How Frequently Does My Credit Score Get Updated and What Factors Influence These Changes?

Have you ever wondered how frequently your financial health is reassessed? This is a common concern for many individuals navigating the world of borrowing and lending. The reality is that various factors can influence this assessment, and it’s important to stay informed about how often these evaluations occur.

In today’s world, managing your financial reputation is crucial, especially when it comes to significant life decisions like purchasing a home or taking out a loan. Many people find themselves asking about the timing and triggers behind these important evaluations. It’s not just about knowing where you stand; it’s about understanding how your actions can shape that standing over time.

In this discussion, we’ll delve into the mechanics behind these evaluations, exploring aspects that lead to changes and how to stay ahead in maintaining a positive financial image. Understanding these details can empower you to take control of your financial journey with confidence.

Understanding Credit Score Maintenance

Keeping track of your financial standing is essential for reaching your monetary goals. Regular attention to your financial health helps ensure that you are in good shape when it comes to loans or other forms of credit. It’s about knowing the factors that influence your standing and taking proactive steps to maintain or improve it over time.

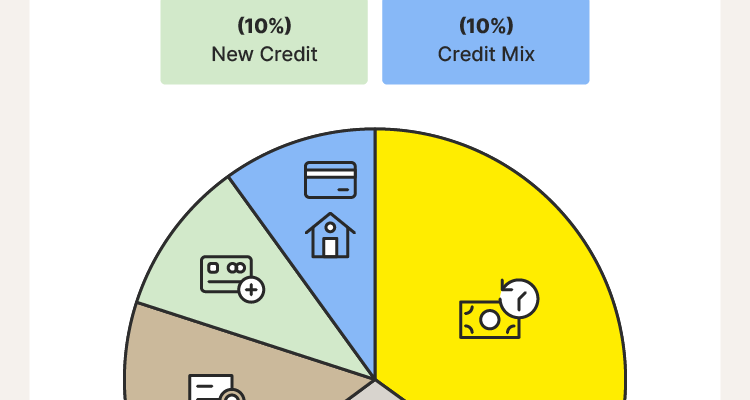

Various elements play a role in shaping your financial profile. Payment history, total amounts owed, length of credit history, new credit inquiries, and types of accounts all contribute to that overall image. By understanding how these components interact, you can make informed decisions that positively impact your overall assessment.

Monitoring your financial status regularly is vital. Not only does it help you catch any discrepancies, but it also allows you to track your progress. Engaging with resources that provide insights into your financial well-being can be a game changer. Keeping an eye on your figures ensures that you are aware of any changes that may arise over time.

Ultimately, developing healthy financial habits pays off. Timely payments, maintaining a manageable amount of debt, and avoiding unnecessary applications for new credit are all steps that lead to a more favorable evaluation. Think of it as nurturing a garden; consistent care leads to flourishing results.

Factors Influencing Your Credit Score

Understanding the elements that impact your financial reputation is essential for anyone keen on maintaining a healthy financial profile. Various aspects come into play, each contributing to how trustworthy you appear to lenders and service providers. Exploring these components will help you gain control over your financial journey.

Payment History: One of the most significant factors is how consistently you meet your repayment obligations. Late payments, defaults, or any delinquencies can negatively affect your standing. Conversely, a history of on-time payments builds trust.

Credit Utilization: This refers to the ratio of your outstanding balances to your available limits. Keeping this percentage low demonstrates responsible use of your resources. Aim to utilize less than 30% of your available credit to maintain a positive perception.

Length of Credit History: The duration for which you have maintained accounts plays a crucial role. Longer histories with responsible management are viewed more favorably than newer accounts, which may be seen as a higher risk.

Types of Credit: Having a mix of different lending products, like revolving accounts and installment loans, can enhance your profile. This variety shows lenders that you can handle different types of obligations effectively.

Recent Inquiries: When you apply for new credit, a hard inquiry is made, reflecting your request for additional funds. Numerous recent inquiries may suggest financial distress, which could undermine lender confidence.

By being aware of these integral components, you can make informed decisions that positively shape your financial identity and enhance your prospects in the lending landscape.

How Often Scores Are Updated

Many people wonder how frequently their financial ratings change. Understanding this aspect can help you better manage your financial journey and make informed decisions. The timing of these changes can impact your ability to secure loans or favorable interest rates.

Generally, assessments are refreshed on a regular basis, reflecting your latest financial activities. For most individuals, these evaluations may evolve monthly as lenders report your repayment behaviors and any new credit opportunities. However, it’s essential to note that each financial institution may have its own timeline for reporting, leading to variations in how quickly your metrics adjust.

Additionally, certain events can trigger immediate shifts in your evaluation. For instance, if you take out a new loan or miss a payment, you might see changes sooner than expected. Keeping an eye on your financial practices can make a significant difference in how these figures move over time.

Overall, while there are typical patterns to expect, individual experiences will vary. Staying aware of your financial habits and regularly checking your standing can help you navigate your options more effectively.

You light up the screen! There’s something so captivating about your energy and presence. Beautiful!