Understanding Whether Financial Aid Packages Include Loans

When it comes to pursuing higher education, many people find themselves exploring various avenues to help them manage the costs. One of the common questions that arise in this context is about the different types of resources available to students to alleviate their financial burdens. This topic brings to light the various forms of support that can play a crucial role in making education more accessible.

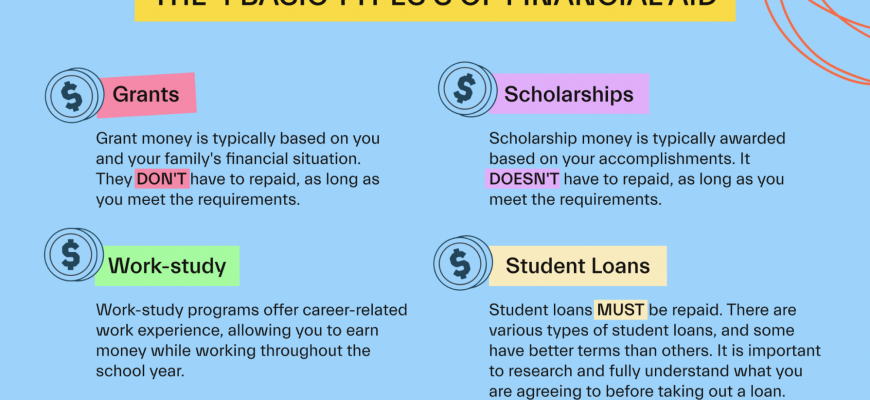

In this discussion, it’s essential to delve into the nuances of what types of support are available and how they can impact students’ financial situations. While some assistance comes in the form of gifts that don’t need to be repaid, others might involve options that require repayment in the future. Understanding these distinctions can help students make informed decisions about their educational financing.

Moreover, it’s important to recognize the implications of choosing different forms of assistance. Each option carries its own set of benefits and responsibilities, so being well-informed can empower students and their families to navigate the complexities of funding education effectively. By examining these choices, one can better appreciate the broader landscape of educational funding.

Understanding Financial Aid Components

When it comes to pursuing education, there are various kinds of support that can help ease the financial burden. It’s essential to grasp the different elements involved in this process, as they can significantly affect your overall experience. Each component plays a unique role, and knowing how they fit together can help you make informed decisions about your funding options.

One of the key aspects often discussed in this context relates to grants and scholarships. These forms of support do not require repayment and can significantly reduce the amount you need to cover out-of-pocket expenses. They are typically awarded based on financial need, academic merit, or specific talents, making them a desirable option for many students.

Another crucial element involves credit-based options, which provide additional resources to cover educational costs. This type of support can be essential for those who require more funding than what is available through grants or scholarships alone. Understanding the terms and conditions attached to these funds is important, as repayment is generally required after graduation or when you cease to be enrolled.

In addition, there are sometimes work-study opportunities available that allow students to earn money while attending classes. This can also be a great way to gain valuable work experience in a field related to your studies. All of these components contribute to your financial strategy for education, and being aware of them can lead to smarter choices as you navigate your academic journey.

Types of Assistance Available

When it comes to supporting education, there are various options that can help alleviate the financial burden. Understanding the different forms of support is essential for anyone looking to further their studies without breaking the bank. Each type brings unique characteristics and benefits, catering to diverse needs and situations.

Grants are one of the most sought-after varieties. These are funds that do not require repayment, making them a fantastic choice for students who qualify. They are typically based on financial need, academic performance, or specific criteria to promote education for underrepresented groups.

Scholarships serve as another excellent resource. Primarily awarded based on merit, these funds encourage students to excel academically or to engage in particular activities, whether it’s sports, the arts, or community service. Winning a scholarship can significantly reduce the costs associated with schooling, allowing students to focus on their studies.

Then there are assistance programs that offer support tailored to certain professions, encouraging students to enter fields that are in high demand. These programs often provide stipends or tuition coverage in exchange for a commitment to work in that area after graduation.

For those who may need to borrow, credit options provide a pathway to cover remaining expenses. While these solutions require repayment, they can make education accessible for students who may not have the means otherwise. It’s important to understand the terms involved to manage any future obligations effectively.

In summary, whether through grants, scholarships, targeted programs, or borrowing options, there are numerous avenues to explore. Each type of funding can play a crucial role in achieving educational goals, so it pays to research and find the best fit.

The Role of Loans in Education Funding

When it comes to pursuing higher education, many individuals face significant financial challenges. One of the most common strategies to bridge the gap between personal resources and educational expenses involves borrowing money. This practice serves as a crucial tool for countless students, enabling them to access quality education despite limited immediate funds.

Access to Opportunities is a primary benefit of borrowing. For many, the prospect of attending a university wouldn’t be feasible without the option to secure funds upfront. This enables students to focus on their studies and career aspirations rather than being hindered by financial constraints.

Moreover, repayment terms typically offer flexibility, allowing borrowers to manage their finances more effectively after graduation. This means that individuals can invest in their education now and pay off their obligations later when they have hopefully secured better job opportunities.

However, it’s essential for borrowers to approach this option with caution. Understanding interest rates and terms is vital. A well-informed decision can enhance one’s educational experience without leading to overwhelming debt in the future.

In summary, borrowing plays a pivotal role in the landscape of educational funding, making it possible for many to achieve their academic goals and ultimately improve their long-term financial situation.