Understanding the Importance of Financial Aid Exit Counseling for Students

When the time comes to wrap up your time with educational assistance programs, it’s essential to have a clear understanding of what lies ahead. Many individuals experience a wide array of emotions as they prepare to navigate the next steps in their personal and financial journeys. This transitional phase is not just about saying goodbye, but about equipping yourself with crucial knowledge and strategies for the future.

In this informative section, we’ll explore the importance of preparing for the upcoming changes in your obligations. You’ll discover how to approach your responsibilities with confidence, ensuring you make informed decisions that positively influence your financial wellness. This process is an opportunity to reflect on your experiences and to gain clarity about the commitments that await you.

As you embark on this new chapter, be ready to gain valuable insights that can help shape your future. With the right tools and understanding, you can transition smoothly and take control of your financial landscape, building a foundation for successful management of your resources.

Understanding Financial Support Transition Guidance

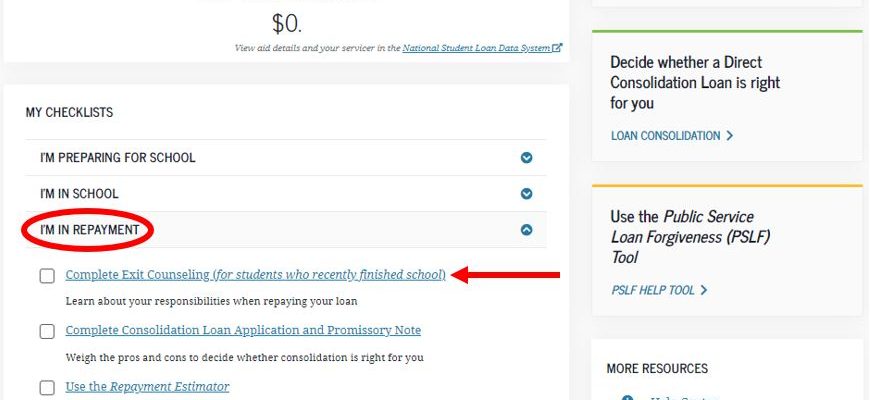

When you’re wrapping up your educational journey, there’s an important step that often gets overlooked: the process of preparing for the financial responsibilities that come after graduation. This transition period is crucial for setting yourself up for success, both in managing your finances and understanding the obligations that lie ahead. It’s about gaining a clearer picture of how to navigate your economic landscape as you step into the next phase of your life.

Essentially, this guidance is designed to help you grasp the implications of your monetary commitments. You may have taken out different types of loans or received various forms of support during your studies, and knowing how to handle these afterward can be a game-changer. It’s all about equipping you with the information you need to make informed decisions moving forward.

During this informative session, you’ll learn about repayment options, budgeting tips, and strategies for managing your overall financial health. It’s not just about numbers; it’s about empowering you to make choices that align with your personal goals and circumstances. By the end of this process, you’ll have a roadmap for your financial future, making the transition smoother and less overwhelming.

Importance of Learning Loan Repayment Options

Understanding how to manage your repayments is crucial for anyone who has taken on monetary obligations. It’s not just about borrowing money; it’s about knowing how to navigate the path to paying it back. With various plans available, making an informed choice can save you both time and stress.

Having choices means you can find a plan that fits your unique situation. Whether you’re just starting your career or balancing other expenses, knowing your options can lead to a more manageable repayment journey. Being proactive about this can prevent future headaches, ensuring you stay on top of your obligations without feeling overwhelmed.

Furthermore, understanding the different repayment strategies not only prepares you for what lies ahead but also empowers you to make decisions that align with your financial goals. It’s essential to explore the various paths so that when the time comes to start paying back, you feel confident and in control.

Strategies for Managing Student Debt

Taking on expenses for education is often a significant step that many individuals face. While it can open doors to numerous opportunities, the accompanying obligations can feel overwhelming. It’s crucial to adopt effective methods to navigate these responsibilities and ensure a secure financial future.

1. Create a Budget: Start by outlining your monthly income and expenses. This helps in understanding where your money goes and identifying areas where you can save. A clear budget will guide your spending and allow for regular payments toward your obligations.

2. Explore Repayment Options: Various repayment plans exist that cater to different financial situations. Research and consider options like income-driven repayment or consolidation. Each plan has its pros and cons, so evaluate what suits your circumstances best.

3. Prioritize Payments: Not all obligations are created equal. Focus on those with higher interest rates first while maintaining minimum payments on others. This strategy can save you money in the long run and help reduce overall costs.

4. Seek Assistance: Don’t hesitate to reach out for help if you’re feeling overwhelmed. There are organizations and resources available that offer guidance tailored to your specific needs. Taking advantage of these can provide valuable insights.

5. Consider Side Gigs: If your schedule allows it, think about supplementing your income through part-time work or freelance opportunities. This extra cash can make a noticeable difference in how quickly you can tackle your responsibilities.

6. Stay Informed: Regularly update yourself on any changes in policies or programs that could assist you with your obligations. Being well-informed will empower you to make decisions that can lead to better financial health.

By employing these strategies, you can take charge of your financial circumstances, alleviate stress, and pave the way toward a more secure future.