Comprehensive Guide to Using a Financial Aid Calculator for Maximizing Your Funding Opportunities

Have you ever wondered how to navigate the often confusing landscape of educational funding? Understanding the options available can be a daunting task, but there’s a resource designed to simplify the process. This handy tool helps individuals grasp their potential assistance based on various parameters, opening the door to countless opportunities for pursuing education without overwhelming financial stress.

With just a bit of information about your circumstances, you can receive tailored estimates that reflect your unique situation. Imagine having a personalized overview of what help you might receive–this is the essence of a support assessment tool. It’s an empowering way to gain clarity and make informed decisions about your educational journey.

Whether you’re a prospective student or looking to continue your studies, utilizing this resource can give you a clearer picture of your financial landscape. It’s more than just numbers; it’s about mapping a path towards achieving your aspirations without the burden of unexpected costs. Delve into how these estimators work and discover the possibilities that lie ahead.

Understanding Financial Assistance Tools

When navigating the complex world of education funding, having the right tools at your disposal can make a significant difference. These resources help you estimate the amount of support you might receive, offering a clearer picture of your potential expenses and financial commitments. By utilizing these helpful instruments, you can gain valuable insights into your eligibility and how much support you may qualify for, without running into too many hurdles.

It’s essential to recognize that these tools vary in design and functionality, yet they all aim to simplify the planning process. Users can input basic information, such as income, family size, and the type of institution they wish to attend. The output typically provides an estimate of the resources available to help lighten the financial burden of education.

Many individuals find these resources incredibly useful, as they pave the way for smarter decision-making regarding future studies. They can also highlight the discrepancies between costs and available support, which is crucial for planning. Understanding how to leverage these resources can empower you to make informed choices, ultimately leading to a more manageable and successful educational journey.

Benefits of Using an Estimator

When planning for higher education, understanding potential support options is crucial. Utilizing an estimator can provide clarity and help you navigate the often complex landscape of funding. By giving you an early glimpse into possible assistance, it sets the stage for informed decisions about your educational journey.

Firstly, these tools offer a personalized experience. They consider your specific circumstances, allowing you to input details such as income, household size, and academic aspirations. This tailored approach means you get more accurate projections, rather than generalized estimates that might not reflect your situation.

Additionally, using an estimator can greatly reduce stress. Knowing what to expect in terms of support allows for better financial planning and less uncertainty. With a clearer picture, you can focus on what truly matters–your studies and goals.

Moreover, these tools can uncover options you may not have been aware of. By exploring various funding sources and types of support available to you, it broadens your horizon. This means you might discover grants, scholarships, or programs that align perfectly with your needs.

Lastly, estimators promote proactivity. Instead of waiting until applications are due, you can start preparing early, ensuring you have all necessary documents and information ready. This kind of advance preparation often leads to better outcomes and peace of mind.

How to Interpret Your Results

Understanding the outcomes you receive from your assessment is crucial in navigating your funding options. These figures can initially seem overwhelming, but breaking them down can provide clarity and direction. Let’s explore how to effectively make sense of the data presented to you.

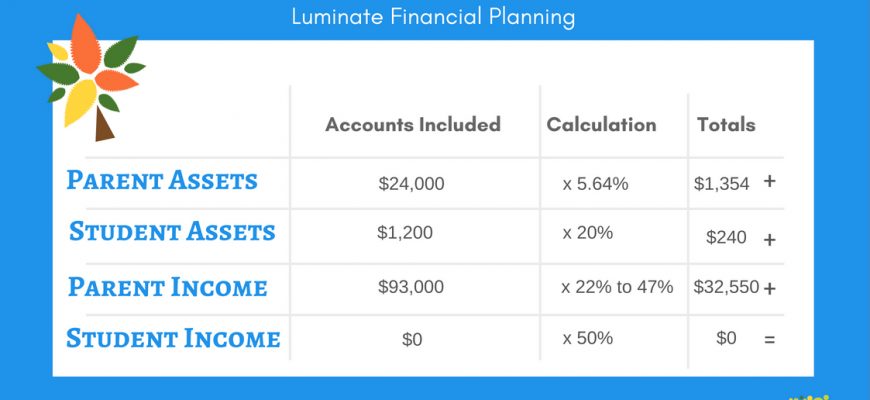

First, look at the total amount suggested for support. This is often a cornerstone figure, indicating the maximum you may be eligible to receive. However, this number is just a starting point. Consider your unique situation–factors like income, assets, and family contributions play significant roles in determining what you might actually obtain.

Next, pay attention to the breakdown of different sources of support. You might see grants, loans, and work-study opportunities listed. Each category comes with its own set of terms and obligations. For instance, grants are often free money that doesn’t require repayment, while loans will need to be paid back with interest. Knowing the difference helps you strategize on how to manage your finances in the long run.

Finally, don’t overlook the estimated costs for attendance provided in your results. Compare these with your potential support to understand the gap you may need to fill. This awareness empowers you to explore additional resources, such as scholarships or part-time work, to bridge any shortfalls.

By carefully examining your results and considering all variables, you can make informed decisions that align with your goals and financial well-being.