Regulating Credit Rating Agencies in the European Union to Enhance Financial Stability and Transparency

The landscape of financial evaluation services is evolving, particularly within the European context. As markets become increasingly interconnected, the mechanisms that oversee these institutions gain paramount importance. This article delves into a critical aspect of ensuring transparency and accountability in the evaluation processes used by various organizations operating in the EU.

Governments and stakeholders alike are keen to foster an environment that balances innovation with consumer protection. By establishing certain guidelines, they aim to enhance the credibility of these institutions while also safeguarding the interests of investors. What does this look like in practice? Let’s explore how the EU approaches the oversight of these important entities, including the challenges and opportunities that arise.

As we dissect the policies in place, we will uncover the nuances that define how assessment firms operate and the standards they must adhere to. Understanding these frameworks can provide valuable insights into the reliability of the evaluations that influence major financial decisions. So, let’s dive into the specifics and uncover what makes this topic so vital for both the economy and everyday consumers.

Understanding EU Credit Rating Framework

When we talk about the European landscape for assessing the financial health of issuers, it’s all about ensuring transparency, reliability, and trustworthiness in the evaluations provided. The overarching aim is to create a robust environment where investors can feel confident in their decisions. Let’s explore the essentials of this framework and how it operates within the EU.

The system encompasses several key components:

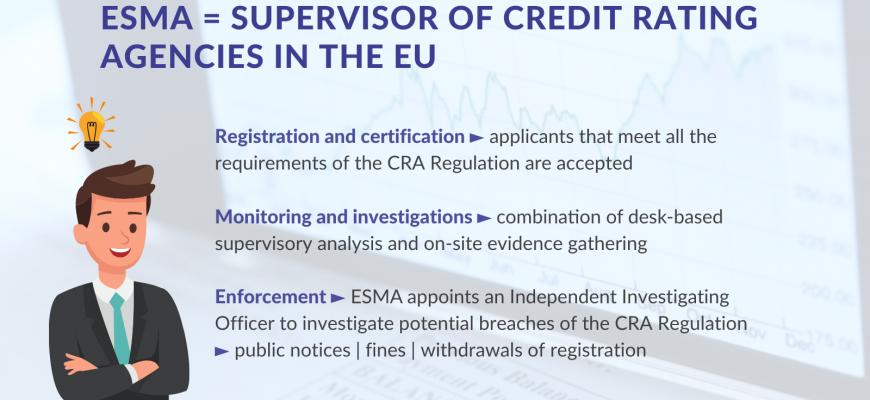

- Oversight Mechanisms: It involves authorities that monitor the processes to ensure adherence to established standards and promote fairness.

- Quality Standards: Evaluators are required to maintain high levels of diligence and accuracy in their analysis, fostering a culture of excellence.

- Transparency Requirements: Firms need to disclose methodologies and assumptions used in their evaluations, allowing stakeholders to understand the basis of conclusions drawn.

- Registration Process: Institutions must go through a formal registration to be recognized, ensuring they meet the outlined criteria before providing assessments.

This framework not only bolsters the credibility of evaluations but also protects investors by enhancing the overall integrity of the financial markets. By establishing clear guidelines and standards, the European approach fosters a competitive environment where only the most reliable entities can thrive.

Moreover, collaboration with international standards ensures a harmonized approach, which benefits all parties involved. Understanding this structure helps stakeholders navigate the complexities of market assessments more effectively, benefiting businesses and investors alike.

Impact of Oversight on Market Stability

When we think about the influence of oversight mechanisms on financial ecosystems, it’s essential to recognize their role in fostering a balanced environment. These frameworks are designed to ensure that market participants operate with transparency and accountability, which ultimately contributes to overall stability. By imposing certain standards, stakeholders can have increased confidence in the systems they engage with.

One significant effect of this oversight is the enhancement of investor trust. When individuals believe that the market is being monitored effectively, they are more likely to commit their resources. This influx of capital not only supports businesses but also promotes growth across various sectors. A stable marketplace attracts more players, leading to improved competition and innovation.

Moreover, strong oversight can help mitigate systemic risks. In turbulent times, having a structured approach can prevent the escalation of volatility. It acts as a safety net, ensuring that even in adverse situations, there are measures in place to protect various entities and, by extension, the larger economic framework. This protective layer is vital for maintaining equilibrium during unpredictable scenarios.

Additionally, the presence of stringent norms encourages better practices among market participants. Entities are pushed to adhere to higher standards, which reduces the likelihood of malpractices and enhances overall integrity. This sense of responsibility not only uplifts individual organizations but contributes positively to the market at large.

In summary, the interplay between oversight mechanisms and market stability is profound. By fostering transparency, encouraging trust, and reducing risks, these systems play a pivotal role in creating a resilient financial environment. As markets continue to evolve, maintaining this balance will be crucial for sustained growth and stability.

Comparative Analysis of Global Evaluation Firms

In today’s interconnected economy, the influence of various assessment firms cannot be overstated. These entities play a crucial role in providing insights into the financial health and stability of organizations and countries alike. By analyzing their methodologies and practices, we can better understand how they impact the global market and the decisions of investors and stakeholders.

When we look at the landscape of assessment firms worldwide, a few key players emerge, each with its unique approach to evaluating financial instruments. While some focus heavily on quantitative metrics, others may prioritize qualitative factors such as management quality or market conditions. This divergence in methodologies leads to variations in the outcomes they provide, creating a complex web of evaluations that can sometimes confuse the end-users.

Moreover, regional differences contribute to the diversity observed among these evaluation firms. For instance, firms in North America might adopt aggressive forecasting models, while their European counterparts may take a more conservative stance. Such discrepancies can lead to contrasting viewpoints on the same entity, highlighting the importance of understanding the context in which these assessments are made.

As we delve deeper, it becomes clear that not all firms are held to the same standards. Some nations impose stricter oversight and transparency requirements, which can enhance credibility but may also limit flexibility. Conversely, other regions may offer a more relaxed environment, potentially resulting in a broader range of opinions but raising questions about reliability.

Ultimately, it is essential for users of these evaluations to be aware of the differences that exist among these entities. By recognizing how each organization operates, the factors they emphasize, and the regulatory contexts in which they function, stakeholders can make more informed decisions based on the evaluations they receive.