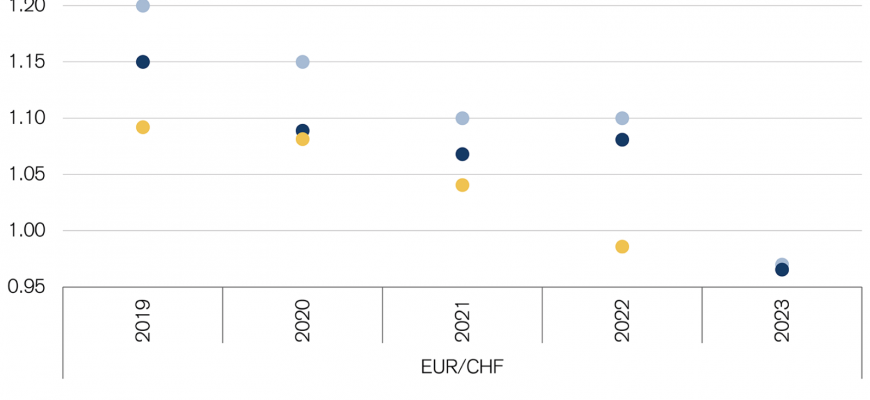

Current Trends in Euro Exchange Rates According to Credit Suisse Analysis

The world of currencies can sometimes feel like a complex puzzle, tangled with various factors influencing values and rates. It’s a fascinating field, as it impacts everything from international trade to your next vacation. By examining the shifts in valuation, we can uncover insights that are both practical and strategic for personal and commercial finance alike.

In this section, we delve into the specifics of how various monetary units compare against one another. This exploration will reveal not only the numbers but also the underlying trends that could affect future positions. Understanding this dynamic is essential for anyone looking to stay informed and make sound economic decisions.

Our focus will also touch on the key players in this arena, including renowned institutions that play a pivotal role in shaping market conditions. By gaining knowledge about these entities and their influence, we can better navigate through the ever-changing landscape of monetary exchange.

Understanding Currency Exchange Rates Dynamics

When we talk about international finances, the way one currency converts to another plays a crucial role in global trade, investments, and even tourism. The fluctuations in these rates can often seem puzzling, driven by various factors that range from economic indicators to geopolitical events. Grasping these movements can help individuals and businesses make informed decisions regarding their financial strategies.

In essence, the value of a currency in relation to another isn’t static; it ebbs and flows based on demand and supply, market sentiment, and economic policies. Central banks, for instance, play a significant role by influencing these values through interest rates and market interventions. Moreover, reports like employment figures or GDP growth can sway perceptions about a currency’s strength, causing reactions that can significantly alter its price.

Additionally, external factors such as political stability or economic crises in a region can lead to swift changes in currency valuation. Investors often seek safe havens during uncertain times, which can boost the value of certain currencies while causing others to diminish. Understanding these dynamics is essential for anyone looking to navigate the complex waters of foreign exchange.

Impact of Financial Institutions on Currency Markets

Financial institutions play a crucial role in shaping the dynamics of currency markets. Their actions and policies can have far-reaching effects, influencing exchange rates and trading volumes globally. Let’s explore how such entities impact these markets and what factors come into play.

Here are some key aspects to consider:

- Market Sentiment: The reputation and stability of a major financial player can greatly influence investor confidence. Positive news or solid performance can lead to currency appreciation, while negative developments can trigger declines.

- Interest Rates: When these institutions adjust interest rates, it directly affects returns on investments. Higher interest rates typically attract foreign capital, leading to a stronger currency.

- Risk Management: These players often engage in hedging strategies that can impact supply and demand. Their decisions to buy or sell large volumes can create volatility in the market.

The movement of currencies reflects many underlying factors, including political events, economic forecasts, and changes in market perception. It’s essential to keep an eye on these significant players to better understand potential shifts in the landscape. Key indicators of their influence include:

- Changes in economic policies

- Global financial trends

- Market reactions to geopolitical risks

In conclusion, the role of dominant financial entities in the currency exchange landscape is multifaceted. Their actions not only reflect market conditions but also help shape future expectations and trends. Keeping abreast of their decisions and strategies can provide valuable insights for traders and investors alike.

How to Monitor Currency Value Trends

Keeping an eye on the fluctuations of a specific currency can be quite beneficial for anyone engaged in trade, travel, or investment. Understanding its trends helps in making informed decisions, whether you’re planning a holiday abroad or investing in foreign stocks. There are various tools and resources available that can provide insight into value changes over time.

One effective approach is to utilize financial news websites. These platforms often feature real-time updates, expert analyses, and forecasts that can help you gauge the market’s direction. Additionally, following economic reports and indicators can offer you a deeper understanding of the factors influencing the currency’s strength, such as inflation rates or geopolitical events.

Another option is to leverage dedicated financial apps that track currency performance. Many of these tools provide customizable alerts, ensuring you stay updated on significant shifts without the need for constant monitoring. By setting specific thresholds, you can receive notifications when the value hits a desired point, allowing for timely actions.

Engaging with online communities and forums can also be advantageous. Many experienced traders share valuable insights and strategies that can enhance your understanding of currency trends. Collaborating with others can broaden your perspective and equip you with various techniques for analyzing market movements.

Finally, consider consulting with financial advisors who specialize in currency markets. Their expertise can provide you with tailored advice and strategies that align with your specific objectives. Combining these resources will empower you to make well-informed decisions regarding your financial activities.