Exploring Various Types of Financial Assistance Available for Students and Individuals

When it comes to pursuing higher education, many individuals encounter challenges when it comes to managing the expenses involved. It’s a common concern, but the good news is that a range of resources are available to assist students in their journey. Understanding these options can make a significant difference in achieving your academic goals without being overwhelmed by financial burdens.

Throughout this guide, we will delve into various ways that learners can secure the necessary support for their studies. From scholarships and grants to flexible payment plans and community programs, there is no shortage of opportunities for those seeking help. With a little research and effort, you can uncover valuable resources that may provide substantial relief and allow you to focus on what truly matters: your education.

So, whether you’re a fresh high school graduate or an adult learner, recognizing and exploring these avenues is crucial. You might be surprised by the variety of options at your disposal, each tailored to fit different needs and circumstances. Let’s explore some of these beneficial pathways together!

Types of Support Available

When it comes to pursuing education or achieving specific goals, numerous resources can lighten the financial load. These resources come in various forms, catering to different needs and circumstances. Understanding the different options can empower individuals to make informed choices.

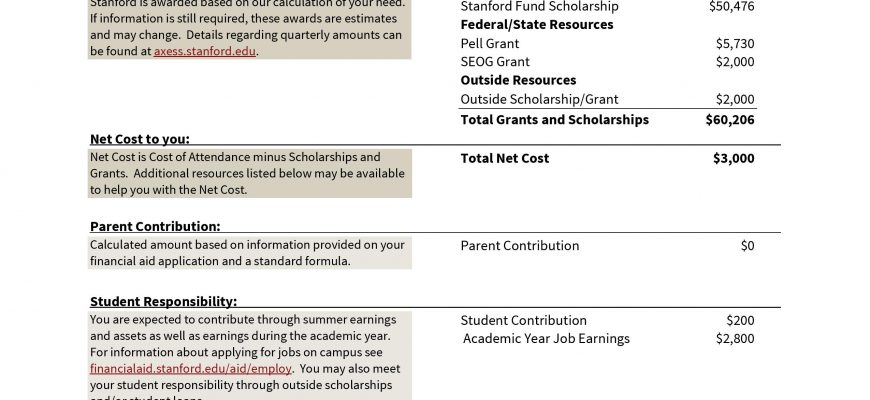

Grants are often the first avenue to explore. These funds, typically provided by governments or organizations, do not require repayment, making them a highly sought-after option. They are usually awarded based on financial necessity or specific criteria set by the granting body.

Scholarships represent another valuable source of funding. Unlike grants, these are often merit-based, rewarding excellence in academics, sports, or community service. Recipients can enjoy reduced tuition costs without the burden of repayment, making this an appealing choice for many.

Loans are also a common method to cover expenses. While they provide immediate access to necessary funds, it’s important to remember that repayment is obligatory, often with interest. Knowing the terms and conditions is crucial to avoid future surprises.

For those actively engaged in specific occupations or sectors, work-study programs can be an excellent solution. These arrangements allow individuals to earn money while gaining valuable experience in their field, striking a balance between work and study.

Additionally, subsidies may be available from various sources to help offset costs in certain areas, such as transportation or childcare. These can be significant in ensuring that essential expenses are manageable.

Lastly, institutional support from educational establishments can provide various forms of assistance, including payment plans and emergency funds. It’s worth exploring what options your chosen institution offers to ease the financial burden.

Understanding Scholarships and Grants

When it comes to pursuing your educational goals, there are numerous opportunities available that can lessen the burden of expenses. Many institutions and organizations offer various forms of support that don’t require repayment, allowing students to focus on their studies instead of worrying about finances.

Scholarships are typically awarded based on merit, which can include academic achievements, talents, or other special skills. They are often competitive and can be offered by schools, private organizations, or even community groups. Applying for these opportunities usually requires students to submit an application highlighting their strengths and accomplishments.

On the other hand, grants are usually awarded based on specific criteria, such as financial need or particular circumstances. These funds are often provided by the government or educational institutions, aiming to help those who might struggle to afford tuition and other related costs. Unlike loans, both scholarships and grants do not need to be paid back, making them an attractive option for many.

In seeking these resources, it’s essential to do thorough research to identify opportunities that align with your situation and qualifications. Whether you excel academically or come from a unique background, there’s a chance that you might find the perfect funding option to support your educational journey.

Loans: Options and Considerations

When it comes to financing your education, borrowing can be a significant part of the journey. Understanding the various choices available, along with their implications, is crucial. Different types of loans come with unique terms and conditions that can affect your financial future.

Here are some common types of loans to consider:

- Federal Loans: Typically offered by the government, these loans often have lower interest rates and more flexible repayment options.

- Private Loans: Provided by banks or lending institutions, private loans may have varying interest rates and terms, often requiring a credit check.

- Subsidized Loans: This type doesn’t accrue interest while you’re enrolled in school at least half-time, which can save you money.

- Unsubsidized Loans: Interest starts accruing as soon as the loan is disbursed, meaning you may end up paying more over time.

Before deciding on a loan, consider the following factors:

- Interest Rates: Compare rates to find the most affordable option. Small differences can have a big impact over time.

- Repayment Options: Look for flexibility in repayment plans. Some loans offer deferment or income-driven repayment plans.

- Loan Limits: Be aware of how much you can borrow. Avoid taking more than you need, as this can lead to higher debt.

- Credit Impact: Understand how borrowing will affect your credit score. Responsible borrowing can build your credit, while mismanagement can harm it.

Taking out a loan is a big step. Evaluate all your choices and be sure you understand the long-term implications before making a commitment. Doing thorough research now can save you from potential headaches in the future.