Comprehensive Overview of the Family Tax Credit Table for 2025

Navigating the world of financial assistance can feel overwhelming, especially for those trying to make sense of various support options available to households. With a myriad of programs designed to alleviate the burden of living expenses, staying informed is crucial. This section offers insights into the different levels of support that families may be eligible for, shedding light on how these resources can significantly impact daily life.

In this guide, we’ll delve into the various methods to assess available support, focusing on the criteria that determine eligibility. Understanding this information can empower households to make informed decisions and explore avenues that could enhance their financial well-being. From evaluating personal circumstances to recognizing the potential benefits, this discussion aims to clarify the landscape of assistance options.

Ultimately, comprehending the nuances of these benefits not only aids in financial planning but also fosters a sense of security for those who are seeking to improve their situations. By staying updated and informed, families can better prepare for the future and take advantage of the opportunities that exist to support their needs.

Understanding the Support Program Overview

The support program serves as a financial boost for households, aiming to ease the burden of expenses related to raising children. It recognizes the significance of nurturing young ones and offers a helping hand to eligible individuals. By providing monetary assistance, it strives to enhance the overall quality of life for families.

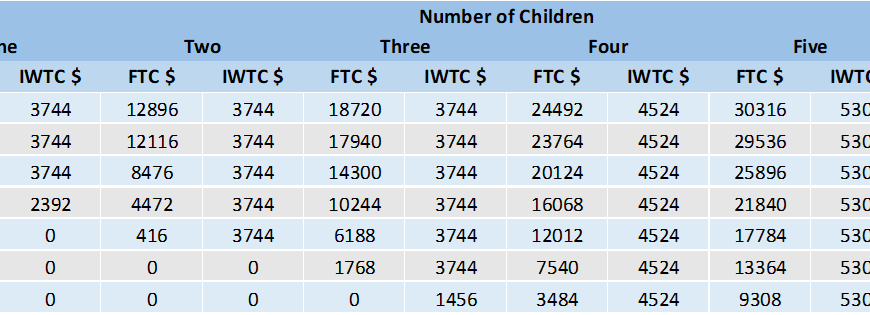

Many people may not realize the eligibility criteria or the potential benefits associated with this initiative. It encompasses various factors, including income levels and the number of dependents, which can impact the amount one can receive. It’s important to stay informed and understand how these details can influence your financial situation.

As we delve deeper, we’ll explore how this program operates, what requirements must be met, and the advantages it can bring to those who qualify. Having a clear grasp of the fundamentals can empower individuals to make the most of the assistance available, contributing to a more stable and secure environment for their loved ones.

Key Changes in 2025 Tax Regulations

As we move into the new year, there are some noteworthy updates in the financial landscape that everyone should be aware of. These modifications have been designed to streamline processes and ensure that individuals receive appropriate benefits based on their circumstances. It’s essential to stay informed about these adjustments to maximize your financial wellbeing.

One of the most significant shifts involves alterations in eligibility requirements, which could impact a wide range of households. There are new conditions that may either expand or limit who qualifies for certain benefits, affecting how many people can take advantage of these financial opportunities.

Additionally, the amounts allocated for assistance have seen revisions, which might mean changes in the levels of support available. This could be particularly relevant for those who rely on such resources for their everyday needs or long-term planning.

Furthermore, adjustments in reporting and documentation requirements may complicate things for some, but they also aim to simplify the process overall. With clear guidelines, it should become easier to navigate through submission protocols, reducing confusion and ensuring that everyone understands the necessary steps to take.

Keeping an eye on these developments will be crucial as they unfold, particularly for those who are looking to benefit from these changes. Being proactive and understanding how these rules may affect you can go a long way in making the most of the opportunities available.

Eligibility Criteria for Households

As we navigate the evolving landscape of financial support for households, it’s essential to understand what sets the stage for qualifying for assistance in 2025. Various guidelines are put in place to ensure that support reaches those who genuinely need it, and that can make a significant difference for many. Let’s delve into the specifics of what it takes for households to be eligible for these benefits.

One of the primary factors to consider is the overall income of the household. Different income brackets can determine whether a group qualifies for assistance, making it crucial to report earnings accurately. Additionally, the number of dependents can play a vital role in shaping eligibility; larger households often receive different consideration compared to smaller ones.

It’s also worth noting that residency status can affect eligibility. Typically, only those who reside in the country legally may apply for such support systems. Furthermore, certain programs may require applicants to be in stable employment or actively seeking work. Maintaining documentation of these requirements is important, as it can reinforce a household’s position when applying.

Lastly, keep in mind that specific conditions, such as disability or other unique challenges, can enhance eligibility. Each situation is unique, and understanding these nuances can empower individuals to take full advantage of available resources.

What a vision of grace and beauty! She’s effortlessly captivating;and every moment of this video is a joy to watch. Absolutely stunning.