Understanding the Monthly Renewal of Your Credit Line

Many people wonder about the patterns and structures that govern their financial resources. It’s a common concern to figure out how often those funds can be accessed and whether there is a limit to their availability. Knowing the rhythm of your monetary tools can make a significant difference in how you plan your budget and expenditures.

Your financial tools can sometimes offer a sense of reassurance, particularly in times of unexpected expenses. However, it’s crucial to grasp the intricacies involved in managing them. Are there specific intervals when you can tap into those resources again? What influences the available balance and its reactivation? These questions are essential for making informed choices.

In this discussion, we’ll explore how these financial resources function, uncover some common misconceptions, and provide insights into what you can expect when managing your monetary assets. With the right knowledge, you can navigate this aspect of personal finance more confidently and intelligently.

Understanding Monthly Credit Line Terms

When it comes to managing your financial resources, grasping the principles behind available funding can be crucial. It’s essential to know how the systems work and what you can expect from your financial institution regarding access and repayment. This knowledge can help you make informed decisions about your spending habits and overall financial health.

Firstly, many lenders offer a structured approach that allows individuals to borrow funds up to a certain limit. This arrangement can provide flexibility for those who might need to cover expenses without drastically affecting their budget. Understanding how often you can tap into this funding and the conditions surrounding it can significantly impact your financial planning.

Additionally, it’s vital to recognize the importance of keeping track of your expenditure. Regularly monitoring what you utilize will ensure you stay within bounds and avoid potential penalties or fees. Each financial provider might have its own set of guidelines, and being aware of these can help you better navigate your financial landscape.

On top of that, understanding the timing of repayment is equally important. Many establishments have specific policies about how and when to settle any outstanding amounts. Familiarizing yourself with these details can empower you to maintain a healthy balance and take full advantage of the available resources without unnecessary stress.

How Utilization Impacts Your Balance

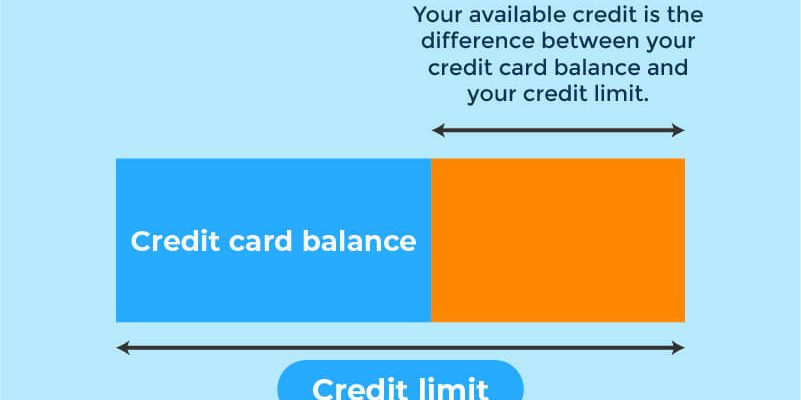

Understanding the way your available funds are used can significantly influence your overall financial health. Each time you tap into your financial resources, the amount you utilize contributes directly to your outstanding balance. Keeping an eye on this can help you manage expenses and plan effectively.

High levels of utilization can reflect poorly on your financial profile, potentially leading to increased interest rates or lowered approval chances for future financing. Conversely, maintaining a lower percentage often suggests responsible management and can positively affect your ability to secure additional funds when needed.

Being aware of how much you’ve used compared to what is available not only aids in better budgeting but also aids in safeguarding your financial standing. Striking a balance between utilization and available credit is key to maintaining a healthy financial picture.

Impact of Payments on Credit Renewal

Understanding how your payments influence your available funds can be quite enlightening. Each time you make a payment, it can significantly affect your overall balance and financial flexibility. Let’s delve into this fascinating relationship.

Payments play a critical role in maintaining your financial health. Regular and timely payments can lead to various positive outcomes:

- Improved limits: Making payments on time may lead to an increase in your available amount, empowering you to manage larger expenses.

- Better terms: Consistent payment history can enhance your standing, potentially unlocking benefits such as lower interest rates.

- Enhanced scores: Keeping your payment schedule can positively impact your credit reputation, making it easier to access funds in the future.

On the flip side, missing payments can have detrimental effects:

- Reduced availability: Delays in settling your dues can lead to a decrease in your accessible funds.

- Higher costs: Late payments often incur penalties, leading to a financial burden that can be hard to manage.

- Negative effects on reputation: A poor payment history can tarnish your financial profile, making lenders cautious.

In summary, maintaining a good payment rhythm is essential. Regularly meeting your obligations not only enhances your purchasing power but also strengthens your overall financial standing.