Exploring the Dynamics and Challenges of the European Credit System

In today’s world, navigating the landscape of financial services is more crucial than ever. The mechanisms that govern lending, borrowing, and investment play a pivotal role in shaping economies and personal fortunes alike. From the bustling streets of major cities to the quiet suburbs, the ways in which individuals and businesses access funds are influenced by a complex interplay of regulations, institutions, and cultural practices.

One of the fundamental aspects of this financial realm lies in the structured approach that various nations adopt to facilitate monetary exchanges. Whether it’s supporting entrepreneurs with the necessary capital to launch their ideas or helping families secure loans for their dream homes, understanding these frameworks can empower people to make informed decisions. Many regions have developed unique practices and systems tailored to their specific needs, reflecting a rich tapestry of approaches to finance.

As we delve deeper into this topic, it’s essential to explore how different regions foster an environment conducive to financial growth. Examining historical trends, current practices, and emerging innovations will provide insight into the mechanisms that ultimately shape individual experiences and broader economic outcomes. Join us as we uncover the nuances of this intricate financial network, revealing how it impacts our lives in often unexpected ways.

Understanding European Credit Systems

When it comes to financial frameworks, many people find themselves puzzled by the intricacies involved. The way individuals and businesses access funds, build their financial profiles, and maintain relationships with lending institutions can vary significantly. It’s essential to grasp how these frameworks function and how they affect our financial interactions.

At the core of these financial platforms is an evaluation of trustworthiness. Institutions rely on various metrics to determine the likelihood of individuals meeting their repayment obligations. This evaluation influences everything from borrowing limits to interest rates, ultimately shaping one’s financial journey.

Moreover, the regulatory landscape plays a significant role in shaping these environments. Different regions have distinct rules and oversight bodies that govern lending practices. This diversity can be beneficial as it allows for tailored solutions to fit various economic situations and cultural nuances.

Understanding the underlying principles can empower you to make better decisions about financing options. Whether you’re considering a home loan, personal financing, or business investment, knowing how these financial structures operate will provide you with the tools to navigate them effectively.

The Role of Financial Lending in Economic Growth

Access to financial resources plays a crucial part in fostering economic advancement. When individuals and businesses can borrow funds, they gain the opportunity to unlock their potential, invest in new projects, or expand existing operations. This dynamic creates a ripple effect, stimulating various sectors of the economy and driving overall progress.

By allowing for investment in innovation and infrastructure, financial backing serves as a catalyst for growth. Entrepreneurs can launch startups, while established companies can upgrade their technology or facilities. This not only boosts productivity but also generates employment opportunities, helping to elevate the standard of living for the community.

Moreover, the availability of these resources encourages consumer spending. When individuals feel financially secure and can access loans for homes, vehicles, or education, it leads to increased consumption. As demand rises, businesses are prompted to increase production, further enhancing economic momentum.

In addition, financial lending initiatives often promote competition among various providers, leading to better terms and rates for borrowers. This healthy competition can drive innovation and efficiency in the marketplace, benefiting consumers and businesses alike.

Ultimately, the interplay between financial support and economic vitality illustrates the essential role of responsible lending practices. By enabling growth and innovation, funding mechanisms can significantly contribute to a prosperous and dynamic economy.

Comparative Analysis of Member State Practices

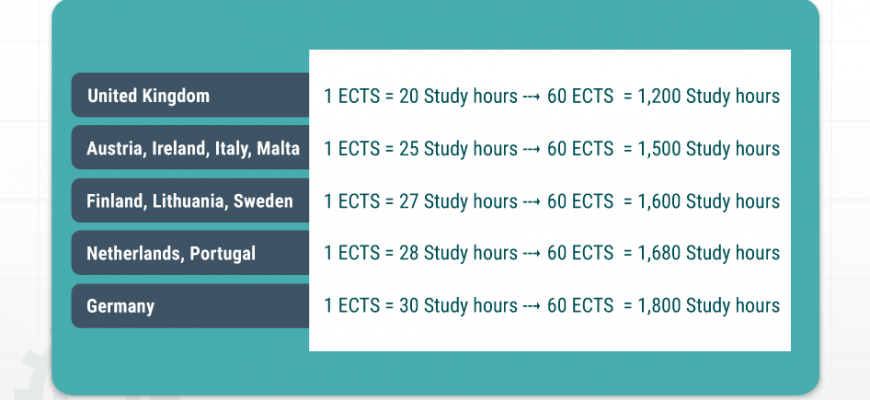

This section dives into the varied approaches taken by different nations regarding financial assessment and lending behaviors. Each jurisdiction showcases unique methodologies and frameworks that shape how individuals and businesses interact with financial institutions. By examining these differences, we can gain insights into their effectiveness and the overall impact on citizens and economies.

For instance, one country might emphasize stringent evaluation criteria before granting funds, ensuring that borrowers have solid repayment plans. In contrast, another might adopt a more relaxed approach, encouraging higher levels of borrowing to stimulate growth. These contrasting practices highlight the diversity in risk appetite and regulatory environments, ultimately influencing consumer access to financial resources.

Moreover, cultural factors play a significant role in how these practices are shaped. In some regions, a strong emphasis on personal relationships can lead to more flexible terms, while in others, a strict adherence to standard protocols might dominate. Understanding these cultural nuances provides a deeper appreciation of why certain practices prevail in specific locales.

By taking a closer look at these different strategies, we can better identify best practices and potential pitfalls. This analysis not only informs policymakers but can also guide individuals in making more informed decisions when seeking financial assistance in their respective countries.