Comprehensive Guide to Comparing Financial Aid Options for Students

When exploring educational opportunities, it’s crucial to have a clear picture of the resources available to you. Navigating through the myriad of options can be overwhelming, especially when you’re trying to weigh the benefits of each one. This section is designed to help you break down the essentials and understand what is out there for you.

Gathering information and assessing your choices will empower you to make informed decisions regarding your educational journey. With a variety of opportunities available, it’s easier than ever to find support that fits your unique circumstances. This guide aims to simplify that process, ensuring you can easily see the differences and similarities between the available options.

By having a structured approach, you can clearly analyze the various forms of support. From loans to grants, understanding these pathways is vital for any student aiming to maximize their potential without unnecessary financial strain. Let’s dive into the specifics and discover how you can effectively evaluate these opportunities.

Understanding Support Options

Navigating the world of educational assistance can feel overwhelming, but it doesn’t have to be. There are various avenues available to help alleviate the financial burden of your studies. The key is to explore the different types available and see what aligns best with your needs and situation.

When considering your options, it’s important to identify whether you are looking for funds that you do not have to repay, such as grants and scholarships, or if you are open to loans that will require repayment down the line. Each category has its benefits and drawbacks, so understanding the specifics can make a significant difference in your planning.

Another aspect worth examining is eligibility criteria. Some programs may cater to specific groups, such as those based on academic performance, need, or even field of study, while others may have broader requirements. Keeping an eye on deadlines and documentation needed is also essential so you don’t miss out on potential opportunities.

Finally, it’s beneficial to compare the terms and conditions attached to each option. Aspects such as interest rates, repayment plans, and the possibility of deferment can all influence your decision. Taking the time to research these options thoroughly will empower you to make educated choices that can ease your monetary constraints during your educational journey.

Creating a Personal Comparison Tool

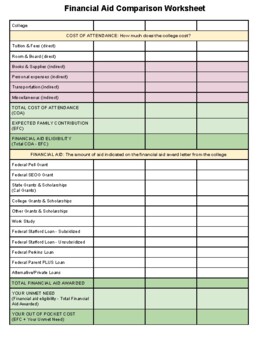

When faced with multiple options for support, it can be challenging to determine which path is best suited to your needs. Developing your own personalized evaluation tool can simplify this process. By structuring your thoughts and findings, you can clearly visualize the advantages and disadvantages of each choice, making it easier to reach an informed decision that aligns with your goals.

Start by outlining your priorities. What aspects are most important to you? Whether it’s the level of support, repayment terms, or additional resources offered, having a clear understanding of your values will guide your evaluation. Once you have your criteria set, you can create categories that will serve as a benchmark in your decision-making.

Next, gather information. Research extensively to ensure you have all the necessary details about the different options available. This could include reading reviews, reaching out to others who have made similar choices, or checking official sources for statistics. As you compile your findings, organize them in a way that makes sense for you–whether that’s through a chart, a list, or another form of comparison.

Analyze the data. Once you’ve laid everything out, take the time to evaluate each option against your established criteria. It might be helpful to assign scores or weights to different factors, allowing you to quantify your preferences and see which alternatives stand out. This method can highlight strengths and weaknesses you might not have initially considered.

Finally, trust your instincts. While data is important, your personal feelings and intuitions about each choice also play a crucial role. After thoroughly examining your options, reflect on how each one aligns with your objectives and aspirations. This comprehensive approach will empower you to choose the most suitable route tailored to your unique situation.

Maximizing Your Financial Resources

When it comes to managing your monetary resources, understanding the various options available can make a significant difference. Many individuals underestimate the power of strategic planning and the optimal use of available support systems. This section focuses on how to make the most of what you have and ensure that you’re not leaving any potential opportunities on the table.

Explore All Available Options: Begin by thoroughly researching the different types of support that may be accessible to you. From scholarships to grants, there are often various avenues that can help lighten your financial burden. Engage with your institution’s counseling services or visit community resources to gather comprehensive information.

Create a Budget: Having a clear outline of your income and expenditure is essential. A well-thought-out budget helps you identify which areas you can adjust to save more effectively. Allocating funds wisely will allow you to stretch your resources further throughout your educational journey.

Leverage Networking: Building a strong network can lead to unexpected opportunities. Connect with peers, professors, and industry professionals who may share information regarding lesser-known resources or potential opportunities. Sometimes, simply talking to others can unveil paths you hadn’t considered before.

Be Proactive: Don’t wait for opportunities to come to you. Actively seek out resources and apply for various programs that support your endeavors. The more you put yourself out there, the better your chances of reaping the rewards that can alleviate your monetary concerns.

By being resourceful and strategic, you can effectively enhance your financial situation and focus more on your goals, rather than worrying about the costs.