Exploring Financial Assistance Options for Students at Junior Colleges

Embarking on the journey of post-secondary education can feel like a daunting venture, especially when finances come into play. Many individuals find themselves seeking assistance to navigate the cost of tuition and related expenses. Luckily, there are various opportunities available designed to lighten the financial burden and make education accessible to everyone.

Exploring these opportunities can lead to discovering grants, scholarships, and other resources that can help students pursue their academic goals without overwhelming debt. Understanding the options can empower you to make informed decisions, ensuring that financial limitations do not overshadow your ambitions.

The availability of these resources means that many aspiring learners can achieve their dreams without breaking the bank. So whether you’re just starting to consider your options or are ready to dive into applications, it’s essential to know what kind of support is out there waiting for you.

Understanding Financial Aid Options

When it comes to pursuing higher education, many individuals find themselves exploring various support systems that can ease the financial burden. Navigating through the different resources available can be overwhelming, but it’s essential to understand what’s out there. Each option serves a unique purpose and can significantly contribute to covering expenses associated with your educational journey.

One popular form of support comes in the shape of grants, which are often merit-based or need-based funds that do not require repayment. Scholarships also fall into this category, usually awarded based on academic achievements, talents, or specific criteria set by organizations. These opportunities can make a significant difference in reducing tuition costs.

Moreover, there are low-interest loans available that help students manage their finances over time. These must be paid back, but they often come with favorable terms and conditions, making them a viable option for many learners. Work-study programs present another alternative, allowing students to work part-time while studying, helping them earn money to support their educational endeavors.

Understanding these various paths is crucial. By doing a little research and being informed, you can strategically choose the options that best fit your situation, ultimately paving the way for a smoother academic experience.

Types of Grants and Scholarships

When it comes to pursuing higher education, there are various forms of support that can ease the financial burden. These opportunities can come in many shapes and sizes, making the journey towards achieving academic goals a little less daunting. Understanding the different options available can help students make informed choices and maximize their resources.

One common type of funding is grants, which are usually awarded based on specific criteria, such as economic need or academic excellence. Unlike loans, these funds do not require repayment, making them a popular choice among many aspiring learners. Additionally, there are numerous scholarships available that can also alleviate costs. These are often merit-based and can be offered by institutions, private organizations, or community groups.

Moreover, some programs focus on particular fields of study or demographics, allowing applicants from those groups to access tailored support. Whether it’s through academic performance, extracurricular involvement, or personal background, it’s essential to explore all potential avenues. No matter the source, these opportunities play a pivotal role in helping individuals achieve their educational dreams.

Student Loans: What You Need to Know

Diving into the world of education financing can be quite overwhelming. With so many options and terms floating around, it’s easy to feel lost. This section aims to shed light on how borrowing works, what to consider before taking the leap, and how to navigate the repayment process once your studies are complete.

First off, it’s crucial to understand that not all borrowing options are created equal. There are private options, which can vary widely in terms of interest rates and repayment terms. Then there are government-sponsored loans, often more favorable. Knowing the difference helps you make informed decisions tailored to your situation.

Before committing to any loan, take the time to evaluate your financial needs. Craft a realistic budget that takes into account not only tuition but also living expenses, books, and other fees. This will give you a clearer picture of how much you truly need to borrow.

Once you’ve made the decision to borrow, it’s essential to understand the repayment process. Different loans come with various grace periods and repayment plans. Familiarizing yourself with these details can save you a lot of stress down the line and help you avoid surprises after graduation.

Lastly, don’t forget to look into any potential forgiveness programs or deferment options that may apply to you. These can provide significant relief in times of need, allowing you to focus on what truly matters: your education and future career.

Applying for Financial Assistance Successfully

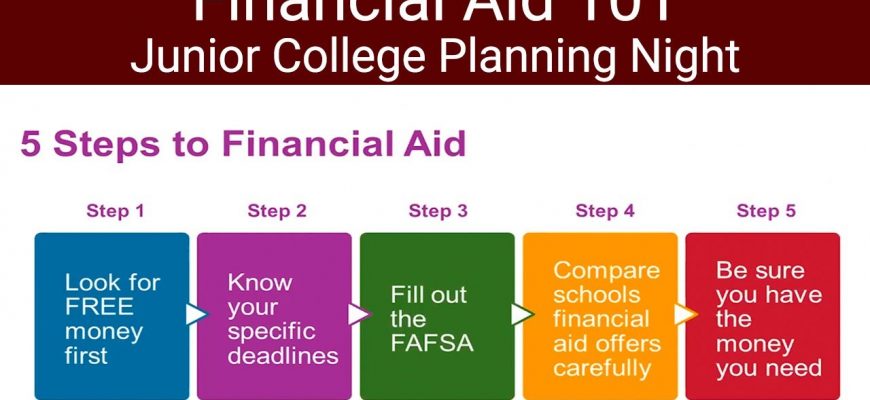

Getting support for your studies can feel overwhelming, but it doesn’t have to be. With the right approach and preparation, you can navigate the process smoothly and increase your chances of receiving the resources you need. Here’s how to tackle the application process effectively.

First and foremost, it’s essential to start early. Many options have deadlines, and you don’t want to rush at the last minute. Here’s a simple timeline to consider:

- Research available resources and understand requirements.

- Gather necessary documentation such as income statements and personal information.

- Prepare your application thoroughly, ensuring all sections are completed.

- Submit your application before the deadline.

- Follow up to confirm your application was received.

Next, be honest and clear when filling out your application. Misrepresentation can lead to disqualification, so it’s crucial to provide accurate information. Additionally, be ready to share your story–explain your goals and how this support will help you achieve them. Personal touches can make your application stand out.

Don’t hesitate to ask for help if you feel lost. Many institutions offer guidance during the application process. Connect with advisors or financial officers; they can clarify any confusion you might have.

Finally, keep track of all communications and documents related to your application. Organization is key, and it can save you from unnecessary stress later on. With these steps in mind, you’ll be well on your way to securing the resources you need for your educational journey.