Comprehensive Guide to Financial Assistance Opportunities at LSU

Embarking on an academic journey can be both exciting and daunting. For many students, the financial aspects can feel overwhelming, yet there are numerous resources available to make this adventure more accessible. Understanding the various possibilities to ease financial burdens is not just important–it’s essential for achieving your goals and making the most of your educational experience.

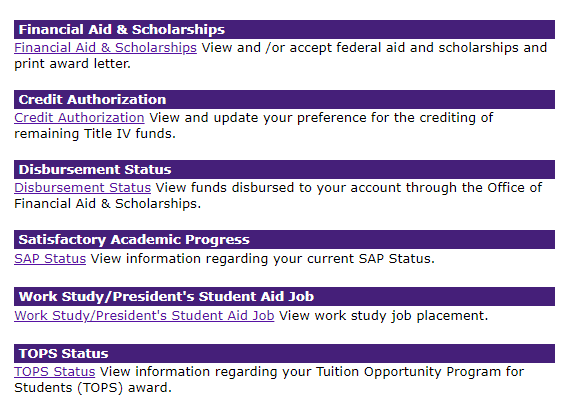

Students often find themselves navigating a maze of programs and resources designed to provide assistance during their studies. There’s a lot to explore, from grants and scholarships to work-study programs that help you earn while you learn. Each option serves its unique purpose, ensuring that everyone has the opportunity to pursue their dreams without being held back by monetary constraints.

The key is to stay informed and proactive. Knowing where to look and what options are available can significantly enhance your university life. With the right support, you can focus more on your studies and campus life, rather than stressing about financial challenges. Let’s delve into the various pathways that can help you secure the support you need for a successful academic journey.

Types of Support Available

When it comes to pursuing higher education, numerous options can help lighten the financial burden. Students often find themselves exploring various resources that can ease the costs associated with tuition, books, and living expenses. Understanding the array of possibilities is key to making informed decisions about funding your academic journey.

One popular option includes scholarships, which are typically awarded based on academic merit, talents, or specific criteria such as community involvement. These funds do not require repayment, making them an attractive choice for many students. Additionally, grants are another form of monetary assistance that usually stems from government programs or institutions, providing support based on financial need.

On the other hand, work-study programs offer students a chance to earn money while gaining valuable experience. These positions can be on-campus or with approved off-campus employers, allowing flexibility in balancing work and studies. Furthermore, loans can also play a substantial role in financing education. While these funds must be repaid, they often come with favorable terms, making them accessible for students tackling the costs of their degree.

Lastly, there are resources available specifically for certain demographics or fields of study. These niche opportunities can provide additional relief and can be a great way for students to connect with their future careers. Exploring the full spectrum of options can lead to a more manageable approach to funding educational aspirations.

How to Apply for Grants

When it comes to funding your educational journey, seeking out resources can make a significant difference. One valuable way to cover expenses is through the application process for various forms of support. Successfully navigating this path can unlock opportunities that might otherwise be out of reach.

Start your journey by researching available options. There are numerous programs designed to assist students in need, each with its own eligibility criteria. Take your time to understand what you qualify for and prioritize those that align with your background and goals.

Next, prepare a compelling application. This is your chance to showcase your achievements and aspirations. Highlight your academic performance, extracurricular activities, and any challenges you’ve overcome. Pay attention to the required documentation–having everything ready in advance will streamline the process.

Don’t hesitate to reach out for guidance. Many institutions offer resources to help you through the application process. Whether it’s a workshop or one-on-one advising, these services can provide valuable insights and tips that enhance your submission.

Finally, keep track of deadlines. Applications often come with specific dates that you don’t want to miss. Set reminders for yourself and ensure that you submit all materials well before the cut-off. Following these steps can greatly increase your chances of receiving the support you need to achieve your educational objectives.

Understanding Student Loan Options

Navigating the landscape of borrowing options for education can feel overwhelming. With a variety of choices available, it’s crucial to grasp the fundamentals so you can make informed decisions about your future. Each type of loan comes with its own set of rules and benefits, designed to accommodate different needs and circumstances.

Federal loans are often the first choice for many students. They typically offer lower interest rates and more flexible repayment plans. Additionally, some federal options provide benefits like deferment and forgiveness programs, which can be a lifesaver for graduates stepping into the workforce.

On the other hand, private loans can also be appealing, especially for those who may need to cover additional costs. These loans usually depend on creditworthiness and might have variable interest rates. It is essential to shop around and compare offers from various lenders to find the most advantageous terms available.

Understanding the variances between these options can make a substantial difference in your financial well-being post-graduation. Remember to consider factors such as interest rates, repayment periods, and borrower benefits while deciding which path to take.

Finally, don’t hesitate to seek advice from experts or your educational institution. They can provide valuable insights that help clarify your selection process and ensure you’re making the best choice for your situation.