Understanding the Monthly Reset of My Credit Score and What It Means for You

Have you ever wondered how your financial history is evaluated over time? Many people are curious about the periodic evaluation of their financial profiles and how it can influence their ability to make significant purchases. This topic is essential, as it affects not only personal finances but also future opportunities for loans, mortgages, and other financial services.

When examining how these evaluations work, it’s important to recognize that various factors come into play. Patterns of spending, timely payments, and existing balances can all contribute to the overall picture painted by financial institutions. Moreover, the frequency with which these assessments occur can often lead to misunderstandings about how they truly impact individuals’ financial situations.

In this article, we will clarify the nuances surrounding the timeline of these evaluations and the implications they have on individuals seeking to manage their financial health effectively. We will explore common misconceptions and provide insights into maintaining a favorable standing over time for those aspiring to achieve their financial goals.

Understanding Monthly Credit Reporting

Have you ever wondered how your financial behavior is tracked and evaluated? Each time you engage in a transaction, lenders and financial institutions monitor your activities, compiling a comprehensive snapshot of your financial activities. This tracking system plays a crucial role in assessing your reliability when it comes to borrowing. The insights gathered from these activities culminate in periodic assessments that influence various aspects of your financial journey.

It’s important to be aware that the timing and frequency of these evaluations can greatly affect your standing. Every so often, the information gathered is compiled by organizations that assess your financial habits, which can then be used by lenders to make informed decisions about your ability to obtain loans or credit lines. This cycle can create fluctuations in how you are perceived financially, meaning it’s beneficial to understand how it operates.

Monitoring your financial habits can help you make informed choices. Keeping track of your spending patterns, on-time payments, and outstanding balances creates a solid foundation for improving your overall standing. With each evaluation period, you have the opportunity to refine your financial strategy, ensuring that you present the best possible version of yourself to potential lenders.

The Impact of Credit Utilization Rates

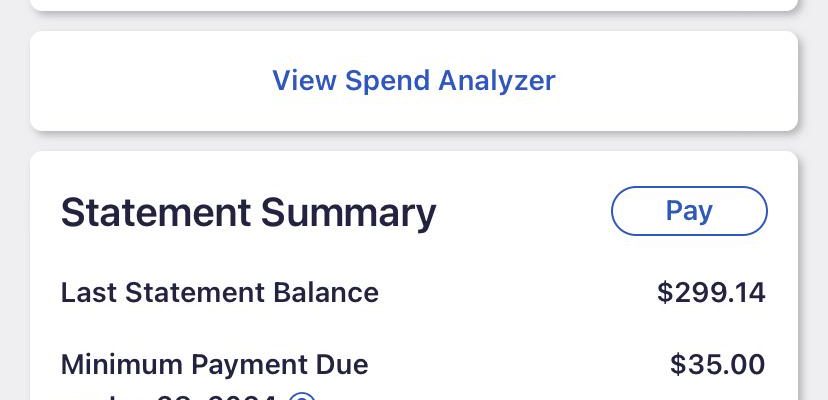

Understanding how your borrowing habits influence your financial health is crucial. One of the key elements that can affect your overall standing is the proportion of your available credit that you are using. This aspect plays a significant role in how lending institutions perceive you.

When you utilize a high portion of your available borrowing capacity, it can indicate to lenders that you may be over-relying on borrowed funds. This could pose risks from their perspective, potentially affecting your opportunities for favorable financial products.

- Typically, a lower percentage indicates financial responsibility.

- Aiming for around 30% or less is often suggested to maintain a good standing.

- Even better, aiming for a usage rate below 10% could yield optimal results.

It’s also worth noting that your utilization can fluctuate. As you make purchases or pay down outstanding balances, this percentage can change, impacting how lenders view your overall behavior.

Being mindful of this ratio, especially during significant financial decisions, can enhance your prospects. Maintaining an appropriate level can contribute to a more favorable impression, ultimately benefiting your financial ambitions.

How to Track Your Score Changes

Keeping an eye on how your financial status shifts over time can feel like a daunting task, but it doesn’t have to be. With the right tools and methods, monitoring your rating becomes a manageable and even enlightening process. Understanding fluctuations in your standing can help you make informed decisions and improve your overall financial health.

One of the simplest ways to stay updated is by using online services that provide regular updates on your standing. Many platforms allow you to check your status for free and offer comprehensive reports. Setting up notifications can also be helpful, as they often alert you to significant changes, ensuring you’re always aware of your position.

Another effective approach is to review your financial records periodically. Keeping a calendar or reminder system can help track when you last checked your standing and when to do it again. Regularly inspecting your reports not only helps you observe trends but also allows you to catch any discrepancies early.

Lastly, having an understanding of the factors that influence your standing is crucial. Payment history, outstanding balances, and new credit inquiries all play a role. By familiarizing yourself with these elements, you can better anticipate changes and take proactive steps to maintain or improve your overall rating.