Essential Information You Need to Know About Financial Aid

Navigating the world of educational assistance can feel like a daunting task. With so many opportunities available, it can be hard to know where to start or what to look for. Whether you’re a high school graduate seeking to further your education or an adult looking to enhance your skills, there are various resources designed to help ease the financial burden of learning.

Understanding the different programs and resources can open doors to new possibilities. From scholarships and grants to loans and work-study programs, there is a wealth of information that can empower you to make informed decisions about your educational journey. It’s essential to be well-informed, as this knowledge can play a crucial role in making your aspirations a reality.

In this section, we’ll explore some key elements that everyone should know before diving into the options available. By equipping yourself with the right information and strategies, you can maximize your chances of securing the support you need to achieve your educational goals.

Understanding Types of Assistance

Diving into the world of support options can feel overwhelming at first. But don’t worry, many avenues can help you ease the financial burden of education. Different categories of help are available, each offering unique benefits tailored to meet diverse needs. Let’s break it down and explore the various options that you might find useful.

First up, we have grants. These are essentially gifts that don’t need to be repaid, making them a fantastic choice for anyone looking for help. Typically awarded based on need, they can open doors to opportunities you might not otherwise afford. Scholarships are another excellent avenue; these are often merit-based and can reward academic achievements, talents, or other criteria like community service.

Now, let’s talk about loans. Unlike grants and scholarships, these funds must be repaid after you finish your studies. However, many loans come with lower interest rates and flexible repayment plans, making them a manageable option for many students. Combining grants, scholarships, and loans can create a solid financial plan that helps bridge the gap to afford that degree.

Lastly, part-time work opportunities can also supplement your funding. Many institutions offer work-study programs that allow you to earn while you learn, giving you valuable experience and a little extra cash.

Understanding these different forms of support helps you make informed decisions when planning your educational journey. It’s all about finding the right mix that suits your situation best!

Eligibility Criteria for Assistance Programs

When it comes to obtaining support, understanding the requirements can make all the difference. Each program has specific guidelines that determine who qualifies for help. These criteria can vary widely, reflecting the diverse nature of available resources. Knowing the essentials will empower individuals to navigate the options effectively.

Most typically, potential beneficiaries need to demonstrate a certain level of need or hardship. This often involves financial assessments, such as income verification or asset evaluations. Additionally, some initiatives may set age limits, residency stipulations, or educational prerequisites. Being prepared to provide the necessary documentation can streamline the application process.

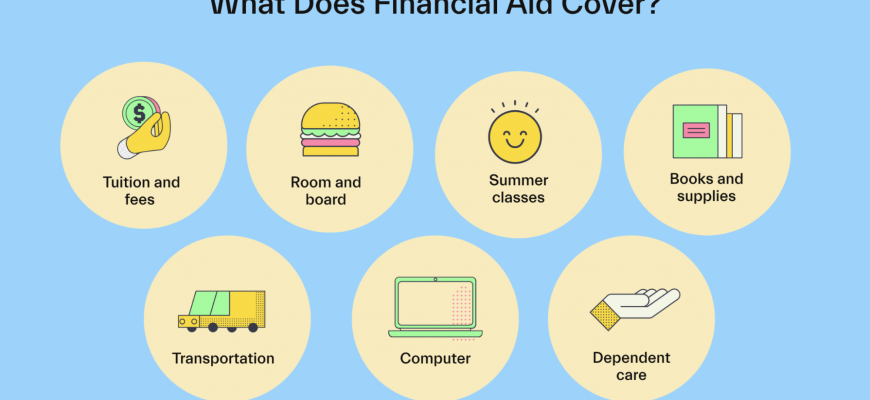

Furthermore, it’s important to stay informed about deadlines and submission processes, as these can differ across programs. Understanding the scope of support available is crucial, whether it covers tuition, living expenses, or specific costs like textbooks. Ultimately, reviewing the eligibility requirements carefully increases chances of receiving the help needed to pursue one’s goals.

Common Misconceptions About Funding

When it comes to securing financial assistance, there are plenty of misunderstandings that can lead to unnecessary stress and confusion. Many people have preconceived notions that can skew their perception of what’s achievable and accessible, which may deter them from exploring options available to them. Let’s clear up some of these common myths and get a better grasp on the reality surrounding support resources.

Firstly, a prevalent myth is that only students with straight A’s can qualify for scholarships or grants. While academic excellence can certainly boost your chances, many organizations offer assistance based on various criteria, such as involvement in community service, personal background, or even unique talents.

Secondly, there’s the belief that applying for this type of support is a tedious process that consumes a lot of time and effort. In reality, while there may be paperwork involved, many programs are designed to simplify the application process. With some organization and diligence, it can be more manageable than you think.

Another misconception is that financial support is solely for undergraduates. On the contrary, many programs cater to graduate students, adult learners, and even non-traditional students. No matter your educational path, opportunities could be available to assist in your journey.

Lastly, some believe that accepting assistance will limit their ability to take out loans or receive other forms of financial support. This is not always the case. In fact, many institutional and government programs are designed to work alongside loans, enabling students to balance their funding sources effectively.

Being informed is key. By shedding light on these common misunderstandings, you empower yourself to take the necessary steps toward securing the resources you need. Don’t let myths hold you back from exploring what’s out there!