Exploring Financial Assistance Options for OCC Students

Embarking on a journey towards higher education can often feel overwhelming, especially when considering the financial aspects involved. Many students are keenly aware of the expenses associated with tuition, materials, and daily living costs. Luckily, there are various pathways available to help ease this burden. It’s essential to explore these opportunities, as they can make a significant difference in the overall experience and success of your studies.

From scholarships to subsidized programs, numerous resources exist to assist individuals in achieving their academic dreams without the financial strain. Understanding what is available and how to apply can open doors that might otherwise remain closed. Whether you’re a new learner or looking to advance your skills, knowing where to turn when finances become a concern is invaluable.

Investing your future doesn’t have to mean putting yourself in a difficult position financially. With a bit of research and determination, you can find the necessary support to pursue your educational goals confidently. Let’s dive into some of the incredible opportunities that can help facilitate your path to success.

Understanding Support Options for Students

Navigating the world of educational support can be a bit overwhelming at first, but it opens doors to countless opportunities. This section aims to clarify how various resources can assist you in pursuing your academic goals without the constant worry of expenses. The key is to explore all available options and find the one that aligns perfectly with your needs.

Many institutions provide different types of assistance to help lighten the financial burden on students. This can include grants, scholarships, and various types of loans. It’s essential to familiarize yourself with the different opportunities, as they often come with specific eligibility criteria and application processes.

Taking the time to research these resources and understanding the requirements can make a significant difference in your educational journey. Each opportunity has its advantages, whether it’s the opportunity to receive funds that don’t need to be repaid or low-interest loans that allow for more manageable repayments after graduation.

Remember to reach out to the appropriate offices on campus for guidance. They are there to help you navigate through the complexities of securing the necessary financial resources. Engaging with experienced advisors can provide insights that might save you time and enhance your overall experience.

In conclusion, being well-informed and proactive is critical. The right support can make all the difference, enabling you to focus on your studies and personal growth without being held back by financial constraints.

Types of Assistance Available

When it comes to pursuing education or training opportunities, there are various options out there to help lighten the financial burden. Understanding the available resources is crucial in making an informed decision about your educational journey. Let’s explore some pathways that individuals can consider to support their aspirations.

- Scholarships: These are typically awarded based on merit, need, or specific criteria set by organizations. They don’t require repayment, making them an excellent choice.

- Grants: Similar to scholarships, grants provide funds that do not need to be returned. They are often need-based and can come from the government or private entities.

- Work-Study Programs: These arrangements allow students to work part-time while attending classes. It’s a great way to earn income to cover living expenses and tuition fees.

- Loans: Borrowing money can be another way to fund your education. These funds will need to be repaid, usually after finishing your program, but they can provide immediate support.

- Tuition Reimbursement: Some employers offer programs that reimburse employees for educational costs. This can be an attractive option if you’re already working.

No matter your situation, there are numerous avenues to explore. It’s essential to research each option thoroughly and see which aligns best with your goals and financial circumstances.

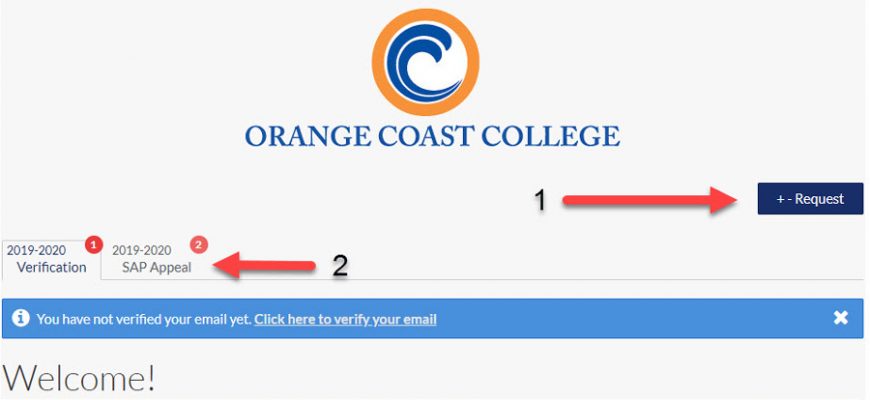

Navigating the Application Process

Getting started with your journey towards support can feel like a maze, but it’s all about understanding the steps involved. First off, many resources are available to assist you in managing your financial responsibilities while pursuing education. Knowing where to begin is the key, and with a bit of guidance, you can make the process smoother.

The first thing to do is gather the necessary documentation. This typically includes proof of income, identification, and any relevant academic records. Having these items ready can significantly speed up your application. Next, familiarizing yourself with the specific requirements and forms needed is crucial. Many systems provide detailed instructions online, so take advantage of those resources.

After preparing your documents, it’s time to fill out the application form. Pay close attention to each question and provide accurate information. It might be helpful to double-check everything before submitting. Once you send it off, be prepared for follow-up communication. This could include requests for additional information or clarification on your submission.

Finally, remember to stay on top of deadlines. Keeping a calendar can help you track essential dates and ensure you don’t miss any opportunities. It’s also a good idea to reach out for help if you need it. There are numerous organizations and individuals who are eager to assist you in this process.