Exploring Financial Support Options Available for Married Students

Starting a journey in higher education is an exciting yet challenging endeavor, especially when you have a partner by your side. Balancing academics with shared responsibilities can sometimes feel overwhelming, but there are numerous resources available to help lighten the load. Understanding the various opportunities out there can make a world of difference in navigating this unique experience together.

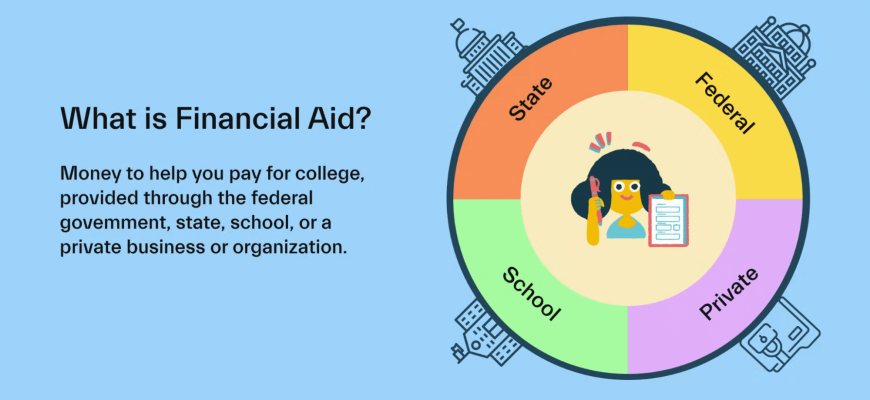

When it comes to achieving educational goals, couples often face distinct financial challenges. However, there’s a silver lining: various programs and platforms exist specifically to ease these burdens. From grants to scholarships, exploring these options can significantly enhance the overall educational journey.

Moreover, thinking creatively about resource management can pave the way for a smoother path through academic life. Whether you’re considering part-time work or exploring alternative financing methods, being proactive is key. In this article, we delve into the specifics of the support available, empowering partners to focus on their studies while building a future together.

Understanding Financial Assistance Options Together

When two people embark on the journey of higher education, navigating the landscape of support can seem daunting. It’s essential to combine your resources and knowledge to uncover what’s available to make this academic adventure smoother. Exploring the various pathways to support can empower both partners, ensuring that each person feels informed and involved in the decision-making process.

As a couple, it’s crucial to dive into the array of options together. This means not only looking at what might work individually but also considering how your combined situation–like income, family size, and expenses–affects eligibility for different opportunities. By discussing these factors openly, you can strengthen your understanding and make more informed choices that support both partners’ educational goals.

Also, don’t hesitate to reach out for guidance. Universities often have dedicated resources to help couples figure out what’s best for them. Engaging with these offers not only clarifies your unique circumstances but also forms a foundation of teamwork that will serve you well throughout your journey. Remember, working together increases your chances of finding the assistance you need.

Grants and Scholarships for Couples

Finding ways to ease the burden of education can be especially helpful for partners pursuing their academic goals together. Various programs allow couples to benefit from monetary support that helps tackle tuition fees and related expenses. These opportunities can come in the form of grants or scholarships specifically designed to assist those who are navigating their schooling as a duo.

Many organizations and institutions recognize the unique challenges faced by couples in their journey through higher education. As a result, they offer targeted funding options that promote joint applications, encouraging partners to excel together. This not only alleviates financial strain but fosters a sense of teamwork in achieving shared aspirations.

Whether you are looking for institutional support or community-based initiatives, there are numerous resources available. It is worth exploring various eligibility criteria and application processes. This approach opens doors to potential awards that can significantly ease the financial aspects of pursuing an education as a couple.

Managing Student Loans as a Team

When two individuals embark on their academic journeys together, they often encounter the responsibility of handling borrowed money. Balancing budgets, planning repayments, and supporting each other through the process can transform what seems like a burden into a shared goal. Working as a cohesive unit is key, as both partners can contribute their unique strengths to navigate financial commitments.

Communication plays a vital role. Setting up regular check-ins can help both parties stay on the same page regarding their plans and expenses. Discussing monthly budgets, upcoming payments, and any potential changes in circumstances ensures that both partners feel involved and informed. This openness fosters mutual support and prevents surprises down the line.

Creating a joint strategy can also be beneficial. Whether it involves consolidating loans, tracking spending habits, or deciding who will handle which part of the repayment process, collaborating on a plan can simplify the entire experience. Utilizing tools like shared spreadsheets or financial apps can help both partners visualize their financial landscape, making it easier to align goals and adjust as needed.

Lastly, celebrating small victories is essential. Paying off a portion of a loan or sticking to a budget for a month can be cause for celebration. Acknowledging these milestones can strengthen the bond and motivation to maintain focus on collective goals, helping to cultivate a sense of teamwork on this financial journey.