Understanding the European Union Credit Score System and Its Impact on Financial Opportunities

When navigating the financial landscape, understanding one’s standing can make all the difference. This numeric representation often dictates the terms of loans, mortgages, and various financial engagements. It serves as a guiding star for lenders, giving them insight into an individual’s responsibility and reliability in managing money.

In various regions across the continent, the methodology and criteria for assessing this standing can differ significantly. Local customs, laws, and practices all play a role in shaping how individuals are evaluated. With the variety of systems in place, it’s crucial for anyone looking to embark on major financial ventures to grasp the essentials of their standing.

A positive financial reputation opens doors to better interest rates and favorable terms, making it essential for anyone looking to secure a stable financial future. So, whether you’re planning to purchase a home, invest in a business, or simply want to enhance your fiscal well-being, understanding this concept is key to achieving your goals.

Understanding Ratings in Europe

When it comes to borrowing money or making significant investments, assessments of financial reliability play a crucial role. These evaluations help lenders gauge how likely individuals or businesses are to repay their obligations. However, the process and structure of these evaluations can vary widely across different regions, particularly in Europe.

In many countries, the evaluation system consists of several key components:

- Numerical Expressions: Many organizations provide ratings in the form of numbers or letters, indicating the level of trustworthiness.

- Factors Considered: Elements such as income, outstanding debts, and payment history are usually analyzed to form a comprehensive picture.

- Variations by Country: Each nation might have its own methods and agencies responsible for these assessments, leading to different approaches.

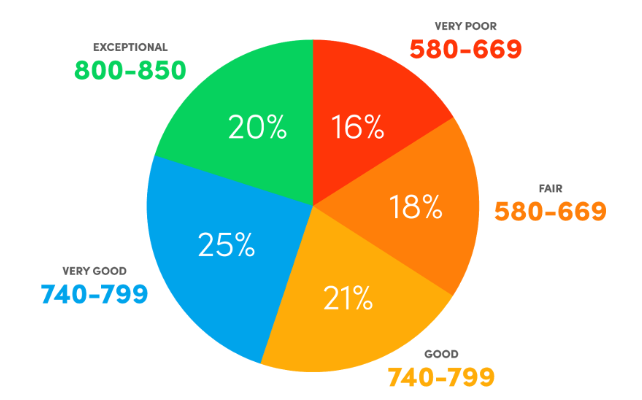

Understanding how these assessments work is vital for anyone looking to engage with financial institutions. Here are some common categories and their implications:

- Excellent: Individuals or organizations in this category often enjoy lower interest rates and more favorable loan conditions.

- Good: While still a reliable borrower, slight risks may be noted, resulting in reasonable, yet slightly higher rates.

- Fair: This group may face higher fees and interest due to perceived risks, requiring careful financial management.

- Poor: Those in this category can struggle to secure financing and may be limited to higher interest rates if they qualify at all.

Being aware of your status can empower you to take steps toward enhancing it. Managing finances wisely, making timely payments, and maintaining low balances can all contribute to a more favorable evaluation. Ultimately, grasping the intricacies of these assessments can make a significant difference in achieving financial goals.

The Impact of Financial Ratings on Loans

When it comes to borrowing money, your financial background plays a pivotal role in influencing terms and conditions. Lenders want to ensure that they are making a sound investment, and they rely on various indicators to determine the reliability of potential borrowers. One of the key factors considered is an individual’s financial record, which reflects their history of managing finances and repaying obligations.

These assessments can significantly affect the amount you are able to secure, the interest rates applied, and even the type of loan you may qualify for. A higher rating often translates to better offers, making it easier to access funds under favorable terms. On the flip side, a lower rating might restrict options, leaving individuals with fewer choices and higher costs.

Moreover, different lenders have varying criteria for evaluating these records. Some may place more emphasis on specific elements, such as payment history, while others might consider the overall financial behavior more holistically. This inconsistency means that potential borrowers should be proactive in managing their financial profiles, keeping track of any factors that might influence their standing.

Ultimately, understanding how these ratings impact borrowing opportunities is crucial. By working to enhance your financial health, you can better position yourself to take advantage of advantageous lending conditions in the future.

How to Enhance Your Financial Standing

Improving your financial reputation can significantly open doors to better opportunities, whether you’re looking to secure a loan or make a major purchase. There are several effective strategies you can implement to boost how lenders view you. It’s all about demonstrating responsibility and reliability when it comes to your financial activities.

First off, make sure to keep your payment history spotless. Always pay your bills on time, as this shows potential lenders that you’re dependable. If you’ve missed a payment in the past, don’t worry; just focus on ensuring that all future payments are punctual.

Another important aspect is to manage your available credit wisely. Try to maintain a low balance relative to your credit limit. It’s generally recommended to use no more than 30% of your available credit at any given time. This practice not only demonstrates disciplined spending but also boosts your financial credibility.

Regularly checking your financial record for any inaccuracies is an essential step. Errors can sometimes plague your record, affecting how you’re perceived by lenders. If you spot any discrepancies, make sure to dispute them swiftly to avoid any negative impact.

Diversifying your credit types can also work in your favor. Consider having a mix of different types of accounts, such as a credit card and a personal loan. This variety can illustrate your ability to handle different kinds of financial commitments, showcasing your versatility to potential lenders.

Lastly, avoid unnecessary inquiries into your financial background. Each time you apply for new financing, it can trigger a hard inquiry, which may lower your standing temporarily. Limit new applications and focus on maintaining the accounts you already have.

By following these tips, you can take meaningful steps toward improving your financial reputation. With time and effort, you’ll likely see a positive shift that can lead to better financial opportunities down the road.