Exploring Financial Aid Options for Students at Fresno State University

Embarking on an academic journey can be both exciting and daunting, especially when it comes to managing the costs associated with higher education. Many learners find themselves seeking various forms of assistance to ease the financial burden. This section will explore the different support mechanisms available to help students navigate their educational expenses, ensuring a smoother path toward achieving their goals.

Understanding the landscape of funding opportunities is essential for anyone looking to further their education. There are numerous resources, from scholarships to loans, that can provide crucial backing. By familiarizing oneself with these options, students can make informed decisions that align with their educational aspirations and financial situations.

Each individual’s circumstances may vary, and it’s important to consider personal needs when exploring options. With the right information and guidance, students can unlock opportunities that not only alleviate some of the economic stress but also enhance their overall academic experience. Embracing these resources can lead to a more enriching and fulfilling time at university.

Understanding Financial Assistance Options

Navigating the world of monetary support can feel overwhelming at first. Many students find themselves unsure of where to start or what choices are available. The good news is that there are various resources and programs designed to help individuals cover their educational expenses.

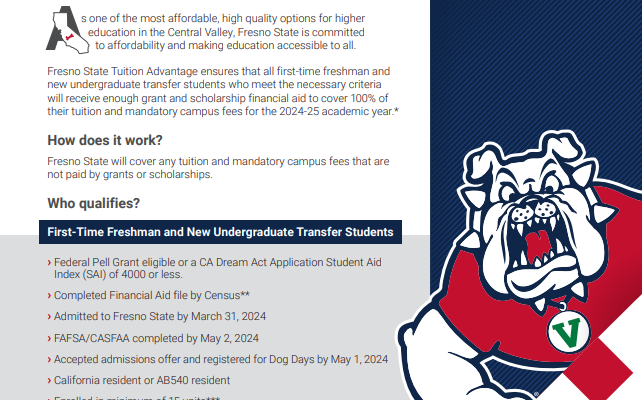

It’s essential to recognize that assistance comes in multiple forms, including scholarships, grants, work-study opportunities, and loans. Each type has its own set of requirements and benefits, so it’s worthwhile to explore these options to determine what best fits your situation. Scholarships, for instance, often reward academic or extracurricular achievements, while grants typically consider financial circumstances.

Additionally, institutions frequently provide advisors and online resources to guide students through the process. Taking advantage of available workshops or information sessions can significantly enhance your understanding and aid you in making informed decisions. Remember, the key is to research, ask questions, and stay proactive about your funding journey.

Securing the right support can ease the financial burden and allow you to focus on what truly matters–your education and personal growth. So, dive into the various alternatives and discover the possibilities that await you!

Applying for Scholarships and Grants

Navigating the world of funding opportunities can be both exciting and overwhelming. Scholarships and grants provide fantastic chances to ease the burden of educational costs, making them accessible to more students. Understanding how to effectively apply for these opportunities can significantly enhance your chances of receiving support.

Begin by researching various options available to you. Many organizations, schools, and community foundations offer programs tailored to different backgrounds and interests. Compile a list of those that resonate with your goals and personal experiences. This targeted approach will save you time and effort.

Once you’ve identified potential programs, take a closer look at their requirements. Each opportunity may have distinct criteria, such as academic performance, specific fields of study, or volunteer experiences. Pay careful attention to deadlines and ensure that you gather all required materials ahead of time.

Your application is your chance to shine. Craft a compelling personal statement that highlights your achievements and aspirations. Use this space to tell your story, emphasizing what sets you apart from other candidates. Additionally, secure strong letters of recommendation from mentors or teachers who can vouch for your dedication and character.

Don’t forget to review your submission before sending it off. Proofread your essays and double-check that all needed documents are included. Mistakes can detract from an otherwise great application, so take the time to ensure everything is polished and professional.

Finally, keep an eye on your email for updates. Some committees may reach out for interviews or further details. Stay engaged and responsive throughout the process, and remember that persistence often pays off.

Student Loans: What You Need to Know

When it comes to pursuing higher education, many individuals find themselves considering various options to secure the funds necessary to achieve their goals. One popular choice is borrowing money to cover expenses. This can be a significant decision, and it’s essential to understand how it works and what it entails.

Types of Loans: There are different varieties available, ranging from federal options to private institutions. Each type has its distinct features, interest rates, and repayment plans, so it’s crucial to conduct thorough research to find the best fit for your situation.

Repayment Plans: Understanding repayment terms is vital. Some loans offer deferment options, while others may require immediate payments. Knowing when and how to start repayment can help you avoid unnecessary stress down the road.

Interest Rates: The cost of borrowing can vary significantly. Keep an eye on different rates and consider whether a fixed or variable rate suits your long-term financial strategy better. Small differences in percentage can lead to considerable savings over time.

Borrow Responsibly: It’s easy to get carried away and take out more than you truly need. Always analyze your budget and future earning potential before committing to a certain amount. The goal is to invest in your education without overburdening yourself with debt.

In summary, understanding the ins and outs of student loans will empower you to make informed choices. It’s all about finding the right tools to support your educational journey while keeping your financial future in mind.