Exploring the Choices in Financial Aid Options A and B

When it comes to pursuing higher education, the journey often involves navigating a maze of different resources and opportunities meant to ease the financial burden. Each individual’s situation is unique, prompting many to weigh their options carefully. The choices presented can significantly impact both academic experiences and long-term goals. In this context, two main routes emerge, each with its own set of pros and cons.

In the quest for assistance in funding one’s studies, the decision-making process can feel overwhelming. The two paths often debated–let’s call them Option A and Option B–represent different philosophies and benefits. Some may lean towards a model that promotes immediate, less complicated access to support, while others advocate for a more integrated approach that might take longer to materialize but promises greater overall sustainability. As we delve into the nuances of each choice, it’s essential to consider not just the financial implications, but also how these options align with one’s personal aspirations and values.

Ultimately, the decision is not just about numbers; it’s about envisioning a future filled with possibilities. Understanding the intricacies of each choice can empower potential students, enabling them to take proactive steps toward shaping their academic and professional journeys. Let’s explore the merits and drawbacks of both sides, and see which path might be the best fit for you.

Understanding Financial Assistance Options

Navigating the world of support options can seem daunting. With various choices available, it’s essential to grasp what each can offer and how they align with your needs and goals. Whether you’re looking for help to cover tuition, textbooks, or living expenses, understanding the landscape can empower you to make informed decisions.

Here’s a breakdown of the most common forms of support:

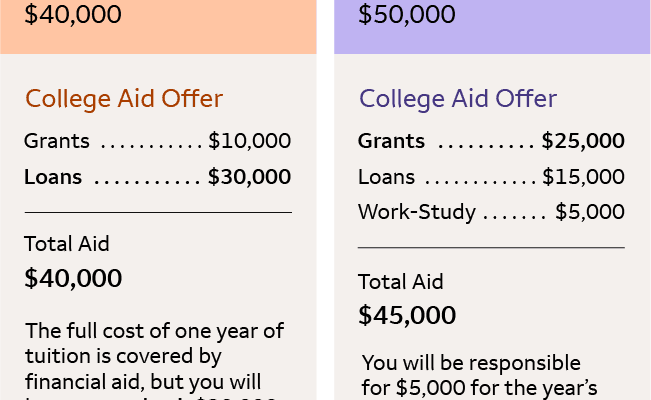

- Grants: Funds that do not require repayment, usually based on financial need.

- Scholarships: Awards based on merit or achievements, which also do not need to be paid back.

- Loans: Borrowed money that must be paid back with interest, often post-graduation.

- Work-Study Programs: Opportunities to work part-time while studying to help offset costs.

When considering your alternatives, think about the following:

- What is your current financial situation?

- What type of support aligns with your educational path?

- Are there specific eligibility criteria you need to meet?

- How will each option affect your future financial obligations?

Each form has its pros and cons, and being well-informed can lead to smarter choices. Start exploring these avenues early to maximize your resources and reduce your stress.

Grants vs. Scholarships: Key Differences

When it comes to funding your education, there are various options, but two of the most common are grants and scholarships. While they both offer financial support, they come with distinct characteristics that can significantly impact your schooling experience. Understanding these differences can help you make informed decisions on how to best manage the costs of your academic journey.

Grants are typically need-based awards that don’t require repayment. They are often provided by government bodies or educational institutions and are aimed at students who demonstrate financial necessity. The application process usually involves submitting detailed financial information to assess eligibility. These funds generally cover tuition, fees, and sometimes even living expenses.

On the other hand, scholarships can come from various sources, including private organizations, businesses, or schools, and they can be need-based or merit-based. Unlike grants, scholarships often reward students for specific achievements, such as high academic performance, athletic skills, or artistic talent. The criteria can vary widely, making it crucial to research different options to find one that suits your profile.

In summary, while both grants and scholarships serve similar purposes in supporting students financially, the key differences lie in their eligibility requirements and application processes. Knowing these nuances can empower you to pursue the funding opportunities that align best with your circumstances and goals.

Navigating Student Loan Opportunities

Finding your way through the maze of borrowing options can feel overwhelming. With numerous choices available, it’s essential to understand the various paths you can take to support your education. Each opportunity comes with its own set of requirements and benefits, making it crucial to gather all the necessary information before making a decision.

First things first, take the time to research government-backed programs. These typically offer lower interest rates and flexible repayment plans, which can ease the burden during your studies and beyond. It’s important to explore all available options, including grants and scholarships, as these can significantly reduce the amount you need to borrow.

Next, consider private loan possibilities. While they often come with higher rates compared to federal options, some lenders provide perks such as cash back or rewards for making on-time payments. Be sure to read the fine print and understand the terms before committing to any agreement.

Ultimately, careful planning and a thorough understanding of your financing choices can empower you to make informed decisions. Knowing where to look and what to expect can turn a daunting journey into a manageable experience, allowing you to focus on achieving your academic goals.