Comprehensive Overview of the European Union’s Credit Rating and Its Implications for Economic Stability

When discussing the economic landscape of the European Union, one cannot overlook the significance of its fiscal evaluations. These assessments play a crucial role in determining the financial health of member states, influencing investment decisions, and shaping public policy. In this section, we’ll delve into what these evaluations entail and why they matter for both the EU and its citizens.

But what exactly are these evaluations? At their core, they serve as an indicator of a country’s ability to meet its financial obligations. They provide insight into economic stability and governance, helping stakeholders gauge the risks associated with investing in different regions. This becomes particularly essential in a diverse economic union like the EU, where each country has its unique challenges and strengths.

Moreover, these assessments impact not only national economies but also the collective financial mechanisms within the EU. Understanding how these evaluations are conducted and what factors influence them enriches our comprehension of the broader economic framework, setting the stage for informed discussions around fiscal responsibility, investment opportunities, and economic growth across the continent.

Understanding the EU Credit Rating System

When we talk about the assessment of financial health in the European Union, we’re diving into a world where economic stability and trust play crucial roles. This framework is essential for investors, governments, and businesses alike. It essentially helps to gauge the likelihood that entities, whether they be countries or corporations, will meet their financial obligations.

Within the EU, the process of evaluation is conducted by various agencies that analyze economic indicators, fiscal policies, and overall governance. These evaluations are pivotal as they influence interest rates, investment decisions, and, ultimately, economic growth across member states. By providing a clear picture of financial reliability, these assessments help maintain market confidence and smoothen transactions within the economic space.

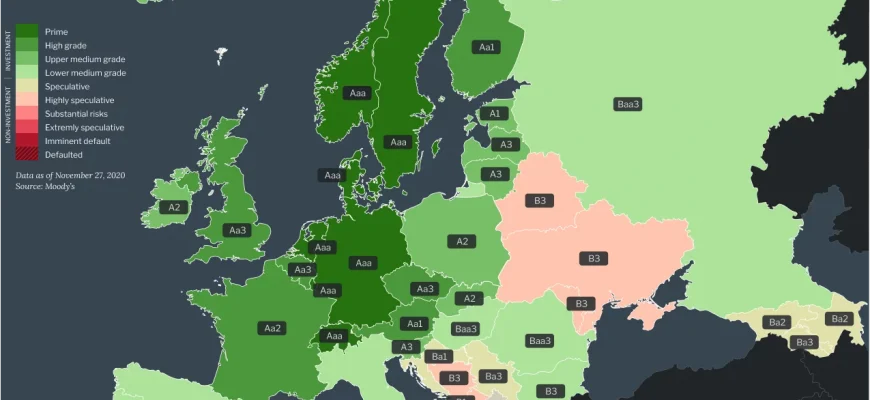

Different tiers of evaluations exist, offering nuanced insights into the performance and risks associated with each entity. This tiered approach allows stakeholders to make informed decisions, ensuring that their investments are safeguarded. Moreover, understanding these evaluations empowers businesses and individuals to navigate the economic landscape more effectively.

In summary, the mechanisms for assessing financial reliability in the EU play a fundamental role in shaping economic outcomes. They provide not just a roadmap for borrowers and lenders but also a benchmark for the overall economic environment, fostering trust and stability across European markets.

Factors Influencing Ratings in Europe

When it comes to evaluating the financial health of entities across Europe, several key elements play a significant role. These factors not only reflect the economic environment but also the specific attributes of the entities being assessed. Understanding these components helps stakeholders navigate the complexities involved in financial assessments.

Economic Stability is often at the forefront of considerations. A strong and stable economy tends to inspire confidence and can lead to more favorable evaluations. Conversely, economic downturns or instability can negatively impact assessments.

Political Environment also weighs heavily on evaluations. A stable political climate typically fosters a trustworthy atmosphere for financial activities. On the other hand, political unrest or frequent changes in policy can raise concerns among evaluators.

Debt Levels are crucial as well. Entities that manage their obligations responsibly tend to be viewed more favorably. Excessive debt, especially if it’s mismanaged, can signal potential risks, thus impacting evaluations adversely.

Financial Transparency is essential too. Organizations that maintain clear, consistent financial reporting build trust. A lack of transparency can lead to skepticism regarding an entity’s true financial standing.

Global Influences can’t be overlooked either. Factors like international market trends, foreign exchange rates, and global economic conditions can all play a part in shaping perceptions and, consequently, assessments across Europe.

In summary, the landscape of evaluations is shaped by an interplay of economic, political, and financial factors. Recognizing these influences can offer valuable insights into the assessment process and help stakeholders make informed decisions.

The Impact of Ratings on Investments

When it comes to investing, the perceived stability of a market or entity plays a crucial role in shaping decisions. Investors often look for indicators that signal the likelihood of a solid return or the potential risks involved. These assessments can greatly influence the willingness of individuals and institutions to put their money into various assets.

A high evaluation typically instills confidence among investors, leading to increased interest and often higher capital inflow. On the other hand, a poor assessment can prompt caution, making investors wary and sometimes causing them to withdraw their funds entirely. This dynamic underscores the influence of evaluations on market behavior and the overall economic landscape.

Moreover, these evaluations are not just numbers or letters; they carry weight in determining borrowing costs and access to financing. A favorable assessment can lead to lower interest rates, benefiting both issuers and investors. Conversely, a negative outlook might result in higher costs of borrowing, which can stifle growth and impact investment decisions across the board.

In summary, the significance of these evaluations is profound. They serve as key indicators that inform investment strategies, shape market perceptions, and ultimately guide the flow of capital in the economy. Understanding their impact helps investors navigate the complex world of finance more effectively.