Understanding Whether Xfinity Performs a Credit Check for New Customers

When signing up for a new service, many people wonder about the evaluation process they might undergo. It’s not uncommon for companies to review certain aspects of potential customers’ financial backgrounds to determine eligibility. It’s a step that can feel a bit invasive, but it’s often a necessary measure to ensure that both parties enter into a fair agreement.

Typically, this evaluation aims to gauge the reliability of future clients and assess their ability to meet the terms of service. This process can involve looking at various factors, including previous payment histories and any outstanding obligations. The goal is to mitigate risk and create a smoother experience for everyone involved.

Understanding how this assessment works can help individuals prepare for what’s ahead. It’s essential to be aware of the criteria used by providers to make their decisions, as this knowledge can be advantageous when seeking new options. After all, being informed is the first step toward making the best choices for your service needs.

Understanding the Assessment Process

When you’re considering signing up for a new service, it’s natural to wonder how your financial background might come into play. Many providers evaluate potential clients to ensure responsible usage and lower risk for their business. This section will give you insight into how these evaluations work, what factors they consider, and what you can expect during the evaluation period.

Typically, the evaluation consists of several key steps:

- Information Gathering: Providers usually collect essential details such as your name, address, social security number, and sometimes employment information.

- Data Analysis: The collected information is compared against various databases, which may include details of payment history, existing debts, and other financial behaviors.

- Risk Assessment: Based on the analysis, a risk profile is generated, helping the company determine your level of reliability as a client.

It’s important to note that not all evaluations are created equal. Some companies may simply perform a soft inquiry, which doesn’t impact your overall financial standing, while others might conduct a more in-depth review. Here’s a quick rundown of what to expect:

- Typically, a soft inquiry occurs during initial assessments, offering a general view without major repercussions.

- A hard inquiry may be conducted for some services, and this can have a temporary effect on your overall financial score.

- Clear communication from the service provider regarding which process they use can prevent surprises later on.

Understanding this process not only helps you prepare but also empowers you to take action if needed. Being aware of your financial situation can give you better control over the outcome of the evaluation.

Finally, it’s always a good idea to review your own financial records before applying for a service, ensuring you stand the best chance for a favorable assessment.

Implications of a Credit Check by Xfinity

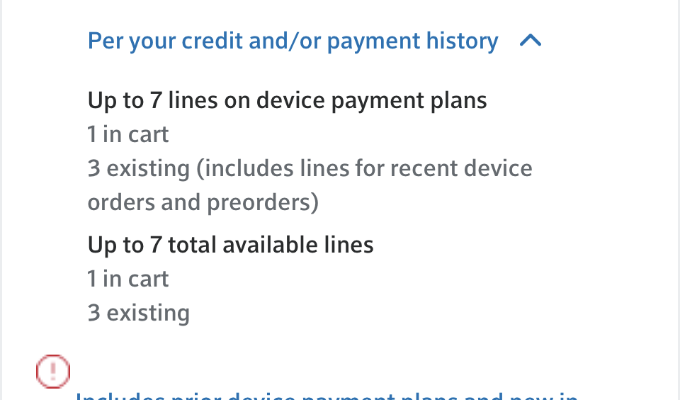

When a company evaluates financial history, it often leads to various consequences for potential customers. Understanding these effects can provide clarity on what to expect and how it might influence your future dealings. This assessment can unveil insights into your financial behavior, potentially affecting your eligibility for services and the terms offered.

One notable outcome of such an evaluation is the potential impact on your financial score. Every inquiry may influence your overall rating, which in turn can shape how providers perceive your reliability. A higher rating may afford you better plans with more favorable rates, while a lower score might limit your options.

Moreover, the process can determine the types of services available to you. Customers with solid financial backgrounds might enjoy access to a wider array of packages, while those with less favorable records may find themselves with limited choices, possibly including higher upfront deposits or stricter contract terms.

Ultimately, being aware of these implications enables better preparation and informed decisions. Taking steps to improve one’s financial standing before engaging with service providers can unlock greater opportunities and benefits in the long run.

Alternatives to Traditional Credit Checks

When it comes to evaluating someone’s financial responsibility, there are various methods that go beyond the usual scrutinies of numerical scores. These alternative approaches can provide a more comprehensive view of an individual’s financial habits, allowing for fairer assessments. Let’s explore some of these innovative strategies.

One popular method is the use of rental payment history. Many landlords consider a tenant’s previous payments as a strong indicator of reliability. Employers and service providers are also beginning to recognize this approach, as consistent payment patterns reflect a person’s ability to manage their obligations.

Another viable option is assessing a person’s bank statements. This technique involves examining income trends, spending habits, and savings patterns. By looking at this data, companies can gain insights into a customer’s overall financial health without relying solely on traditional metrics.

A newer trend is using alternative data sources. This includes information from utilities, phone bills, and even subscription services. By analyzing such data, businesses can paint a clearer picture of an individual’s financial behavior, opening doors for those who may have limited access to conventional evaluations.

Lastly, leveraging technology through financial apps is becoming increasingly common. These tools can track expenses and savings in real-time, providing a more dynamic assessment of someone’s financial status. This method is especially appealing to younger generations who prefer a digital-first approach.

By considering these diverse methods, organizations can create a more inclusive environment that accommodates a wider range of individuals, promoting better opportunities for everyone.