An In-Depth Exploration of Credit Ratings Assigned to European Governments

In today’s interconnected world, how nations manage their financial standing plays a pivotal role in global commerce and investment. Understanding a country’s fiscal health goes beyond mere numbers; it encompasses the trust investors place in its ability to meet obligations. This dynamic environment requires keen attention to various assessments that shed light on a state’s financial responsibility and future prospects.

The tools utilized to gauge this financial viability can seem complex, yet they illuminate the intricacies of economic policies and institutional credibility. Analysts and stakeholders closely monitor these evaluations, as they have far-reaching implications, influencing everything from borrowing costs to international partnerships. By grasping the nuances of these assessments, individuals and institutions can make more informed decisions regarding their investments and collaborations.

As we delve deeper into this subject, we’ll explore how different systems and methodologies come into play. We’ll examine key factors that contribute to these evaluations and what they signify for both the domestic and global arenas. There’s much to uncover about how societies manage their fiscal responsibilities, and the insights gained can be invaluable for anyone seeking to navigate the labyrinth of economic relations.

Understanding Credit Ratings in Europe

When it comes to evaluating the financial health of nations, many factors come into play. This process helps stakeholders gain insights into the likelihood of a country meeting its financial obligations. A thorough comprehension of this evaluation mechanism can help you navigate the complexities of international finance and investment.

These assessments serve as valuable indicators for investors, financial institutions, and even governments themselves. They provide a framework for understanding the risk associated with lending money or investing in a particular country. The ability to decipher these evaluations can empower decision-making and foster confidence in economic partnerships.

Various agencies specialize in these assessments, utilizing distinct methodologies to arrive at their conclusions. While some focus on economic indicators, others may consider political stability and historical performance. Familiarizing yourself with these different approaches can enhance your understanding of how nations are perceived in the global market.

Additionally, these evaluations can significantly influence borrowing costs. A higher perceived risk can lead to increased interest rates, whereas a favorable assessment may result in lower costs for financing. Being aware of these dynamics can aid in grasping how country evaluations impact the larger financial landscape.

In conclusion, gaining insight into this evaluation system can prove beneficial not only for investors but also for anyone wanting to grasp the intricacies of international finance. Understanding the associated factors and their implications can lead to informed decisions and strategic opportunities in the world of economics.

Impact of Evaluations on Economic Policies

When assessing the financial standing of nations, the evaluations provided by specialized agencies play a crucial role. These assessments can influence numerous aspects of how countries shape their financial strategies and interventions. Let’s dive into how these evaluations can steer a nation’s economic decisions.

Firstly, a favorable assessment can lead to:

- Lower borrowing costs, making it cheaper for nations to secure funds on international markets.

- Increased investor confidence, encouraging both domestic and foreign investments.

- Enhanced government credibility, which can facilitate more ambitious fiscal policies.

Conversely, an unfavorable evaluation can have severe repercussions:

- Higher interest rates for loans, resulting in increased debt costs.

- Decreased public and private investment, as risk-averse investors might shy away.

- Underpressure for budget cuts or austerity measures, affecting public services and social programs.

Ultimately, the influence of these evaluations can create a ripple effect on various financial policies, impacting everything from tax structures to public spending. Understanding this interaction is essential for analyzing how nations navigate their economic landscapes in response to external assessments.

Major Rating Agencies and Their Roles

In the world of finance, there are key players that hold significant influence over the perception of entities seeking funding. These organizations assess and provide insightful evaluations, shaping the way investors view various options in the market. Their assessments help potential lenders understand the likelihood of repayment, ultimately guiding their investment choices.

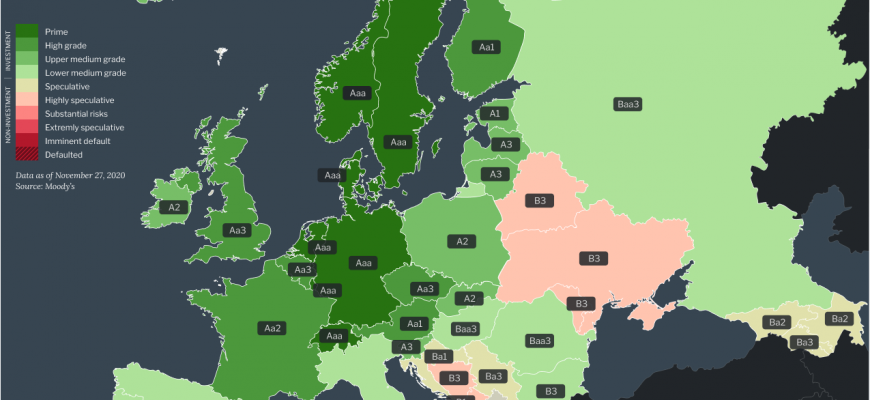

Among the most prominent agencies are Moody’s, S&P Global, and Fitch Ratings. Each has its own methodology for evaluating the viability of entities and their financial obligations. These agencies employ a vast array of data and analytics to determine ratings, which serve as a shorthand for risk assessment. A solid score from these agencies can enhance an entity’s ability to secure funding at favorable terms.

Moreover, their evaluations not only impact the borrowing costs for various institutions but also influence the broader economic landscape. Investors rely on these assessments to gauge market stability and make informed decisions. Consequently, the credibility of these agencies is paramount, as their symbols of quality hold substantial weight in the eyes of the marketplace.

In summary, the presence of these influential evaluators streamlines the investment process and enhances transparency in financial transactions. By providing reliable assessments, they foster a secure environment for both lenders and borrowers alike.