Is My Credit Union Compatible with Zelle for Convenient Transactions?

If you’ve been exploring new ways to manage your money, you might have come across various payment services that promise convenience and speed. Many institutions now provide seamless options to transfer funds to friends, family, and businesses, making it easier than ever to handle transactions. But how do you find out if your financial partner is equipped with these modern tools?

In today’s digital world, consumers expect flexibility and efficiency in their banking experiences. As a savvy individual, you want to ensure that your financial service provider keeps pace with technological advancements. Whether it’s sending money securely or splitting costs with friends, knowing the capabilities of your institution can save you time and hassle.

Understanding whether your provider supports specific platforms is essential for navigating your financial journey. By diving into this topic, you’ll learn how to identify the available options and what steps to take to access them, empowering you to make informed decisions about your finances.

Understanding Zelle and Its Benefits

In today’s fast-paced world, transferring funds has never been easier. Many platforms offer seamless ways to send and receive money, but one option stands out with its efficiency and straightforward approach. This service has gained immense popularity due to its convenience, making transactions feel almost instant.

One of the biggest advantages of this platform is its integration with numerous financial institutions, allowing users to send money directly from their bank accounts. This means no need for third-party apps or additional sign-ups; everything happens within your existing banking app. As a result, you can enjoy a smoother experience without multiple steps.

Security is another crucial factor that has made this method a preferred choice. By using established banks, transactions are often protected with top-notch security measures. Additionally, the option to verify the identity of users adds another layer of trust, making you feel more assured with your transactions.

Another noteworthy aspect is speed. Unlike traditional methods that might take several days to process, this service allows users to send money almost instantaneously. Whether you’re splitting a bill with friends or paying for a service quickly, the rapid transfer feature is a game changer.

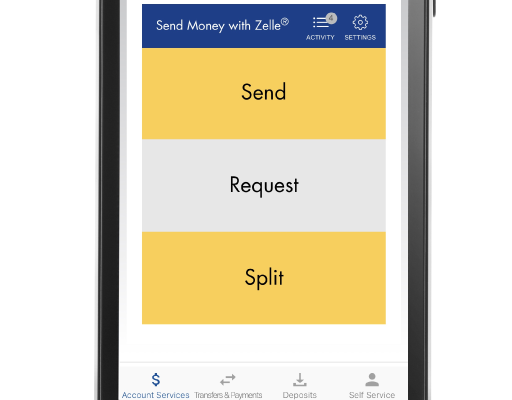

Finally, the simplicity of utilization cannot be overlooked. The interface is user-friendly, making it accessible for individuals of all ages. Even those who might not be tech-savvy can easily navigate through the process, ensuring a smooth experience with every transaction.

How to Check Zelle Availability

Finding out if a specific payment service is part of your financial institution’s offerings doesn’t have to be complicated. There are a few straightforward ways to determine whether you can use this convenient platform for your transactions. It’s all about knowing where to look and whom to ask.

First, consider visiting your financial service provider’s official website. Most institutions list their supported payment options in the online banking section. You can often find detailed information related to features and partnerships right there. If the website doesn’t provide clear details, try their mobile app, as many establishments incorporate this functionality directly into their apps.

If you’re still unsure, reaching out to customer service might be your best bet. A quick call or chat with a representative can clear up any questions, ensuring you have all the necessary details. They can guide you through the available services and how to set everything up if it’s offered.

Additionally, checking social media pages or online forums can give you insights from other users. Many individuals share their experiences and can confirm whether this option is accessible through their financial service provider.

Lastly, keep an eye on any notifications or updates from your institution, as new features get rolled out regularly. Staying informed is key to making the most of modern payment solutions.

Alternatives to Zelle for Transfers

If you’re exploring options for sending money quickly and efficiently, there are various platforms to consider. While one might be popular, it’s always good to know about other services that can meet your needs. Each solution comes with its unique features and benefits, making it important to choose one that fits your lifestyle.

One notable alternative is Venmo, which is widely used for peer-to-peer transactions. Its social media-like interface allows you to see transfers made by friends, adding a fun element to money exchanges. Another option is Cash App, which not only facilitates transfers but also offers features like investing in stocks and Bitcoin.

PayPal also remains a strong contender, especially for online purchases and international transfers. It provides buyer protection, making it a safe choice for transactions. For those who prioritize security, services like TransferWise offer a highly secure way to send money across borders at competitive rates.

Ultimately, the best choice depends on your specific requirements, such as fees, speed, and ease of use. Taking the time to explore these alternatives can help you find a solution that works best for you!