Is Zelle Available at My Credit Union? Exploring Your Options

In today’s fast-paced world, managing money seamlessly is more important than ever. With the rise of immediate payment solutions, many people are left wondering whether their financial establishments are keeping up with these modern conveniences. The ability to send and receive funds quickly has become a staple for anyone looking to navigate their financial landscape effortlessly.

As individuals seek ways to enhance their banking experiences, clarity on the availability of specific features can make a significant difference. You might be curious if your current financial partner offers integration with popular peer-to-peer transaction services. Understanding this can help you take full advantage of the tools at your disposal, ensuring that transferring money to friends and family is as simple as a few taps on your device.

Before diving in, it’s essential to explore the options available to you. Armed with the right knowledge, you can determine how best to manage your financial transactions while enjoying the flexibility that instant services provide. Let’s take a closer look at what you need to know!

Understanding Zelle and Credit Unions

In today’s fast-paced digital world, instant money transfers have become a necessity for many people. Platforms that facilitate quick and seamless transactions are increasingly popular, especially among individuals who value convenience and efficiency. One such service has emerged as a go-to option, enabling users to send and receive funds rapidly.

Financial institutions nowadays are recognizing the significance of integrating modern technology to enhance customer experience. Many members wonder whether their chosen financial service provider embraces these innovative solutions, as they play a crucial role in streamlining everyday transactions. It’s essential to explore how these platforms can complement your banking experience and improve your ability to manage finances effectively.

When looking into options for speedy transfers, it’s vital to consider the specific offerings of your financial provider. By understanding the features and functionalities available, you can determine the best way to handle your payments with ease. This knowledge empowers you to make informed decisions about how you move money and interact with your finances.

How to Check Zelle Availability

Finding out whether your financial institution offers a particular service can sometimes feel a bit like a treasure hunt. However, there are straightforward ways to uncover whether this popular payment method is available to you. Let’s break down some easy steps you can follow.

- Visit Official Website: The first place to start is usually the institution’s website. Look for sections focused on digital banking or payment options.

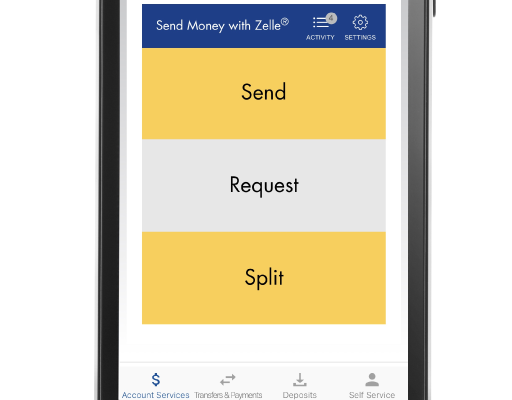

- Check Mobile App: If your institution has a mobile application, download it and navigate to the payment features to see if this service is included.

- Contact Customer Service: A quick call or message to customer support can clarify any questions you might have. They can confirm availability and even guide you through the setup process.

- Search Online Resources: Frequently, blogs or financial forums discuss various institutions and their offerings, providing community insights.

By following these steps, you’ll quickly determine if this service is accessible for your financial needs. Make sure to evaluate your options to take full advantage of seamless transactions!

Advantages of Using Zelle with Financial Institutions

When it comes to transferring funds, many people appreciate the speed and convenience offered by modern technologies. One such option allows users to send and receive money instantly, straight from their bank accounts. This method has gained popularity among various financial organizations, and for good reason.

First and foremost, the ease of use stands out. Users can make transactions using just an email address or a mobile number, eliminating the need for cumbersome details. It ensures a seamless experience, perfect for those who value efficiency in their everyday banking.

Moreover, security is another crucial aspect. Financial firms that integrate this service typically prioritize safety measures, making it a reliable choice for customers. Transactions are encrypted, offering peace of mind while managing personal finances.

Additionally, there’s often no fee involved, which is a significant advantage over some other money transfer methods. This cost-effectiveness allows individuals to move their funds without worrying about hidden charges, making it accessible for everyone.

Lastly, the convenience factor cannot be overstated. Users can initiate transactions from their devices at any time, whether they’re at home or on the go. This flexibility fits perfectly into today’s fast-paced lifestyle, allowing for quick payments or splitting bills with friends effortlessly.