Exploring the Extent of Financial Aid Coverage for Educational Expenses

When considering the journey through higher learning, many people find themselves curious about the various forms of support available to help lighten the load of expenses. It’s common to wonder about the extent to which these resources can cover costs. With so many options out there, navigating this maze can feel overwhelming.

As you dive into this topic, it’s important to recognize the nuances involved. Not all forms of assistance are created equal, and the range of expenses they address can vary significantly. Understanding what is included and what isn’t is crucial for crafting a solid financial plan that aligns with one’s educational goals.

It’s also worth noting that while some resources can provide substantial relief, others may only cover a fraction of the overall costs. Identifying these differences is key to making informed decisions and setting realistic expectations for what can be achieved through various support mechanisms. So, let’s break down the details and demystify the landscape of available resources!

Understanding Financial Aid Coverage

When exploring options for funding your education, it’s essential to grasp what support typically encompasses. Many individuals assume that assistance programs cover all expenses, but the reality is a bit more nuanced. There are various components to consider, and each category can play a unique role in shaping your overall financial picture.

First, it’s helpful to break down the various expenses incurred during your academic journey:

- Tuition and Fees

- Books and Supplies

- Housing Costs

- Transportation Expenses

- Personal Expenses

Each of these aspects varies significantly based on the institution, chosen program, and individual circumstances. Let’s dive into how these elements are typically addressed:

- Tuition and Fees: This is usually the largest expense and what many assume the majority of assistance will cover.

- Books and Supplies: These costs often fall outside standard coverage, requiring additional budgeting.

- Housing Costs: While some programs may provide support for on-campus housing, off-campus living often relies on personal resources.

- Transportation Expenses: Commuting can add an extra layer of costs that aren’t typically included in support packages.

- Personal Expenses: Day-to-day living costs are generally not addressed by assistance options.

Understanding how each of these elements is addressed can greatly impact your planning. It’s advisable to conduct thorough research and consult with financial advisors or school representatives to get a clearer picture of what you might need to cover on your own. Knowing the details allows for better preparation, ensuring a smoother academic experience.

Types of Expenses Covered by Assistance Programs

When it comes to pursuing education, there are various costs involved that can add up quickly. Assistance programs can be a lifeline, helping to ease the financial burden that comes with obtaining a degree. Understanding what kinds of expenses are addressed by these programs can provide a clearer picture of how they can support students on their academic journey.

First and foremost, tuition fees are often a significant portion of educational expenses. Most assistance programs are designed to help students alleviate these costs, making higher education more accessible. Beyond tuition, many individuals overlook additional mandatory fees that universities may impose, such as enrollment or activity fees, which can also be taken into account.

Another key category includes the cost of books and supplies. Educational materials can be quite pricey, and programs often allocate funds specifically for these necessities, ensuring that students have the resources they need for success in their classes.

Housing is another major aspect that these resources can address. Whether living on campus or in private accommodations, securing a place to stay can be a substantial expense. Assistance can go a long way in helping cover rent or related costs, providing stability during a student’s academic endeavors.

Transportation costs are also sometimes included in assistance offerings. Students often need to commute to classes or internships, and contributing to travel expenses can ease the strain on their budgets. Additionally, some programs may aid with childcare costs for those balancing studies with parenting responsibilities.

Ultimately, understanding the varied expenses that support initiatives can help students better navigate their financial landscape. By knowing what is covered, students can plan effectively and focus more on their studies rather than their wallets.

Limitations of Financial Assistance Programs

When it comes to the support systems designed to help students, there are important factors to consider that can shape one’s experience. While many students may rely on various funding sources to alleviate some of their educational expenses, it’s essential to recognize that these programs often come with their own set of restrictions and boundaries.

Coverage Gaps can be a significant concern. Many initiatives cover tuition fees but leave out other necessary costs such as textbooks, supplies, or living expenses. This can create an unexpected financial burden for students who may need to budget more carefully than they initially anticipated.

Additionally, Eligibility Criteria can limit access to available resources. Different programs have specific requirements, including academic performance or enrollment status. Not meeting these criteria might result in missed opportunities, which can be particularly frustrating for those in need.

Another aspect is the Timeliness of Disbursement. Even if students secure support, they might face delays in receiving those funds. This lag can disrupt payment schedules or create stress as they manage immediate costs.

Lastly, it’s crucial to consider the Impact on Future Finances. Some forms of assistance may come with stipulations that affect a student’s financial situation down the line, such as loan repayment terms or expectations that might linger after graduation.

In summary, while support can be a lifeline, understanding its limitations and planning accordingly is vital for students navigating their educational journey.

Strategies for Covering Remaining Costs

Not all expenses are fully covered, and that’s where creativity comes into play. Tackling the outstanding balance requires a mix of resourcefulness, planning, and sometimes a bit of legwork. Let’s explore some effective avenues to bridge that financial gap and ensure you can remain focused on your journey ahead.

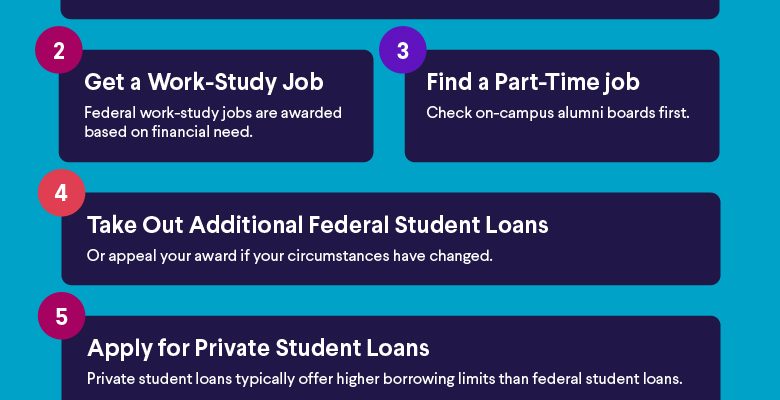

First off, consider part-time jobs or internships that align with your schedule. Many institutions offer work-study programs that provide students with flexible hours to earn some extra cash while gaining valuable experience. This not only helps financially but can also enhance your resume.

Next, look into scholarships that might still be available for your specific situation. There are numerous organizations and foundations that offer funding based on merit, need, or niche interests. Even late applications can yield opportunities, so it’s worth doing some research.

Another option is to crowd-source financial assistance from family and friends. Sharing your goals and what you need helps others understand your situation. They may be willing to contribute or offer support in other ways, such as loans or gifts.

Creating a detailed budget is also essential. By tracking income and expenses meticulously, you can identify areas where you can cut back and save money. This allows for better allocation of your resources toward the remaining costs.

Lastly, investigate community resources or grants specific to your field of study. Many local organizations provide funding to support students pursuing careers in areas like education, healthcare, or the arts. Taking the initiative to explore these avenues can lead to significant financial relief.