Exploring Whether Financial Aid Accrues Interest

When it comes to pursuing higher education, many individuals explore various avenues to alleviate the burden of expenses. One common route involves obtaining assistance that can be crucial for success. However, a key question arises: What are the implications of accepting such support?

This topic invites a closer look at the potential conditions and requirements that may accompany these resources. While some provisions appear straightforward, others might include stipulations that can impact one’s journey. Navigating through the options available can feel overwhelming, but understanding the intricacies is essential.

In this exploration, we will delve into whether the resources provided come with any additional costs over time. By examining specific instances, we can illuminate the finer points that really matter. This conversation is especially relevant for those who are making decisions about their educational finances.

Understanding Financial Aid Interest Rates

When you’re navigating the world of educational funding, one question often lingers: how do charges on borrowed sums work? Grasping this concept is essential for anyone looking to manage their finances wisely while pursuing their studies. Interest rates can significantly impact the overall cost, making it crucial to comprehend what to expect.

Types of Rates play a key role in determining how much you will ultimately pay back. There are usually two main categories: fixed and variable. A fixed rate means your percentage will remain the same throughout the life of the loan, allowing for predictable budgeting. On the other hand, a variable rate can fluctuate, potentially leading to lower initial payments that may rise over time.

Additionally, subsidized versus unsubsidized options can also create differences in how much you’ll owe. With subsidized loans, the repayment burden may be lighter initially, as the government covers the accruing charges while you’re in school. Understanding the nuances of each type can aid in making informed choices.

As you dive deeper into educational financing, don’t forget to consider how credit scores influence the rates offered. A healthy score often translates to lower charges, making the borrowing experience more affordable. Taking the time to improve your financial profile can pay off in the long run.

Finally, always stay aware of any fees associated with borrowing. These can sneak up on you and add to your overall expense, making it essential to read the fine print. Knowledge is power when it comes to understanding the financial obligations you may face.

Types of Assistance Explained

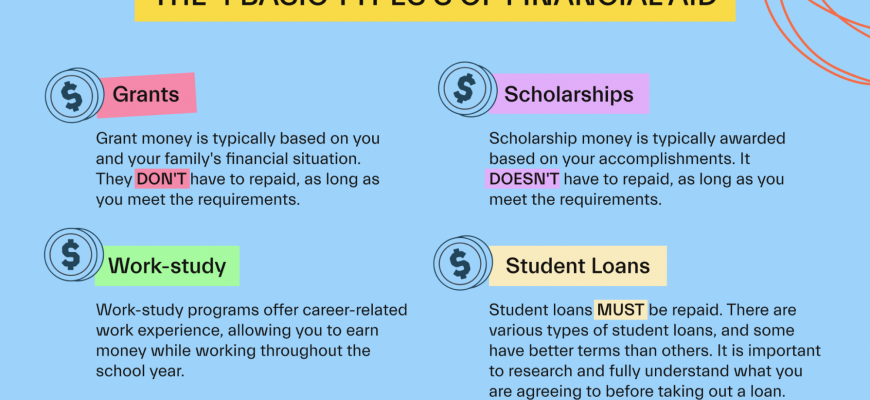

When it comes to supporting your educational journey, there are various forms of support available. Each type has its unique features and benefits, catering to different needs and circumstances. Understanding these options can help you make informed decisions and choose the right path for financial relief while pursuing your academic goals.

One popular category is grants, which offer funds that don’t require repayment. These are often tied to financial situations or specific criteria, making them a great choice for those who qualify. Scholarships are another appealing option; they reward exceptional talents or achievements, be it academic, athletic, or artistic, again without the pressure of returning the money.

Then you have loans, which provide substantial help but do come with the responsibility of repayment, often with added costs. They can be a lifeline for many students, making higher education accessible. Some loans even come with flexible terms that can ease the burden later on.

Additionally, work-study programs allow students to earn money while gaining valuable experience during their studies. This practical approach not only helps cover expenses but also builds skills for future employment. Understanding these various types of support is crucial for navigating your educational journey successfully.

Impact of Interest on Student Loans

When it comes to borrowing money for educational purposes, one of the most significant factors that can affect the overall cost is the extra amount charged over time. This additional cost isn’t just a minor detail; it plays a major role in determining how much borrowers end up paying in the long run.

Understanding this concept is essential for those looking to finance their studies. The higher the percentage applied to the borrowed funds, the more one will eventually need to repay. This can lead to financial strain, particularly after graduation when graduates are trying to establish their careers and manage their budgets.

Moreover, the timing of payments can also influence the total sum due. If payments are postponed or if they start accruing before the borrower graduates, the final amount can balloon significantly. Thus, being mindful of these terms is critical for maintaining financial health.

In addition, the long-term implications of these costs can impact life decisions. From choosing between employment opportunities to planning major life events, the burden of repaying borrowed funds can linger long after the educational journey has ended. Therefore, understanding the implications of these additional charges is vital for making informed decisions.