Exploring the Dynamics and Trends of European Credit Spreads

When it comes to the world of finance, the nuances of loan valuations play a crucial role in shaping investment strategies and economic trends. This complex environment is influenced by a myriad of factors, including market perceptions, investor confidence, and global economic indicators. In this landscape, understanding how different types of borrowing costs interact can provide valuable insights into the overall financial health of regions and institutions.

With a focus on different market segments, we delve into the variances across various financial instruments, examining how shifts in demand and supply can impact perceived risks. By analyzing these fluctuating values, investors can better navigate the intricate web of financial opportunities and challenges that arise in today’s marketplace.

As we explore the connections between different types of financial obligations, it becomes evident that a thorough grasp of these relationships is essential. Not only does this knowledge equip investors with the tools needed to make informed decisions, but it also offers a clearer picture of the broader economic landscape. Join us as we unpack the layers of this fascinating subject, unlocking the mysteries behind the numbers that drive financial choices.

Understanding Financial Risk Premiums

When you dive into the world of finance, it’s crucial to grasp how different factors influence the cost of borrowing and the returns on investments. One fundamental concept revolves around the notion of risk premiums associated with various assets. By analyzing these fluctuations, investors can gain insights into market sentiment and economic health.

So, what exactly drives these premiums? Here are some key elements to consider:

- Creditworthiness: The reliability of borrowers plays a significant role. Investors often look at ratings to assess the level of risk involved.

- Market Sentiment: Economic conditions, geopolitical events, and overall investor confidence can lead to shifts in risk perceptions.

- Liquidity: The ease with which assets can be transferred impacts their attractiveness. More liquid assets often exhibit lower premiums.

Understanding how these aspects intertwine helps in making informed decisions. By keeping an eye on trends, investors can adjust their strategies, potentially maximizing returns while managing exposure to risk.

To summarize, familiarizing yourself with these financial dynamics is essential for navigating the investment landscape effectively. The interplay of risk and reward is always in motion, and staying informed is your best strategy.

Factors Influencing Yield Fluctuations

In the world of finance, various elements can cause shifts in the difference between investment returns and safer options. Understanding these influences is crucial for investors and analysts alike. By examining market conditions, economic indicators, and geopolitical events, one can gain insights into how these variations occur and what might be on the horizon.

One primary factor is the overall health of the economy. When growth prospects are optimistic, risk appetite tends to increase, leading to tighter margins between higher and lower-risk investments. Conversely, during economic downturns, uncertainty can widen these gaps as investors flock to safer assets, fearing potential losses.

Another significant influence comes from changes in monetary policy. Adjustments in interest rates by central banks can dramatically affect investor behavior. For instance, a rise in rates might prompt a reassessment of perceived risk, resulting in altered expectations for returns.

Market sentiment also plays a critical role. Events like corporate earnings reports, political developments, or unexpected crises can sway investor confidence, leading to swift adjustments in risk premiums. Sentiment can fluctuate rapidly, causing immediate reactions in the financial landscape.

Lastly, foreign investment flows and currency fluctuations can further complicate the picture. Capital movement across borders can lead to differing perceptions of risk, impacting the yields associated with various investments. Understanding these dynamics helps provide a clearer view of the landscape.

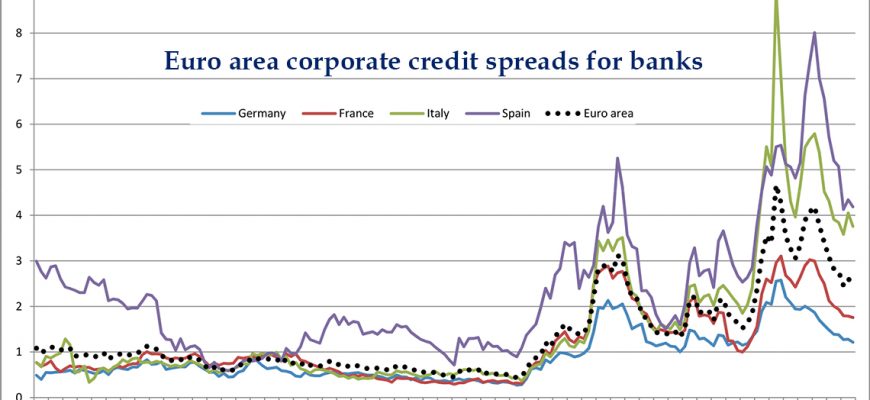

Comparative Analysis of Spreads in Europe

When we dive into the realm of financial markets, one intriguing aspect is how different regions experience variations in their borrowing costs. In this section, we’ll explore the contrasts in these costs across various nations, illuminating the factors that contribute to these differences. It’s fascinating to see how economic conditions, market sentiment, and political stability play a crucial role in shaping these financial indicators.

To begin with, let’s examine how the risk premiums differ among major economies. For instance, it’s common to note that nations with strong fiscal policies often enjoy narrower margins compared to those grappling with more instability. Investors tend to favor securities from stable countries, driving down the rewards they demand due to perceived lower risks.

Additionally, the influence of central banks cannot be overstated. Policies designed to encourage growth or manage inflation can significantly impact the landscape of these expenses. Unconventional monetary measures often lead to tight constraints in one country while others may see widening disparities, resulting in varied experiences for ranchers and traders alike. Understanding these dynamics can provide clearer insights into the overall health of the financial ecosystem.

Lastly, external factors like geopolitical tensions and global economic shifts often reverberate through these markets, creating ripple effects. A disturbance in one part of the world can lead to hurried reallocations of assets, causing fluctuations in these financial metrics. By keeping a close eye on trends and movements, stakeholders can better navigate the complexities of this environment, tailoring their strategies to mitigate potential risks.