A Comprehensive Comparison of Federal Pell Grants and Other Forms of Financial Aid

When it comes to pursuing higher education, the question of how to manage the costs can be daunting. Many students find themselves navigating a maze of resources designed to help them finance their studies. Among these options, two prominent pathways often come into play, each with its own unique characteristics and benefits. In this discussion, we’ll explore how these funding mechanisms differ and what that means for students seeking support.

On one hand, there are resources that provide direct monetary support, which does not need to be repaid, making them incredibly valuable for those striving to ease their financial burden. Conversely, there are other methods of funding that may require students to meet specific criteria, ensuring that a wider range of scholars can benefit from assistance.

Understanding these differences can empower students to make informed choices regarding their financial strategies. By delving into the strengths and intricacies of each option, learners can better navigate the landscape of educational funding and ultimately enhance their academic journeys.

Understanding the Federal Pell Grant

When it comes to pursuing higher education, many students find themselves exploring various funding options. One of the most advantageous resources available is a specific type of assistance designed to help individuals cover their educational expenses. This support is often characterized by its non-repayable nature, providing a significant boost to those who qualify.

What makes this type of assistance so appealing? First and foremost, it opens doors for students from diverse financial backgrounds, ensuring that a quality education remains accessible. It can help cover tuition costs, books, and even living expenses, allowing learners to focus on their studies rather than worrying about financial burdens.

Eligibility for this benefit typically relies on various factors, primarily income and financial circumstances. The determination process involves detailed assessments, ensuring that those who genuinely need help receive it. Many applicants often wonder about the application process, which, while straightforward, requires careful preparation to maximize potential support.

Ultimately, this form of support represents a commitment to fostering educational attainment and reducing barriers for aspiring scholars. By understanding the mechanics and benefits of this assistance, students can make informed decisions and take significant steps toward achieving their academic dreams.

Types of Financial Assistance Available

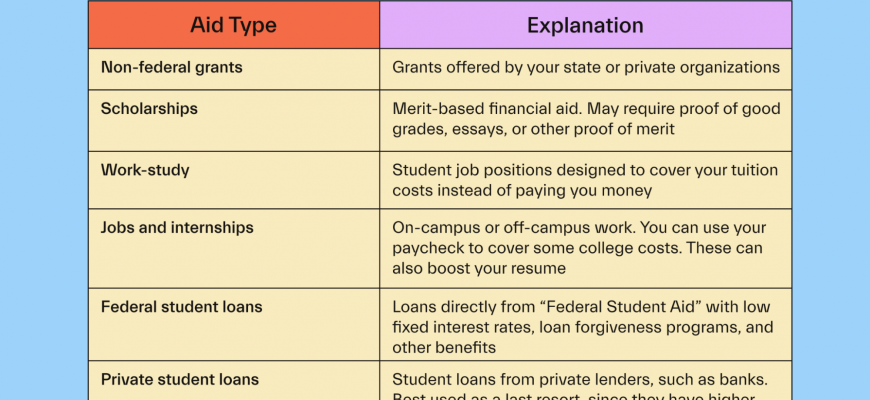

When it comes to funding your education, there are various avenues to explore that can lighten the financial burden. Each option serves a distinct purpose and can significantly contribute to your overall budget, making your academic journey more accessible. Understanding these different types can help you make informed choices on how to cover your expenses.

Scholarships are probably the most sought-after options since they don’t require repayment. They can be awarded based on academics, talents, or even specific interests and affiliations. It’s worth diving into the many sources available, such as schools, private organizations, and community groups.

Then there are programs that provide a certain amount of money based on your financial situation. These funds are typically aimed at assisting those in need and can help bridge the gap between your available resources and the cost of education. Be sure to check your eligibility and apply early, as funds can run out quickly!

Work-study opportunities also present a fantastic route to consider. These arrangements allow students to earn money while they study, which not only helps with tuition but also provides valuable work experience. Jobs can range from campus positions to community service roles, offering flexibility in how and when you work.

Lastly, loans are another common form of support. While they do require repayment, they can provide necessary funds to cover larger expenses that other forms of support may not fully address. It’s crucial to understand the terms and conditions before borrowing so you don’t end up with more debt than you bargained for.

By exploring these various forms of support, you can create a comprehensive plan that meets your needs and helps turn your academic dreams into reality.

Application Process for College Funding

Navigating the route to secure support for your college journey can often feel overwhelming. With various options available, it’s crucial to understand the steps involved in accessing the financial resources that can help make your education more affordable.

First things first, getting started usually involves filling out a specific form. This document serves as the key to unlocking assistance opportunities, and it’s important to complete it accurately and thoroughly. Make sure you gather all necessary information beforehand, such as income records and identification details, to streamline the process.

Once your form is submitted, you’ll typically receive a summary of your potential benefits. This overview outlines the types of support you might qualify for, which can include grants, scholarships, or work-study options. Keep an eye on deadlines, as they play a significant role in determining eligibility.

Your college might also request additional materials, like transcripts or recommendation letters, so it’s wise to be prepared for that possibility. Maintaining communication with the institution’s financial office can clarify any uncertainties and help ensure you’re on track.

Lastly, after receiving your funding options, take the time to review them carefully. Weigh the pros and cons of each type of support to make informed decisions about what best suits your financial situation. Remember, the goal is to lighten the burden of college expenses and make your educational experience as rewarding as possible.