Is My Car Title Held by My Credit Union? Understanding the Process and What to Look For

Owning a vehicle comes with a set of responsibilities, one of which is ensuring that you have all the necessary paperwork organized and accessible. When it comes to the document that proves your ownership, many individuals might find themselves wondering about its current location. Particularly, if you’ve financed your vehicle through a lending institution, it’s natural to question whether that vital document is securely stored there.

The oversight of this important paperwork is often overlooked, especially during busy times. It’s crucial to understand how to track down this document, as it holds significant importance for various transactions, such as selling the vehicle or seeking additional financing. Knowing exactly where it stands can save you a lot of hassle in the future.

In this article, we will explore the various aspects related to your ownership documentation and how to determine whether it resides with your financial provider. Understanding the processes involved can empower you to manage your vehicle-related affairs more effectively.

Understanding Vehicle Ownership Documentation Policies

When you finance your vehicle through a lending institution, it’s essential to grasp how they handle ownership documentation. Different organizations may have various approaches regarding the possession and management of these essential documents. Knowing the specifics can help you avoid potential issues down the road.

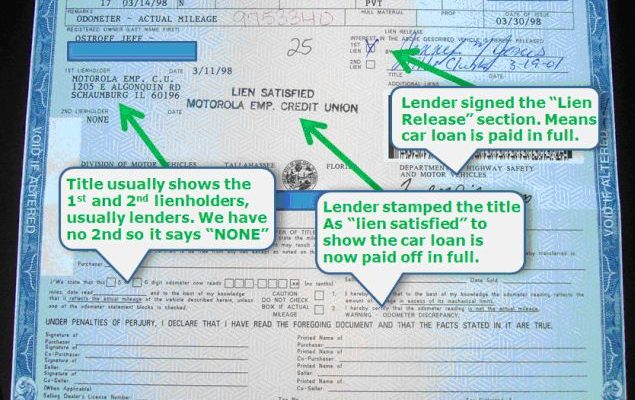

Most lending institutions retain ownership documentation until the loan is fully paid off. This practice not only protects their investment but also ensures that the vehicle remains tied to the loan until you fulfill your financial obligations. However, the specifics of these policies can vary, so it’s wise to inquire directly with your lending organization.

Additionally, some institutions might provide you with a copy of the documentation for your records, while others may only offer access through their online portals. Familiarizing yourself with the processes in place can save you time and eliminate confusion.

Always verify what happens when the loan is settled. Will you receive the original document promptly? Or does the institution require additional steps? Clear communication will ensure you understand your responsibilities and rights regarding vehicle ownership documentation.

Being proactive about these policies helps foster a smooth relationship with your financial partner and ensures that you are well informed about your vehicle’s documentation status at all times.

How to Request Your Vehicle Ownership Document

Getting your ownership document sorted out is a straightforward process, and it’s essential for managing your vehicle. Whether you’ve recently paid off your loan or just want to check on the status of your document, knowing the right steps can make it easier. This guide will help you navigate through requesting what you need, ensuring you’re equipped with all the necessary information.

First, gather all required details about your vehicle. This includes the make, model, year, and VIN. Having these on hand will facilitate the process when you contact the appropriate department. You might also want to keep your loan account number ready if there’s one associated with your vehicle.

Next, reach out to the relevant financial institution. You can do this via phone or their official website. Many institutions have specific forms for this purpose, which can streamline your request. If you prefer more personalized assistance, visiting a local branch could be beneficial.

When you make your request, be clear about why you’re seeking the document. If it’s due to completion of payments, mention that so they can quickly verify your situation. Also, inquire about any potential fees or processing times to avoid surprises down the line.

Lastly, after your request is submitted, keep an eye on your mailbox or email for updates. It might take a bit of time, so be patient. If you don’t hear back within the expected timeframe, don’t hesitate to follow up and ensure everything is moving along as it should.

What to Do If It’s Missing

When important documents go astray, it can lead to confusion and frustration. If you find yourself in a situation where you can’t locate that essential paperwork, don’t panic. There are steps you can take to track it down and ensure that everything is in order.

First, retrace your steps. Think about when you last saw that document. Was it during a recent transaction or maybe after your last visit to the office? If you remember where it might have been, check those spots thoroughly.

If your search doesn’t yield results, the next move is to reach out directly to the organization that may hold the document. They often have procedures in place to help you obtain a replacement. Be prepared with your personal information for verification purposes.

Additionally, if you suspect that the missing item might have been lost or misplaced rather than just unaccounted for, consider filing a report. This way, you not only document the situation but also protect yourself in case any issues arise in the future.

Finally, keep a positive outlook. Many people find themselves in similar situations, and with a little diligence and patience, recovery is often just around the corner.