How Living Off Campus Can Impact Your Financial Aid Situation

When it comes to pursuing higher education, many students find themselves weighing the pros and cons of different living arrangements. Choosing a place to reside can significantly influence the resources one can access while studying. This decision often raises questions about how various financial support options are affected based on where one calls home.

For those contemplating a life beyond the traditional residence halls, it’s essential to recognize that this choice might have different implications for the resources available. Many students wonder if their supportive packages will be adjusted based on this decision, and understanding the nuances of such arrangements can feel overwhelming.

Exploring the effects of living situations on available resources opens up a conversation about budgeting, cost of living, and the overall experience of attending school. Each choice made can lead to different pathways, shaping the educational journey in unique ways.

Understanding Off-Campus Living Costs

When transitioning from on-campus accommodation to an independent residence, the landscape of expenses shifts significantly. This change can have a substantial impact on overall budgeting and available resources for students. A closer look at the various financial aspects associated with staying away from university housing can provide valuable insight for those considering this option.

First and foremost, rent stands out as the most significant expense. Unlike dormitories, where costs are often bundled, renting a private place means dealing with additional bills, such as utilities and internet services. It’s essential to account for these recurring payments, as they can add up quickly and affect overall spending habits.

Moreover, commuting costs can’t be overlooked. Transportation expenses, whether from public transit or maintaining a vehicle, contribute to reshaping monthly budgets. It’s vital to calculate the distance to campus and factor in the time and money spent traveling back and forth.

Groceries are another area where costs might differ. Living away from university facilities means taking charge of meal planning and shopping. This responsibility can lead to changes in dietary choices and spending patterns, making it crucial to establish a sensible approach to grocery shopping.

Lastly, unexpected expenses may arise, such as maintenance fees or deposits for utilities. Preparing for these possible situations can help ensure a smoother experience while adapting to independent living. Understanding all these financial components lays the groundwork for making informed decisions about residential options during academic pursuits.

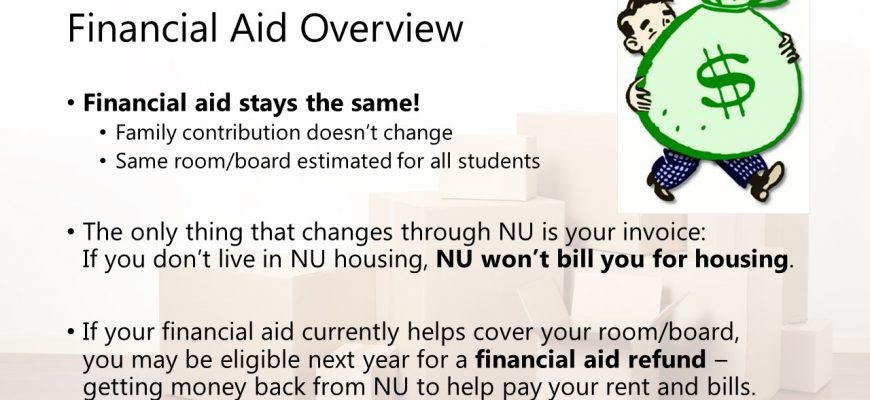

Impact of Housing Status on Aid

The choice of where to reside while pursuing education can significantly influence the support received from various funding sources. This decision affects not only living arrangements but also the financial landscape, leading to different outcomes based on local living conditions and regulations.

When an individual opts for independent accommodation, it’s essential to recognize that such choices may lead to adjustments in the overall assistance package. Numerous institutions take into account various living expenses, which can differ markedly between on-campus and off-campus arrangements. As a result, the overall contribution from available funding could either increase or decrease.

Moreover, factors such as commuting costs and the necessity for additional resources can further impact the overall budget. It’s crucial to evaluate how these elements play into eligibility criteria and what modifications might occur based on the selected living situation. Seeking guidance from relevant offices can provide clarity on how best to approach the complexities of this financial puzzle.

Maximizing Financial Resources for Students

Navigating the world of higher education can be a thrilling yet challenging experience, especially when it comes to managing finances. Understanding how to effectively utilize available resources can make a significant difference in maintaining a healthy budget. By being proactive and informed, students can unlock opportunities that ease the financial burden often associated with their studies.

Making the Most of Scholarships is one of the best strategies for boosting monetary support. Many students overlook local organizations or community grants that could provide assistance. Researching and applying for multiple scholarships, even the smaller ones, can add up significantly and provide unexpected relief.

Additionally, working part-time while studying can offer more than just extra cash. Look for on-campus jobs that cater to student schedules. These positions typically offer flexibility and might even provide networking opportunities that can lead to internships or future employment.

Being mindful of living expenses is vital. Sharing accommodation with roommates can greatly reduce costs, but also consider factors like transportation and utilities when evaluating options. Many students find that exploring alternative living arrangements, such as co-op housing or local housing initiatives, can lead to substantial savings.

Creating a budget is essential to track spending and identify areas for potential savings. Many apps and online tools can help in managing finances effectively. Setting financial goals for both the short term and the long term can keep one focused and motivated throughout the academic journey.

Lastly, don’t hesitate to connect with financial advisors at educational institutions. They can provide tailored advice and may know lesser-known options that could benefit individuals in their pursuit of education. Being proactive and informed is the key to making the most of every financial opportunity available.