Exploring the Scope of Financial Aid Beyond Tuition Costs

When pursuing higher education, many students find themselves exploring various types of assistance designed to ease the financial burden. It’s a common misconception that this support is limited to one aspect of college expenses, but the reality is much broader. Understanding what is included in these helpful resources can significantly influence a student’s budget and overall educational experience.

Various forms of assistance often aim to alleviate expenses beyond just the primary fee for coursework. Besides the obvious costs like books, supplies, and a place to stay, there are additional factors worth considering. Knowing the full extent of available support can empower students to make informed decisions about their finances.

Exploring the expansive nature of these resources is crucial for anyone looking to make the most of their educational journey. From living costs to other academic necessities, being aware of what can be funded opens up opportunities for many learners. Let’s dive into the different components that can be included and help in shaping a well-rounded understanding of the provisions available.

What Support Actually Includes

When we talk about support for education, it’s essential to understand that it encompasses more than just course fees. Many students often overlook other expenses associated with their educational journey. From living arrangements to learning materials, there’s a wide range of costs that can add up quickly.

Housing is a significant component. Whether you live on-campus or rent an apartment off-campus, your accommodation costs can take a big chunk out of your budget. Additionally, utilities, internet, and food are also crucial elements to consider.

Another important aspect is course-related expenses. Books, supplies, and even technology like laptops or software can significantly impact your finances. These items are often required for successful completion of your studies and shouldn’t be overlooked.

Transportation also plays a key role, whether you’re commuting by car or using public transit. Gas, parking fees, or transit passes are often an added expense that can catch students off guard.

Finally, don’t forget about personal expenses. Health insurance, clothing, and daily necessities make up another layer of financial responsibility. Recognizing these various elements can help you make a more informed decision about your educational funding.

Beyond Tuition: Additional Costs Explained

When planning for college expenses, it’s crucial to realize that the costs go far beyond just the price of classes. Many students are surprised to find themselves facing a variety of additional expenses that can quickly add up and impact their overall budget. Understanding these extra charges is essential for anyone looking to adequately prepare for their academic journey.

Housing is often one of the largest expenses aside from class fees. Whether residing in a dormitory or renting an apartment, students should factor in monthly rent, utilities, and any associated living costs. Additionally, meal plans or grocery bills can also contribute significantly to one’s financial responsibilities.

Another important aspect to consider is course materials. Textbooks, lab supplies, and other necessary resources can be quite pricey. Many students overlook this area, assuming they can manage with digital options, but the cost of buying or renting these materials shouldn’t be underestimated.

Transportation is yet another factor that often slips through the cracks. Whether commuting via public transport, driving a car, or even flying home during breaks, these travel expenses can pile up, making it vital to budget accordingly.

Lastly, don’t forget about personal expenses. Everyday costs for things like clothing, toiletries, and entertainment can easily exceed expectations. It’s wise to account for these factors when drawing up a comprehensive financial plan for your time in school.

Understanding Types of Financial Assistance

When it comes to pursuing higher education, exploring the various forms of support available can be quite enlightening. Many individuals may assume that this assistance is limited to academic fees, but the reality is much broader. It’s all about discovering what resources you can tap into to ease the burden of educational expenses.

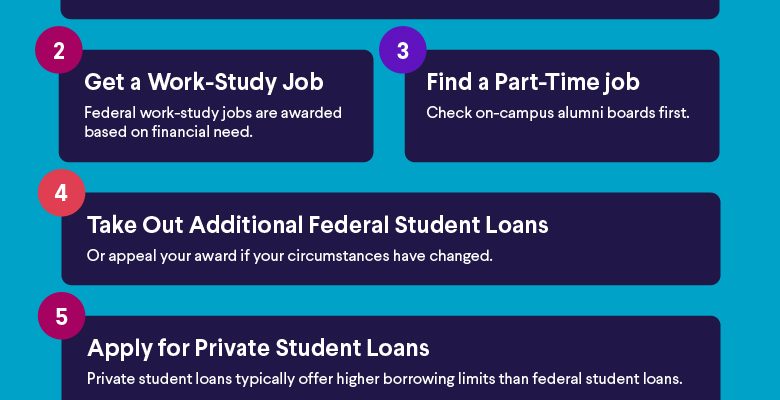

Different types of support programs exist to help students navigate their financial landscape. Scholarships are fantastic opportunities based on merit or need, providing funds that don’t require repayment. Then there are grants, which typically cater to specific demographics or educational fields, offering support without the anxiety of debt. Additionally, work-study options allow students to gain practical experience while earning money to help with their expenses.

It’s also worth mentioning student loans, which, although they come with future repayment obligations, can be beneficial in bridging the gap between available resources and educational costs. By understanding the variety of assistance out there, students can make well-informed decisions that align with their financial goals and academic aspirations.