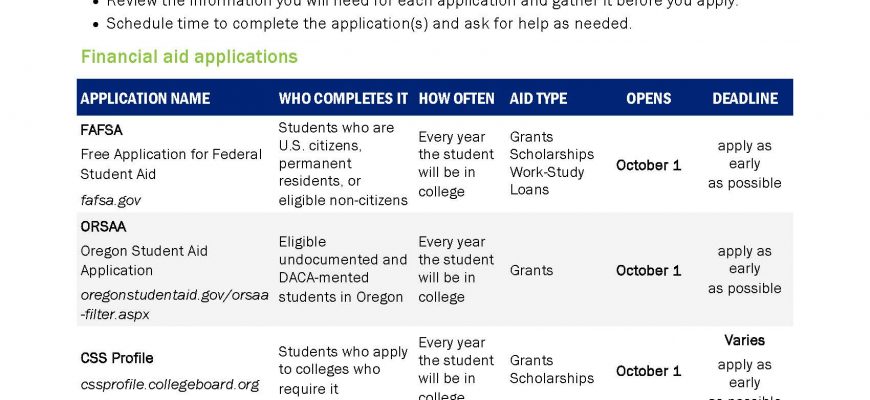

Applying for these programs can seem daunting at first, but breaking it down into manageable steps makes the process much smoother. Start by researching the various types of support available, as they can come in different forms, such as merit-based awards or need-based offerings. Taking the time to familiarize yourself with the requirements and deadlines is crucial for maximizing your chances of receiving assistance.

Don’t hesitate to reach out for help! Many colleges and universities have dedicated offices that specialize in guiding students through the application process. They can provide valuable insights and support, making it easier to navigate the sometimes overwhelming world of funding opportunities. Remember, every little bit helps, so casting a wide net can lead to unexpected resources and make a real difference in your educational experience.

Keep organized while you explore. Create a checklist of the different programs you’re interested in, noting their specific eligibility criteria and application timelines. Staying on top of these details can save you time and prevent unnecessary stress as you approach those important deadlines.

In the end, the knowledge you gain about available resources will empower you to make informed decisions, ensuring you maximize the support you receive. Embrace the journey, and you might be surprised at the opportunities that await!

Understanding Federal Assistance Programs

When it comes to navigating the world of support options, it’s essential to grasp the various initiatives available from the government. These programs are designed to help individuals and families meet their expenses, making education and other necessities more accessible. Whether you’re considering higher learning or dealing with unexpected costs, knowing the ins and outs of these resources can make a significant difference.

Firstly, it’s crucial to identify what types of programs are out there. Various initiatives cater to different needs, ranging from housing stipends to educational resources. Each comes with its own set of eligibility criteria, so understanding those requirements is the first step toward receiving assistance.

Furthermore, many of these programs aim to alleviate burdens and promote self-sufficiency. By exploring these options, individuals can find not only immediate assistance but also opportunities for long-term stability. It’s about leveraging what’s available to create a more secure future.

In addition, applying for these options often involves some paperwork and documentation that demonstrate your circumstances. Being prepared and organized can expedite the process and increase your chances of receiving the necessary support. Don’t hesitate to reach out for help with paperwork if needed; many local organizations offer guidance free of charge.

Overall, tapping into these federal resources can provide a much-needed safety net. By understanding what’s available and how to navigate the application process, individuals can take that first step towards a smoother path through life’s challenges.