Understanding the Implications of a Negative Credit Card Balance

Have you ever checked your account statement and noticed a figure that seems out of the ordinary? It might be a puzzling scenario that raises several questions. Many people find themselves curious about what these unique numbers could signify and how they impact their overall financial health. Exploring such situations can shed light on various aspects of personal finance, helping individuals make informed decisions.

In financial conversations, certain terms can create confusion, especially when they appear to indicate something contrary to expectations. While at first glance these situations might appear alarming, they often carry more complex implications. It’s essential to dig deeper and understand the context surrounding these figures to grasp their true meaning.

With a little bit of insight and knowledge, you can navigate through these financial intricacies confidently. By examining what these atypical results suggest, you empower yourself to manage your resources more effectively and plan for the future. Let’s explore what lies beneath these astringent figures and how they could play a role in your financial journey.

Understanding Negative Credit Card Balances

Ever wondered what it means when your statement shows a figure that makes you scratch your head? Sometimes, you might come across a situation where that number indicates a surplus instead of a debt. This can be a bit perplexing at first glance, but once you break it down, it starts to make sense.

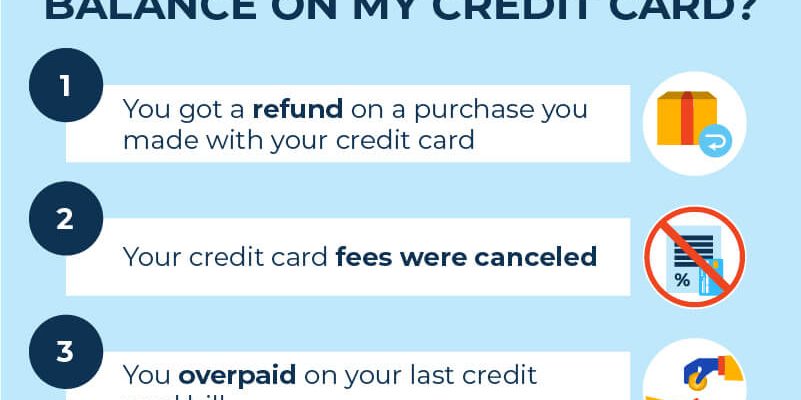

In everyday terms, seeing this unusual figure can indicate that you’ve overpaid on your account or received a refund that surpassed your outstanding charges. It’s like having extra funds available to spend, so rather than being in the red, you’re actually in the green. This can be a welcome surprise, especially if you’re planning a big purchase.

However, it’s essential to keep track of such occurrences. A positive figure on your statement doesn’t mean you should blindly spend; instead, it suggests that your financial habits are in sync, allowing you to manage your spending wisely. Make sure to check for transaction details so you know where you stand financially!

Impact on Your Credit Score

When it comes to your financial image, the way you manage your borrowing tools can have significant repercussions. It’s essential to recognize that how much you owe and how timely you pay can influence your financial reputation. A surprising scenario may arise when the figures on your borrowing statements suggest an excess that needs attention.

Understanding the effects on your financial score involves grasping the factors that are weighed by reporting agencies. Payment history holds considerable sway, but the amounts you owe also play a role. If your statements reflect a favorable outcome, it may even contribute positively to your overall standing. However, a pattern of mismanagement could result in declines that affect future borrowing opportunities.

Moreover, lenders often perceive the total amount owed as a reflection of your financial health. Maintaining a manageable proportion compared to your limits can bolster your score, while high amounts could lead to red flags. Thus, keeping your expenses in check and ensuring timely payments is paramount in building and maintaining a solid financial profile.

Benefits of Having a Surplus

Experiencing a surplus on your financial tool can open up several opportunities that might not be immediately obvious. While it may seem counterintuitive at first, this situation often signals efficiency in managing resources and can provide potential advantages for your financial journey.

Improved Financial Flexibility: A positive surplus can enhance your ability to absorb unexpected expenses without stress. Whether it’s an urgent repair or a spontaneous purchase, having a little extra available allows you to navigate life’s surprises with ease.

Increased Purchasing Power: Enjoying a surplus offers a sense of spending freedom. You can make larger purchases or investments without worrying about interest rates. This can be particularly beneficial when you find a limited-time deal or want to buy something special.

Better Negotiation Leverage: When you’re in a strong position financially, you can negotiate better terms for various services. Companies often appreciate a customer who pays promptly and maintains a healthy surplus, which can lead to discounts or more favorable conditions.

Enhanced Creditworthiness: Maintaining a surplus indicates to lenders that you manage your finances responsibly. This can ultimately improve your credit reputation, making it easier to secure loans or favorable rates in the future.

Stress Reduction: Knowing that you have a positive financial cushion can significantly reduce stress levels. This peace of mind contributes to overall well-being, allowing you to focus on other important aspects of your life without the constant worry about financial setbacks.

In conclusion, while it may seem like a small detail in the grand scheme of finances, having a surplus can set the stage for greater opportunities and a more relaxed financial experience.