Trends and Insights into Credit Growth in the Euro Area

Understanding how lending behaviors shift within the continent can reveal much about the broader economic landscape. This fascinating topic explores the intricacies of financial provisioning among institutions and individuals, shedding light on the various factors that influence monetary policies and borrowing trends.

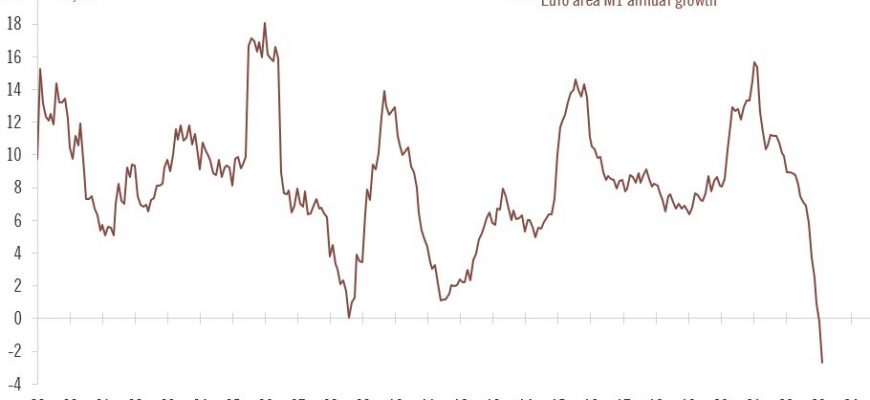

As monetary functions evolve, the pace at which funds circulate among businesses and consumers often reflects underlying economic health. Whether it’s the impact of regulatory changes or shifts in consumer confidence, the patterns of financial evolution can significantly affect overall stability and growth.

In this exploration, we delve into the nuances of how such transformations unfold. We’ll examine the interplay of various players in the financial sector, the influences of international markets, and the implications of interest rate adjustments. Join us as we uncover the compelling story behind the numbers and what they mean for the future.

Trends in Euro Area Credit Expansion

In recent times, there has been a noticeable shift in the dynamics of lending within the monetary union. Financial institutions are adapting their strategies and products to meet the evolving demands of both individuals and businesses. This transformation has significant implications for economic activity and stability across the region.

One of the most prominent patterns observed is the varying pace of lending to different sectors. While households have shown increased appetite for borrowing, particularly in the realm of mortgages and consumer loans, businesses are also starting to access more funds to support expansion and innovation. This duality suggests a strengthening of confidence among consumers and entrepreneurs alike.

Additionally, regulatory changes and monetary policy have played crucial roles in shaping lending behaviors. Central banks, by maintaining accommodative measures, have encouraged banks to offer more favorable terms, stimulating demand. However, as the landscape evolves, potential risks associated with higher levels of borrowing must also be monitored, especially given the possible shifts in interest rates.

In conclusion, as lending trends continue to flourish, it’s important to watch how these developments will influence overall economic health and stability. Stakeholders must remain vigilant and responsive to ensure a balanced approach to financing that fosters sustainable growth.

Impact of Monetary Policy on Lending

Monetary policy plays a pivotal role in shaping the landscape of borrowing and lending in any economy. By adjusting key interest rates and employing various financial tools, central banks can influence how readily banks provide loans to businesses and individuals. This interaction is vital, as it directly affects economic activity and overall financial stability.

Interest rates serve as a primary mechanism through which policymakers exercise their influence. When rates are low, borrowing becomes more attractive, encouraging individuals and businesses to take on loans for investments or consumption. On the flip side, higher rates can temper borrowing activity, leading to more cautious behavior among lenders and borrowers alike.

Additionally, central banks can utilize quantitative easing and other unconventional methods to inject liquidity into the market. These strategies help ensure that financial institutions have the necessary funds to offer loans, thus stimulating economic interaction. The availability of financing can create a ripple effect, promoting business expansion and fueling consumer spending.

Furthermore, the expectations set by policymakers can shape market sentiment. By clearly communicating future intentions, central banks can guide lenders and borrowers towards more informed decision-making. This aspect of monetary policy underscores the psychological element at play in lending practices, where confidence and stability are paramount.

Ultimately, the interplay between monetary measures and lending behavior illustrates how crucial these policies are for fostering a robust financial environment. By understanding these dynamics, stakeholders can better navigate the complexities of the lending landscape and contribute to sustained economic vitality.

Challenges Facing Lending Markets Today

In today’s financial landscape, various obstacles are making it increasingly difficult for individuals and businesses to secure the funds they need. These hurdles impact not only the availability of financial resources but also the confidence of consumers and investors alike. Understanding these challenges is key to navigating the current environment effectively.

One significant issue is the ongoing uncertainty stemming from global economic conditions. Fluctuating interest rates and inflation concerns create an unpredictable climate that can deter both lenders and borrowers. Additionally, recent geopolitical tensions have further complicated matters, leading to a more cautious approach among financial institutions.

Another factor at play is the shift towards stricter regulatory frameworks. While these measures aim to promote stability, they often result in reduced flexibility for lending entities. This can lead to a hesitance in approving loans, particularly for those who might need support the most, such as startups or individuals with limited credit histories.

Technological advancements also present a double-edged sword. While innovations simplify the borrowing process, they can marginalize traditional lenders who struggle to adapt. Furthermore, the rise of alternatives, including peer-to-peer platforms, introduces competition that traditional institutions must face, sometimes leading to a fragmented market.

Lastly, consumer behavior plays a crucial role in shaping the lending landscape. With growing awareness of personal finance, many are opting for less debt and more cautious spending. This shift in mindset can lead to reduced demand for loans, further complicating the dynamics between borrowers and lenders.