Exploring the Use of Commas in Euro Currency Representation

You might have noticed that different regions of the world utilize various symbols and conventions for expressing numerical values, particularly when it comes to finances. This aspect can sometimes lead to confusion, especially when interacting with foreign currencies. How numbers are formatted can differ significantly, and this is particularly true in the context of certain widespread currencies employed across multiple nations.

In many parts of Europe, a fascinating trend emerges regarding how decimal points and separators are depicted. It’s interesting to explore how local customs influence financial communication and everyday transactions. For those who engage with these currencies, grasping whether a dot or a particular symbol is prevalent in discussions of numerical values can enhance understanding and minimize misunderstandings.

Let’s dive into this intriguing topic and clarify some key points surrounding numerical representation. Recognizing the variances can enrich your knowledge and equip you for interactions involving various currencies. So, are you ready to unravel the mysteries of financial notation practiced by different cultures?

Understanding Decimal Separation in Euro Usage

When discussing financial figures in various regions, the format for showcasing numerical values can differ quite significantly. It’s essential to recognize how local customs influence the presentation of amounts, particularly when it comes to fractional parts. Different countries have their unique approaches to representing these values, and being aware of them can make communication much clearer in international settings.

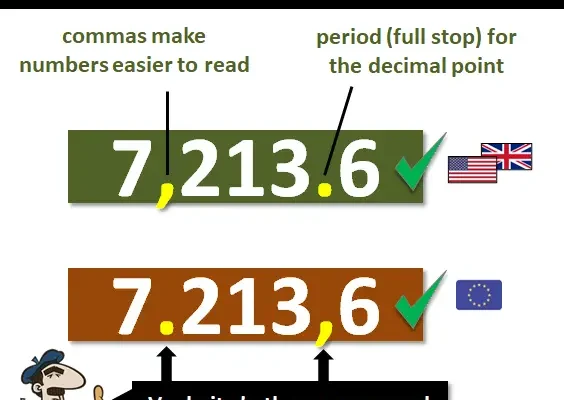

In many European nations, a particular method is favored for indicating decimals. Instead of utilizing a point as seen in other parts of the world, some places opt for an alternative symbol. This distinction is crucial for anyone dealing with cross-border transactions, as misinterpretations can lead to confusion or errors in financial dealings.

Furthermore, the choice of separator not only affects numerical clarity but also reflects the cultural nuances regarding how figures are perceived. Understanding these practices enhances one’s ability to navigate financial discussions seamlessly and avoids any potential pitfalls that might arise from format discrepancies.

Comparative Analysis of Currency Formats

When discussing monetary systems around the globe, it’s fascinating to observe varied approaches to numeric representation. Different regions adopt unique styles for indicating decimal points, enhancing communication in financial matters. Let’s dive into some prevalent formats and their implications.

In many English-speaking countries, a period is the common symbol for decimal separation. For instance:

- United States: $1,234.56

- Canada: C$2,345.67

Conversely, numerous European nations favor a comma as their indicator:

- Germany: 1.234,56 €

- France: 1 234,56 €

This divergence can lead to confusion, especially in international transactions. For instance, presenting a price of 1.000 could imply one thousand or just one, depending on the context. Understanding these formats is crucial for clear communication.

- Consider audience location when displaying prices.

- Utilize conversion tools to clarify numeric values.

- Always double-check formatting to avoid misinterpretations.

Ultimately, embracing these differences enhances financial fluency and fosters smoother interactions in a global marketplace. Understanding distinct currency formats is essential for informed participation in international trade and travel.

Practical Implications for Consumers and Business

Understanding regional conventions can have a significant impact on day-to-day transactions and operations for various stakeholders. When it comes to financial figures, presentation styles might differ between locations, leading to potential confusion and misinterpretations. This aspect is particularly crucial for consumers navigating pricing and for businesses managing financial records and communication.

For individuals shopping or budgeting, awareness of how prices are displayed is essential. Misreading numbers due to formatting differences can result in unexpected expenses. This applies not only to in-store purchases but also online transactions, where clarity in pricing directly affects decision-making. Knowing which system is being applied can help shoppers avoid pitfalls.

On the business side, operations can be equally affected. Companies engaged in international trade or e-commerce must ensure their documentation reflects regional standards. Failure to align financial reporting with local practices could lead to compliance issues or misunderstandings with clients and partners. Consequently, training employees on these distinctions becomes vital for smooth operations.

In summary, grasping the nuances of numeric representation is key for both consumers and commercial entities. By being mindful of these differences, they can facilitate accurate communication and enhance overall experiences in various transactions.