Comparing Federal Student Aid and Other Financial Aid Options Available to Students

When it comes to pursuing higher learning, navigating the various types of support available can be a bit overwhelming. Many individuals find themselves facing choices that can significantly impact their educational journey. While both categories are designed to ease the financial burden associated with college, they come with distinct characteristics that can influence your decision-making process.

On one hand, there are government-sponsored programs that provide resources to help cover the costs of education. On the other, private options might be available through institutions or community organizations, each with its own rules and criteria. Understanding the differences between these two forms of assistance is crucial for making informed choices about financing your studies.

As you explore these options, it’s important to recognize which type aligns better with your personal situation. Evaluating the eligibility requirements, repayment expectations, and the overall impact on your financial future can help you determine the best path forward.

Understanding Government Support Programs

When it comes to financing education, there are various programs designed to assist individuals in achieving their academic goals. These offerings can help cover costs such as tuition, books, and living expenses, making higher learning more accessible for many. Whether you’re considering pursuing a degree or are already enrolled, it’s essential to grasp how these resources can play a pivotal role in your academic journey.

Eligibility for Support: Different programs have specific requirements, and understanding these criteria is crucial. Often, applicants must demonstrate a level of need, which is assessed through various financial metrics. Additionally, certain programs may cater to particular demographics or fields of study, so it’s worthwhile to explore all available options.

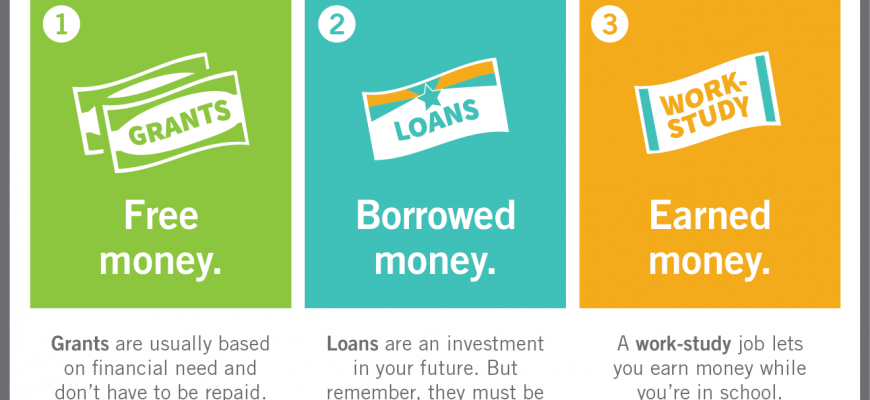

Types of Programs: There are several categories of assistance that individuals can take advantage of. Some programs provide grants, which typically do not require repayment, while others offer loans, which must be repaid over time. Furthermore, some initiatives focus on work-study opportunities, allowing students to earn money while attending classes.

The Application Process: To tap into these resources, applicants typically need to complete an application form, often requiring documentation of their financial situation. This process can vary, but being organized and proactive is essential for maximizing the chances of receiving support. It’s advisable to pay attention to deadlines and gather necessary documents beforehand.

Staying Informed: Knowledge is power, especially when it comes to educational funding. Keeping abreast of changes in these programs and exploring new opportunities can significantly impact one’s financial planning. Many institutions offer workshops and resources to help prospective recipients understand the landscape, so take advantage of those offerings.

Ultimately, understanding these government initiatives is key to unlocking your potential and ensuring that education is within reach. Investigate your options, stay organized, and don’t hesitate to seek guidance when needed. The right support can make a profound difference on your educational path.

Types of Financial Support for Education

When it comes to pursuing higher learning, there are various avenues to explore for securing assistance. Understanding these options can arm you with the knowledge needed to make informed decisions about your education funding journey. Whether you’re contending with tuition fees, books, or living expenses, knowing where to find help is crucial.

Grants are one of the most sought-after forms of support, as they typically do not require repayment. These funds are often awarded based on specific criteria, such as financial need or academic achievement. It’s a great way to lighten the financial burden while enhancing your educational experience.

Scholarships are another excellent source of support. Unlike grants, these funds are often competitive and can be offered for a range of reasons including merit, talent, or particular fields of study. Successfully landing a scholarship can significantly reduce the overall cost of your education.

Loans represent a different category altogether. While they can provide larger amounts of funding, it’s important to keep in mind that these will eventually need to be repaid, often with interest. Careful consideration of loan terms is essential to avoid future financial strain.

Work-study programs offer a fantastic opportunity to earn money while studying. These arrangements often allow students to work part-time jobs related to their field, helping to offset costs while gaining valuable experience.

Finally, family contributions can also play a significant role in funding education. Many families set aside funds specifically for their loved ones’ schooling, making it an important source to consider when planning your educational finances.

By exploring all these varied options, you can piece together a suitable strategy that minimizes debt while maximizing your academic potential. Understanding the different forms of support can make a world of difference in your pursuit of knowledge.

Eligibility Criteria for Aid Options

When it comes to funding your education, understanding the specific requirements for different options is crucial. Each type comes with its own set of rules, determining who can access the resources available. Let’s break down these qualifications to help you navigate the path to financial support more easily.

- Income Level: Many programs consider your family’s income. Generally, lower income can enhance your chances of receiving assistance.

- Academic Performance: Some opportunities require maintaining a certain grade point average or completing specific coursework.

- Enrollment Status: Whether you’re attending part-time or full-time may affect your qualification. Full-time students often have more options.

- Citizenship Status: Eligibility can depend on whether you are a citizen, a permanent resident, or have another status.

- Field of Study: Certain types of support are targeted toward specific disciplines, so your chosen major may play a role.

- Age: Some grants or scholarships may have age restrictions, particularly for non-traditional students.

- Special Circumstances: Unique factors, such as being a veteran, having a disability, or coming from a specific background, can open additional avenues of support.

As you explore these avenues, it’s essential to research each option thoroughly to ensure you meet the criteria and maximize your chances of receiving assistance. Take the time to check the specific requirements of the programs that interest you, as they can vary widely.