Exploring Financial Aid Opportunities Available at Georgetown University

Embarking on an academic adventure is an exciting yet daunting prospect. For many aspiring scholars, the path to higher learning comes with a set of challenges that can sometimes feel overwhelming. However, there are resources available designed to ease the burden and make this journey more accessible. Understanding these options can turn a dream into reality, opening doors that may have seemed closed before.

Every institution values its students and recognizes the importance of providing pathways to ensure that everyone has the opportunity to succeed. Whether you’re a fresh high school graduate or a returning learner, there are numerous programs out there tailored to your needs. It’s all about finding the right match for your situation, and once you do, you’ll find that help is closer than you think.

This assistance isn’t just about finances; it’s also about creating an environment where all learners can thrive regardless of their background. With the right support in place, students can focus on what truly matters: building knowledge, developing skills, and making lasting connections. Embracing these resources can empower you to reach for your goals with confidence and enthusiasm.

Understanding Financial Assistance Options

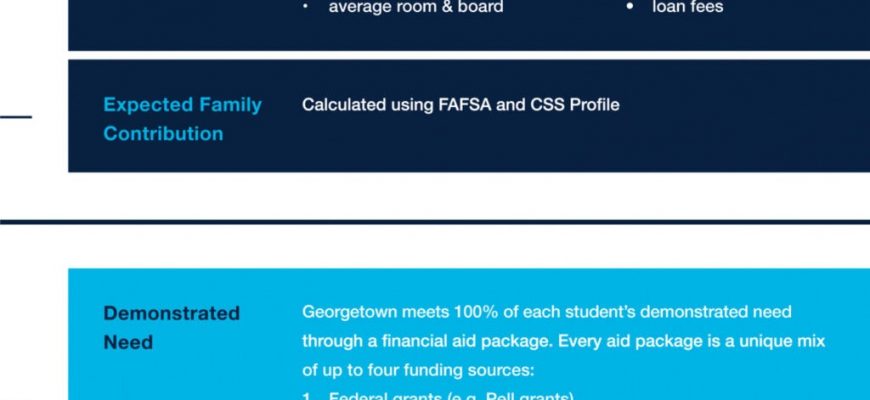

Navigating the landscape of support mechanisms available during your academic journey can feel overwhelming. It’s essential to comprehend the various resources that can help ease the burden of educational expenses. Here, we’ll break down the avenues you can explore to fund your studies and lighten your financial load.

These resources typically come in several forms, each with its own eligibility requirements and benefits. Let’s take a closer look at some of the key types:

- Grants: These are often need-based and do not require repayment, making them an attractive option for many students.

- Scholarships: Awards based on merit, talent, or specific criteria that can significantly reduce tuition costs.

- Loans: Borrowed funds that must be repaid after graduation, usually with interest. It’s crucial to understand the terms before considering this option.

- Work-study programs: Opportunities to earn money while studying, allowing you to gain valuable experience and offset some costs.

To better understand what is available to you, it’s vital to research and assess your qualifications for each option. Many institutions provide resources to assist you in this process, ensuring you have access to the necessary tools to succeed financially.

Remember to also consider other external sources, such as private scholarships and community programs. These can complement the support you receive from your institution and make a significant impact on your overall funding strategy.

Ultimately, being informed about the different types of resources and how to access them can transform your educational experience and pave the way for a successful future. Explore your options with an open mind and a proactive approach!

Types of Support Available at Georgetown

When it comes to financing your education, there are various forms of assistance that can help lighten the load. Understanding the different options available can be a game-changer in managing your educational expenses. From scholarships that recognize academic achievements to loans designed to break down costs, there’s a wide array of opportunities for students. Let’s explore what’s on offer.

Scholarships: These are often awarded based on merit, need, or specific talents. They can significantly reduce tuition fees, allowing students to focus on their studies rather than financial burdens. Various organizations, alumni, and even the institution itself may provide these awards, making them a valuable resource.

Grants: These funds are typically awarded based on financial necessity and do not require repayment. They can come from federal, state, or private sources and can cover anything from tuition to living expenses, easing the strain on students and their families.

Work-study Programs: Engaging in a part-time job while studying not only provides additional monetary support but also invaluable work experience. Positions may be on campus or in the local community, allowing students to earn money while balancing their academic responsibilities.

Loans: While these must be repaid, they can be a critical part of financing education. Borrowers can choose from federal or private options, each with its own terms and conditions. Understanding these details is crucial for making informed decisions about future repayments.

Payment Plans: Many institutions offer flexible payment solutions that allow families to break down the cost of education into manageable monthly installments. This can make the financial aspect much less overwhelming and more accessible.

Each of these resources plays a unique role in helping students achieve their academic goals. By understanding and utilizing the various options available, students can create a financial strategy that aligns with their needs and circumstances.

Navigating the Application Process

Getting through the process of securing monetary support can feel overwhelming, but with the right guidance, it can be quite manageable. The key is to break it down into smaller steps and stay organized. Throughout this section, we’ll explore the essentials that can help you effectively maneuver through the various requirements and deadlines associated with the funding you need.

First off, familiarize yourself with the necessary documentation. Each source of support often requires specific forms, so understanding what’s needed will save you a lot of time and effort. Make sure to gather documents like tax returns, income statements, and any other relevant information ahead of time.

Next, take a close look at deadlines. Mark important dates on your calendar to avoid any last-minute chaos. Schools often have different timelines for submitting applications, so keeping track of these will ensure you don’t miss out on any opportunities.

Another tip is to reach out for assistance. Don’t hesitate to contact the financial services office or attend workshops they might offer. They can provide insights and answer any questions you might have, ensuring you’re on the right track.

Finally, be thorough and double-check your application before submitting it. Small mistakes can lead to delays or even denials, so taking the extra time to ensure everything is accurate will pay off in the end. By following these steps, you’ll be well on your way to successfully obtaining the resources you need.